Hiring plans increase 12 points for small businesses [WSJ/Vistage Dec 2020]

Highlights:

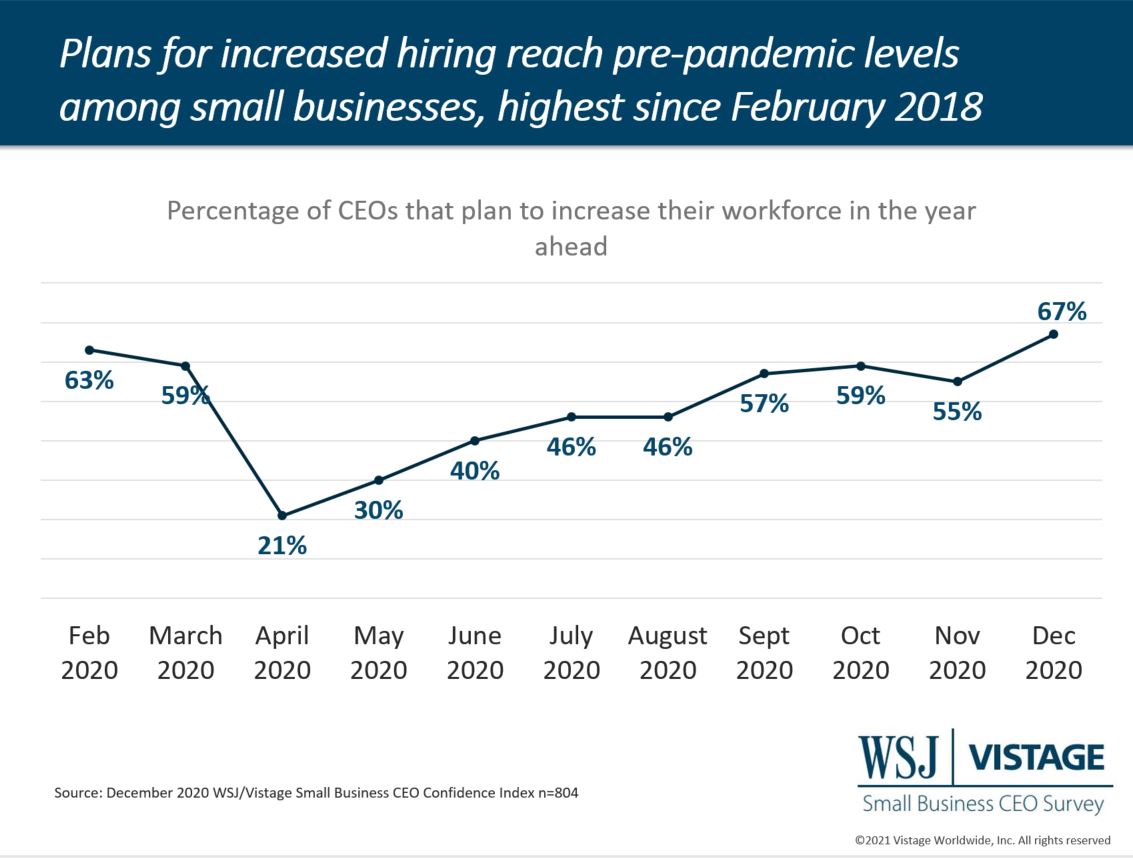

- Hiring plans increase significantly over last month; 67% of small businesses report plans to increase their workforce in the year ahead compared to 55% in November.

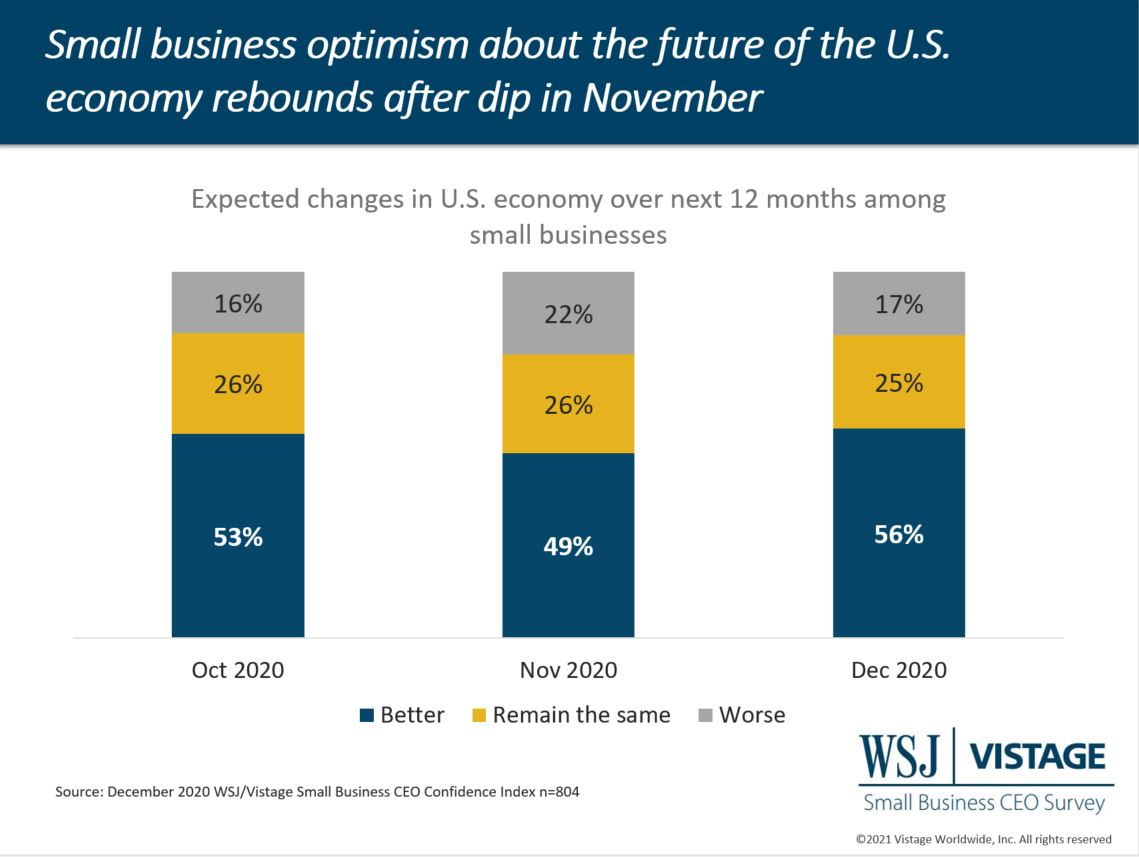

- Optimism about the U.S. economy on the rise with 56% of small businesses expecting the economy to improve in the next 12 months, a 7-point increase from last month.

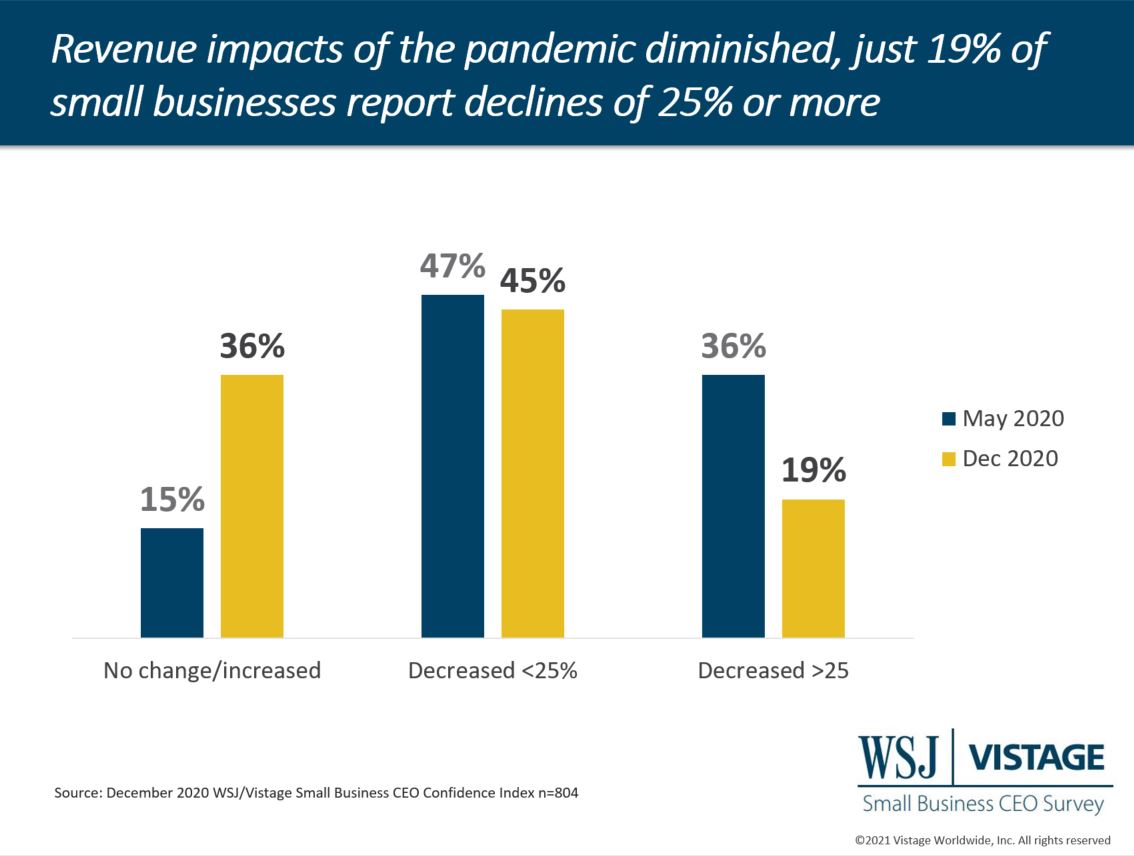

- Revenue impacts of the pandemic have diminished over time; in December just 19% of small businesses reported revenue declines of 25% or more.

Download the December WSJ/Vistage report for the complete analysis

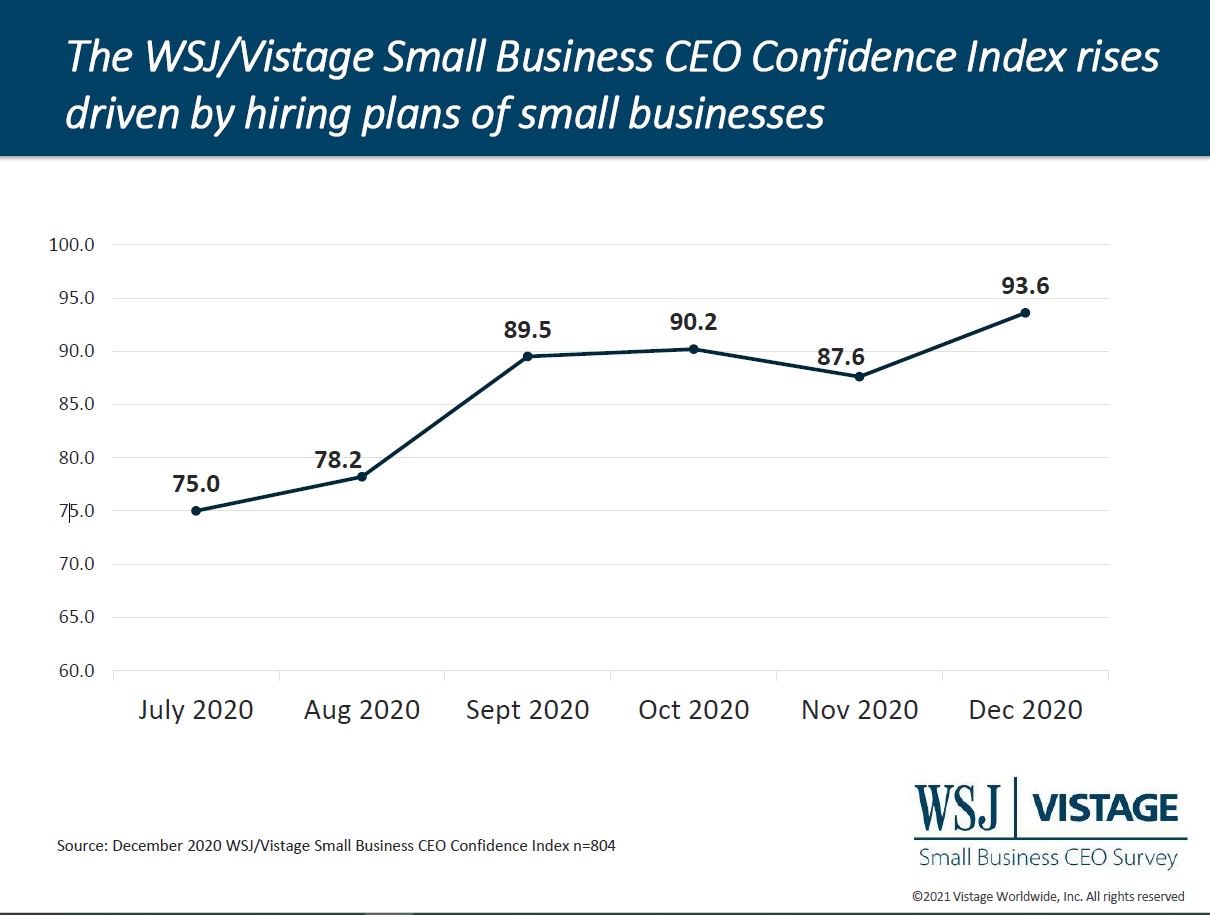

December brought positive news about the future of small business with overall confidence rising to its highest level since the pandemic began. The WSJ/Vistage Small Business CEO Confidence Index reached 93.6 in December, doubling the 44.7 recorded in April. However, there is much room for improvement as this reading is still well below February’s peak of 105.7.

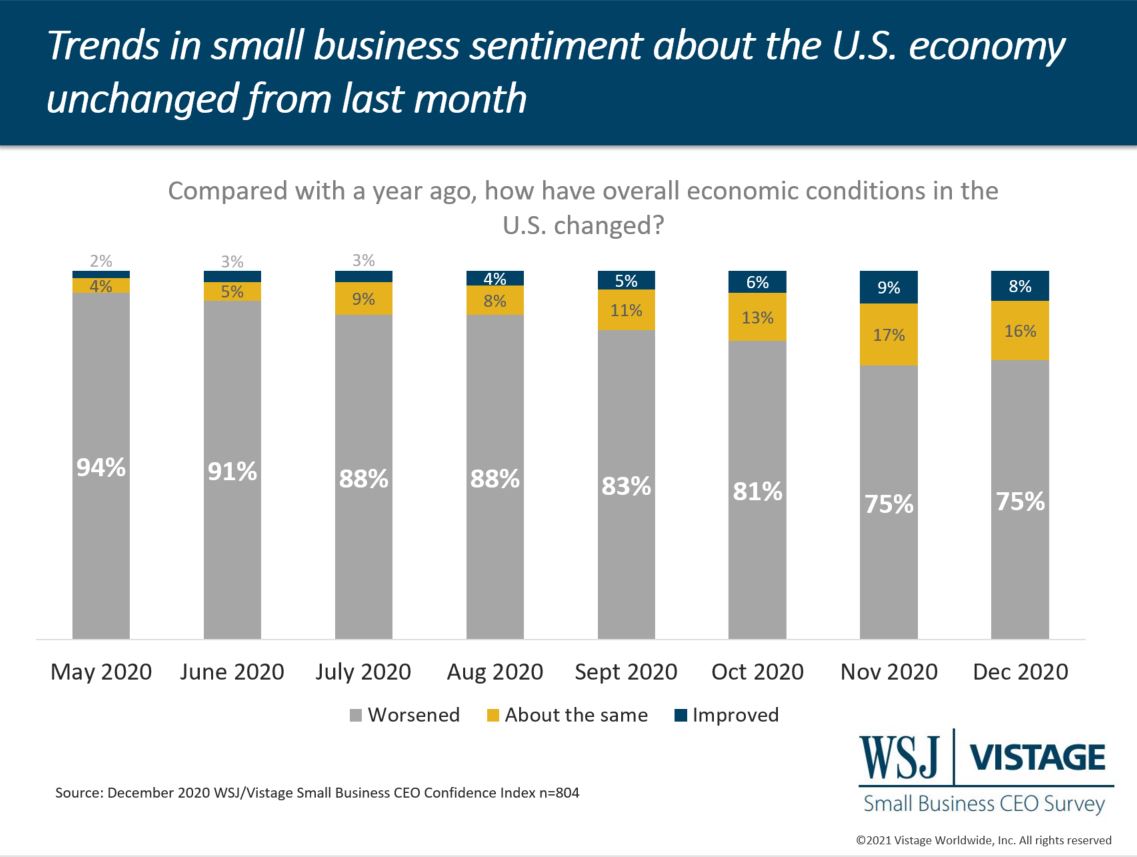

Small businesses are increasingly optimistic and seeing signs of recovery for their business in terms of stable revenue projections in the year ahead, however these signs of life are not yet evidenced in their sentiment about the economy today. Small businesses maintain a cautious view; three-quarters indicate the U.S. economy has worsened compared to a year ago and just 8% thought it improved, on par with economic sentiment recorded in November.

CEO sentiment about the future of the economy is more optimistic with 56% of small businesses reporting the economy will improve in the next 12 months, this 7-point gain from last month is not enough to offset the pessimism about current conditions.

However, one thing that will be driving the economy in the year ahead are the expansion plans of small businesses. Robust expansion plans are the primary driver behind the increase in the overall Index, plans that are necessary to support stable revenue projections.

Expansion plans support revenue expectations

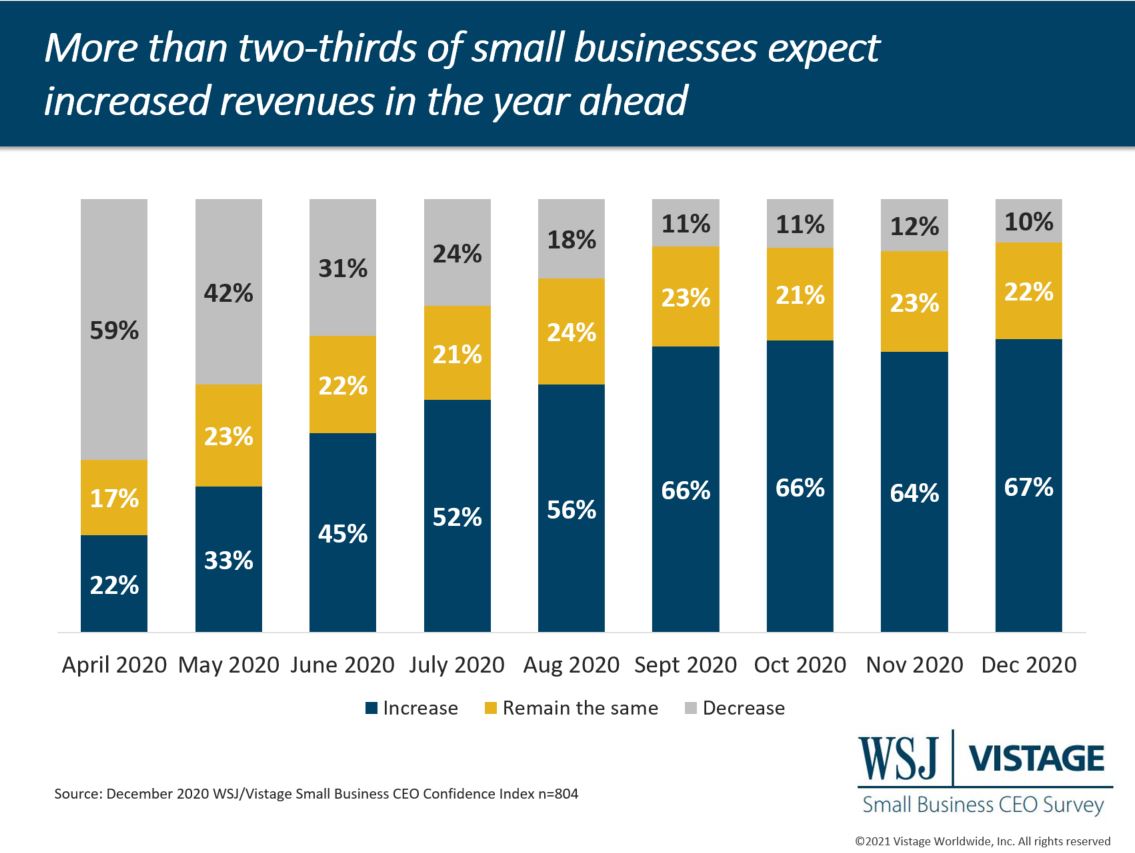

Looking ahead, 67% of small businesses expect increased revenues in the year ahead, and an additional 22% expect them to remain the same. To support this anticipated demand, small businesses are increasingly investing in their infrastructure.

The most notable finding from the December survey is that more than two thirds (67%) of small businesses reported plans to increase their workforce in the year ahead, up significantly from 55% in November. These expansion plans among small businesses are the highest since February of 2018.

While not as robust as workforce expansion, investment plans are also on the rise with 38% of small businesses reporting plans to increase investments, up from 33% last month. These expansion plans reflect that small businesses are looking forward, having successfully mitigated the negative effects that were realized early in the pandemic.

Revenue impacts of the pandemic diminished over time

In May, our survey showed that 85% of small businesses had some level of revenue declines as the result of the pandemic, with 36% reporting that those declines were 25% or more. As economic activity stabilized and small businesses developed new ways to connect with customers, these statistics have improved. In December, less than two-thirds (64%) reported revenue declines and just 19% of small businesses reported revenue declines of 25% or more.

Over time small businesses have also stabilized their cash reserves; 58% of small businesses said their funds would last longer than six months, a figure that has remained stable over the last four months. But clearly small businesses are divided in their preparation for the future, as 41% report cash reserves that will carry them 5 months or less, which reflects uncertainty that exists among certain segments of small businesses.

Economic outlook factors in growth and uncertainty

The data reveals that 56% of small businesses believe the economy will improve in the coming year, the highest figure since the start of 2017. In terms of timing of that improvement, that is a longer game as most think that the improvement will take place in the latter part of 2021. A small portion – 17% – believe that improvements to the U.S. economy will take more than a year. Those that believe the improvement will take longer are likely in industries that were hardest hit by the pandemic with no clear view of recovery based on current restrictions.

Dr. Richard Curtin, a researcher from the University of Michigan who analyzed the December survey results shares his thoughts on the data. “Small businesses sense that the economy is poised to mount a robust response to the expected success of the coronavirus vaccine,” Curtain says. “There is substantial uncertainty about how soon and how fast which may impact the pace of renewed growth, however.”

Uncertainty abounds, from a tenuous transition of political power, to rising cases of COVID-19 and slow roll out of vaccines. Time will tell if this uncertainty will again cause a waning of optimism among small businesses.

Download the December WSJ/Vistage report for the complete analysis

Related links

|

Survey methods The December WSJ/Vistage Small Business CEO survey was conducted December 7-14, 2020 and gathered 804 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our January survey, in the field January 4-11, 2021 will capture sentiment of small businesses at the start of the new year. |

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey