Wall Street Journal/Vistage Small Business CEO Survey: Record-breaking expectations for revenue growth

A record percentage of small business CEOs said that they anticipate greater revenues for their firms in the year ahead, according to the August 2017 edition of the Wall Street Journal/Vistage Small Business CEO Survey. In that same survey, however, CEOs expressed a less favorable outlook for the U.S. economy overall.

In his analysis of the survey results, Dr. Richard Curtin of the University of Michigan noted, “While it may be tempting to think that small firms expect more robust growth for themselves than for the overall economy, it is more likely that firms simply anticipate that the cumulative gains by the end of the ninth year of expansion will boost revenues and profits to new heights.”

Results from the August 2017 survey, which had 674 respondents, indicated that the Small Business CEO Confidence Index rose to 113.6 in August, an increase from the 110.0 recorded in July and 113.5 recorded in January.

Key findings from the survey include the following.

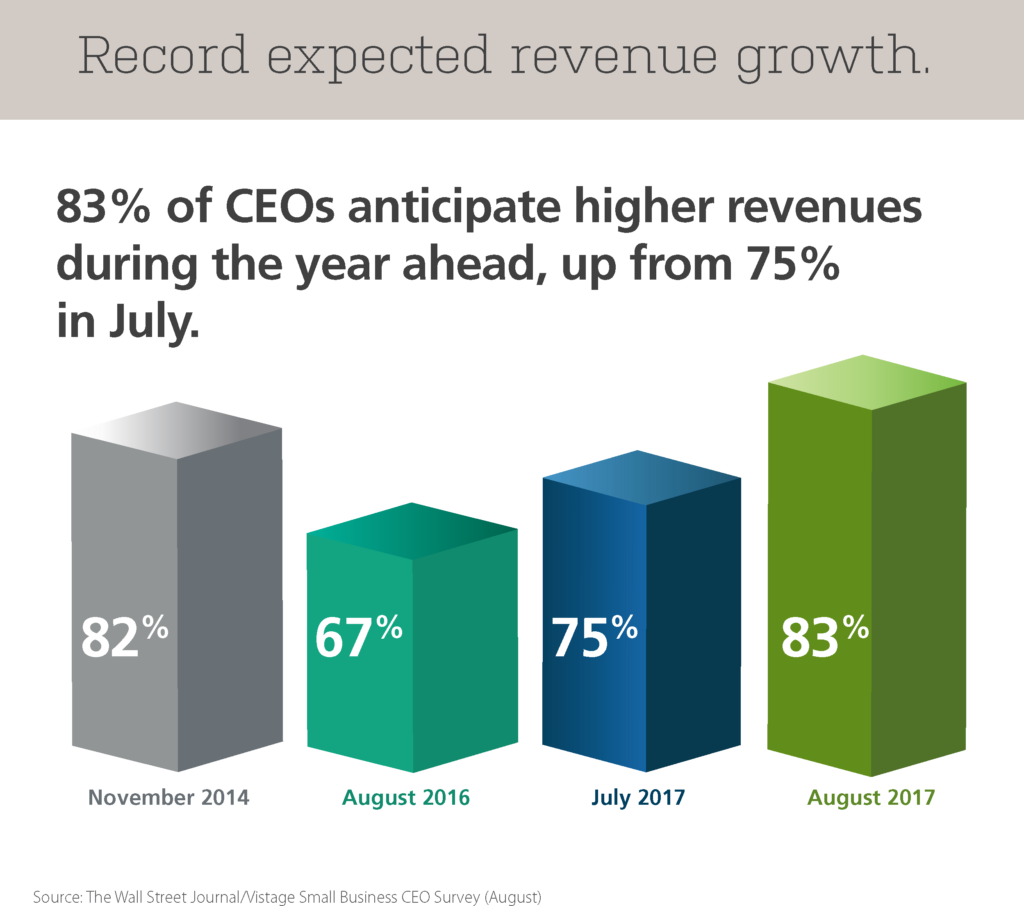

A record number of firms expect revenue growth

The vast majority of small firms (83 percent) said that they anticipated sales revenues to increase in the year ahead. This is the highest percentage recorded since the Wall Street Journal/Vistage Small Business CEO Survey was launched in June 2012. The previous peak (82 percent) was recorded in November 2014.

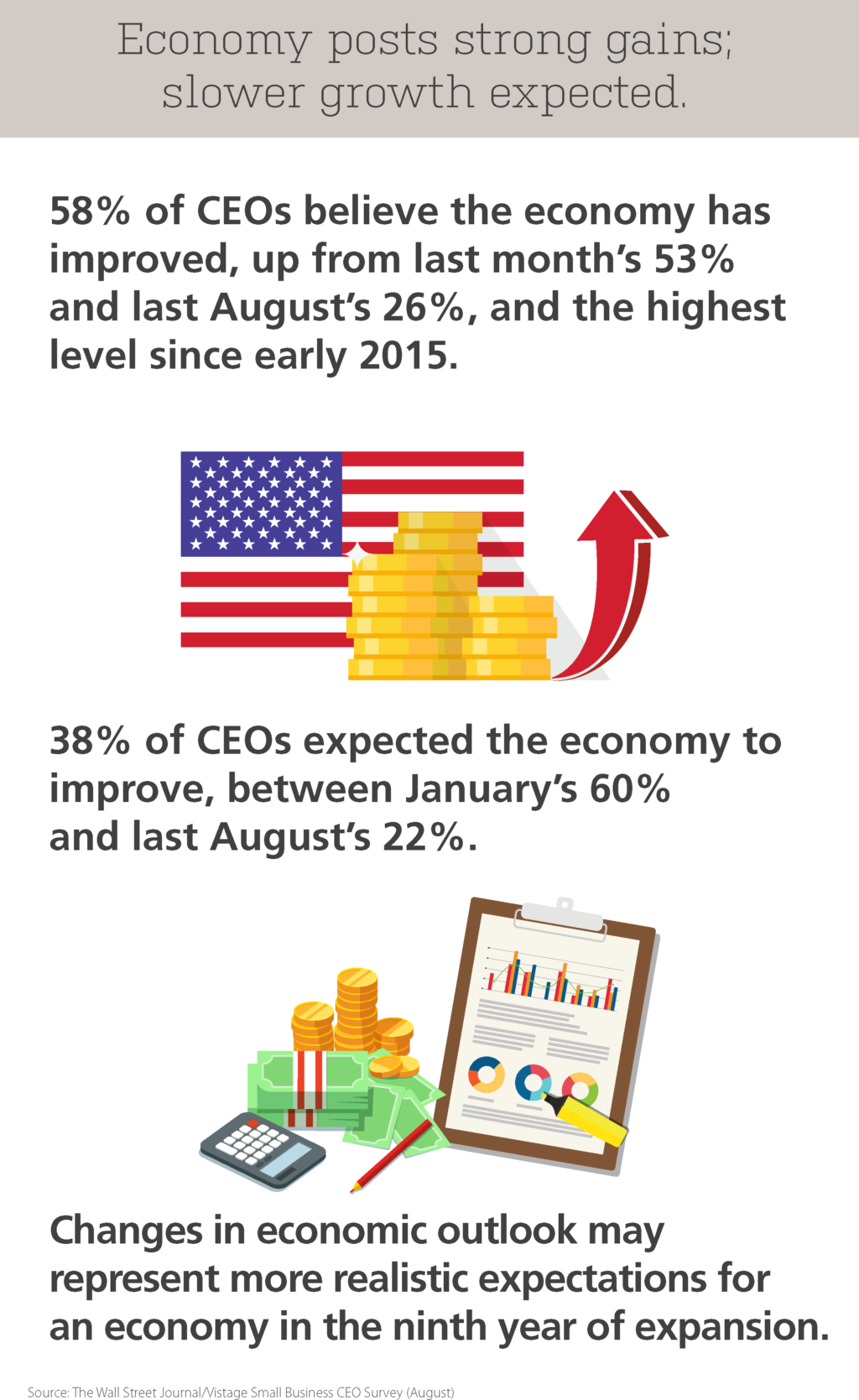

Less optimistic outlook for U.S. economy

Consistent with figures reported in the last three months, only 38 percent of respondents said that they expected the U.S. economy to improve in the year ahead. However, 58 percent of CEOs said that economic conditions had improved in the last year. Looking ahead, about half (48 percent) of respondents said that economic conditions would stay the same in the year ahead, while 11 percent said that they expected them to worsen.

CEOs anticipate profit increases

Tying with the record set in January 2015, 65 percent of small business CEOs said that they expected profits to increase during the year ahead, compared to 59 percent in July and 52 percent last year. Only 7 percent of CEOs said that they expected profits to decrease.

More firms plan to increase hiring

Good news on the job front: Sixty-four percent of firms said that they planned to increase their total number of employees, up from 59 percent last month and 53 percent last year.

This represents “the most aggressive hiring plans [for small firms] in several years,” said Curtin. “Overall, hiring plans have been quite favorable since the start of 2015, with the proportion of small firms that planned increases in their total workers staying in the narrow range of 51 to 64 percent.”

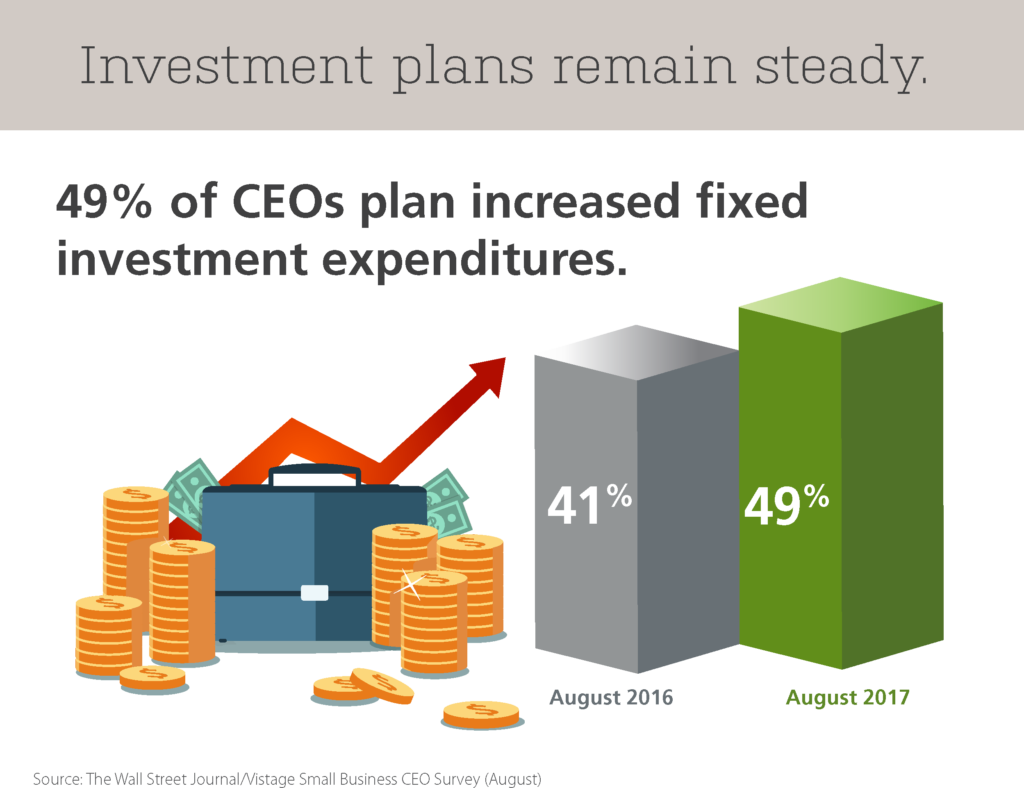

Plans for investment expenditures continue

Nearly half (49 percent) of small firms said that they planned to increase the total fixed investment expenditures, a figure consistent with the 47 percent reported in July and 50 percent reported in June.

“Firm births are much more common among small firms, with the expansion of fixed investments, as well as total employees, being more common among young firms,” said Curtin. “The WSJ-Vistage sample data on small firms certainty confirms that small firms are more likely to be in a growth phase, expanding fixed investments and employment.”

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey