Optimism dips as CEOs anticipate slowdown in economic growth, Q3 2018 survey shows

Economic confidence among CEOs continues its slow decline, according to the Q3 2018 Vistage CEO Confidence Index. The survey of 1,484 leaders of small and midsize businesses shows confidence decreasing from the 14-year peak set in late 2017, following the passage of the tax cut legislation. The Vistage CEO Confidence Index was 103 in the Q3 2018, reversing the entire gain recorded in the past three quarters.

Economic confidence among CEOs continues its slow decline, according to the Q3 2018 Vistage CEO Confidence Index. The survey of 1,484 leaders of small and midsize businesses shows confidence decreasing from the 14-year peak set in late 2017, following the passage of the tax cut legislation. The Vistage CEO Confidence Index was 103 in the Q3 2018, reversing the entire gain recorded in the past three quarters.

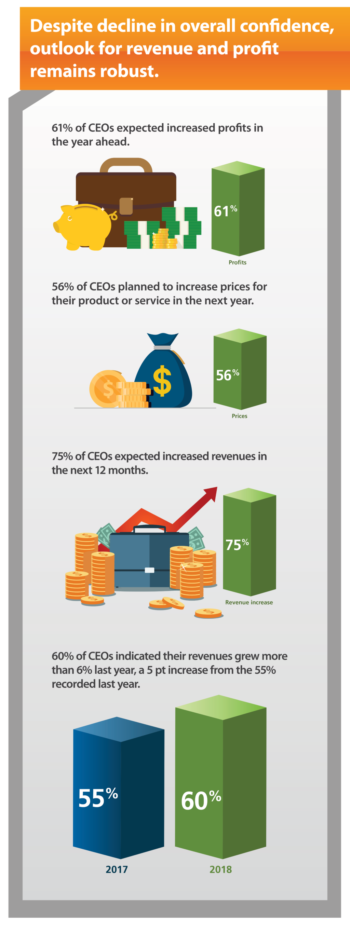

Most of the recent decline was due to an anticipated slowdown in economic growth, as well as a slight decline in revenue and profit expectations. Important to note, however, that CEOs’ expectations for revenues and profits were still quite robust.

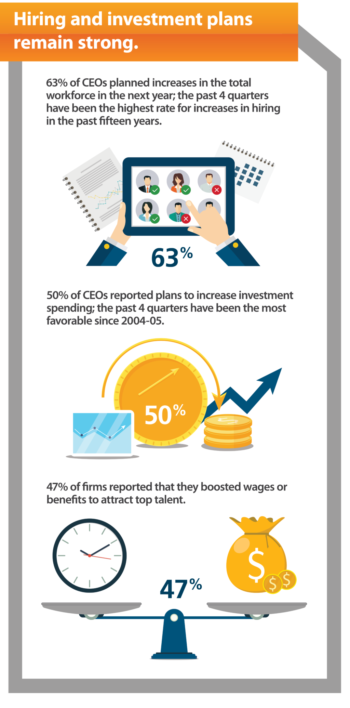

Higher costs for labor and delaying firm growth dampened their expectations:

- 47% of firms reported that they boosted wages or benefits

- 14% reported slowing growth in sales and order fulfillment.

Increased production costs due to higher wages, benefits, interest rates, and prices of materials will squeeze profits, putting a premium on lowering costs and raising prices charged for goods and services. In fact, about 56% of respondents said they planned to increase prices for their goods and services.

Perhaps the prime source of current economic uncertainty is the escalating trade war with China, which could increase inflation. The resulting increases in inflation will stiffen the Fed’s resolve to increase interest rates later this year and next year.

Hiring and investment plans remain strong.

Hiring and investment plans remain strong.

CEOs reported plans for robust expansion during the year ahead in their workforce, as well as increased investment spending on new plant and equipment.

- 63% of CEOs planned increases in the total workforce, up slightly from the 61% recorded one quarter ago. During the past four quarters, firms voiced the most expansive hiring plans in the past 15 years. Planned increases in investment spending were the most favorable in the past four quarters than any time since 2004-05.

- About half of CEOs reported plans to increase spending, up from 48% in the prior quarter and 47% in Q3 2017.

- Just 8% of CEOs planned declines in investments in the coming year.

Low expectations for continued economic growth.

Low expectations for continued economic growth.

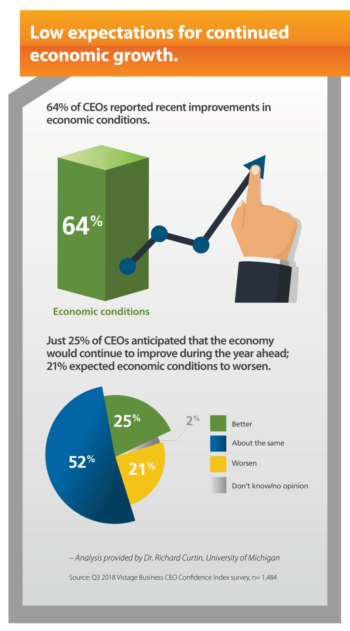

More CEOs reported recent gains in the pace of economic growth in the Q3 survey. More CEOs also reported that they anticipated a weaker pace of growth during the year ahead.

- 64% of CEOs reported recent improvements in economic conditions, unchanged from last quarter and above last year’s 52%.

- Just 25% of CEOs anticipated that the economy would improve during the year ahead.

- 21% expected economic conditions to worsen—the worst outlook since the election. This may simply be a recognition that GDP growth will not be sustained at the recent 4% level, and it may suggest the recognition by firms that darkening economic clouds loom on the distant horizon.

Category : Economic / Future Trends

Tags: CEO Confidence Index, WSJ Vistage Small Business CEO Survey

A confidence chart over several periods would be helpful.

Hi Robert — The full report shows the trends over time: https://www.vistage.com/wp-content/uploads/2018/06/CI-flyer-Q218.pdf