Profitability expectations soften amid cost pressures [WSJ/ Vistage September 2021]

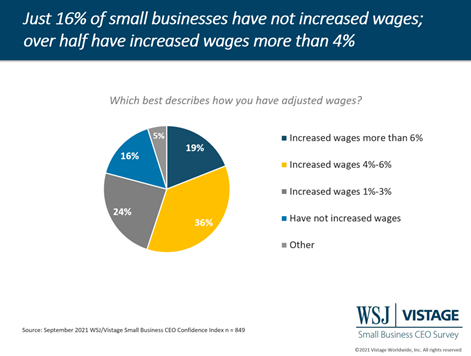

Inflation, supply chain challenges, and uncertainty due to the Delta surge contributed to the declining sentiment of small businesses about the economy. The WSJ/Vistage Small Business CEO Confidence Index fell for the fourth consecutive month, reaching 103.3 in September. The rising cost of everything has many impacts, but for small businesses, the cost pressures include paying higher wages. Our survey revealed that just 16% of small businesses have NOT increased wages. Of those that have increased wages, 65% reported increases greater than 4%.

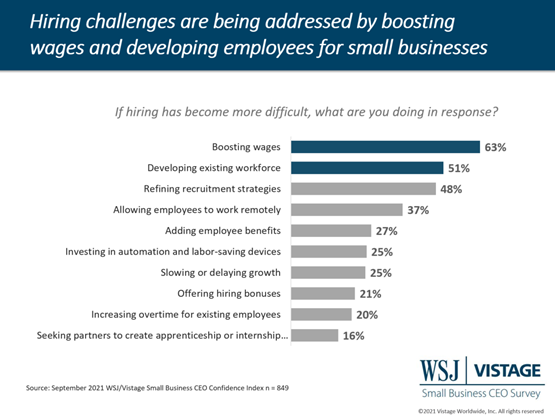

Part of the reason for increased wages? The talent wars. Talent scarcity is challenging 62% of small businesses to operate at full capacity. When asked about how they are addressing hiring challenges, the top response was boosting wages, with 63% of small businesses offering higher wages.

Offering higher wages not only helps small businesses be more competitive in their hiring efforts, but also has positive impacts on retention as well. Just 22% of small businesses report that retention has decreased since the beginning of the year, up slightly from 19% in June’s survey. The second most popular way to address hiring challenges, among small businesses, is to develop their existing employees. Development programs that improve the capability and capacity of existing team members also drive loyalty as an investment in their future.

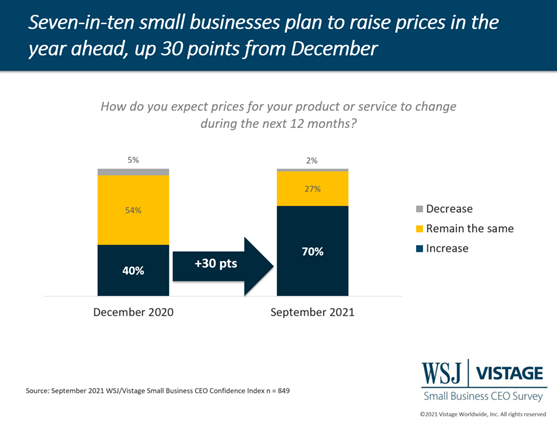

Other costs come in the form of supply chain challenges: 38% of small businesses report that their supply chain is getting worse. Shortages and delays in products and raw materials have impacted pricing. The simple laws of economics come into play: When supply is low and demand is high, prices rise. Accordingly, 7-in-10 small businesses are planning to increase their prices in the next 12 months.

However, the price increases planned by small businesses are not translating to projections for increased profits. In fact, the increases might not completely offset increased costs based on the declining trend of profitability for small businesses. Expectations for profits have declined over the past five months, with the proportion of small businesses that expect increased profitability dropping 11 points in that time. More significantly, the proportion of small businesses that expect profits to worsen has doubled in that same time.

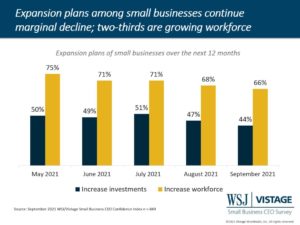

While the supply chain challenges and higher prices for inputs may be transitory, they have caused small businesses to be more conservative in their investments for the future. The proportion that plan to expand their workforce has dropped 9 points from the peak in May.

This month’s survey is evidence that the economic headwinds have not passed. Inflation continues to put margins at risk, supply chain issues are far from resolved and there is no end in sight to the talent wars, which means wages will continue to increase. Small business leaders need to be prepared for another round of price increases and continue to refine their recruitment tactics, while also investing for a future when the COVID-19 pandemic becomes endemic, and the economic headwinds calm to a soft breeze.

Download the September report for complete data and analysis

For the complete dataset and analysis of the September WSJ/Vistage Small Business CEO Confidence Index survey from University of Michigan’s Dr. Richard Curtin, download the report and infographic to learn more, including.

- Declining optimism about the economy

- Investment and hiring plans soften

- Revenue and profit expectations continue to moderate

Related resources

Download September 2021 WSJ/ Vistage Small Business CEO Conference Survey

Download September 2021 WSJ/ Vistage Small Business CEO Conference Infographic

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The September WSJ/Vistage Small Business CEO survey was conducted September 7-14, 2021 and gathered 849 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our October survey, in the field October 4-11, 2021, will capture sentiment of small businesses as vaccine mandates unfold and booster distribution ramps up.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey