Inflation’s steady rise continues to impact small and midsize businesses

Trees don’t grow to the sky, but with June’s inflation rate rising from 8.6% in May to 9.1%, you have to wonder where the top is. The steady rise of inflation has touched every aspect of business and life — from durable goods to household necessities like food, gas and rent.

Businesses have been forced to increase prices to maintain margins. Ten years ago, in June of 2012, inflation was at 1.7 and pretty much averaged that rate over the next eight years leading up to the pandemic recession. Since March of 2021, inflation has steadily risen each month adding a new economic reality to the concentrated volatility of the past pandemic world.

Inflation has been politicized in the media, but it is not a uniquely U.S. issue. In May, the UK’s 9.1% inflation figure was above the eurozone rate of 8.6%. Common factors are driving inflation in all western economies, including:

- Surging consumer spending as a result of government economic stimulus programs.

- Higher wages for a still in-demand workforce.

- Intense competition for goods and services — all underlined by volatile energy costs.

- The continuing war in Ukraine.

There is a limit to how high inflation can rise before the Federal Reserve’s actions and softening consumer demand reign it in, but that point is still to be seen.

CEOs are hypervigilant about their markets and growth implications as a result of the uncertainty and volatility of the current economic cycle. And increasing prices is top of mind for businesses to keep pace with the pressures from inflation, interest rates, fuel costs, supply chain issues, hiring, retention and wages.

These factors have sparked discussions of the “R” word. Whether we are about to enter into or are already in a recession, the more important considerations are how long and how deep this downturn will last, questions that no one can answer.

The accelerated disruption of the pandemic has led to concentrated volatility in the economy, and CEOs are tempering their outlook. Our recent CEO Confidence Index fell to 69.0, just above the Q2 2020 reading recorded at the bottom of the pandemic.

Inflation’s implications

Inflation and supply chain complications are impacting every business. The top 3 concerns for CEOs are:

1. Hiring and retention remain the top business challenge.

CEOs are locked in an ongoing war for talent at a time when the hiring market remains hot, giving every worker a chance to find a better job as part of the “Big Upgrade.”

Increasing demands to raise compensation, improve benefits and invest in employee/leadership development to attract and retain workers are major contributors to inflation.

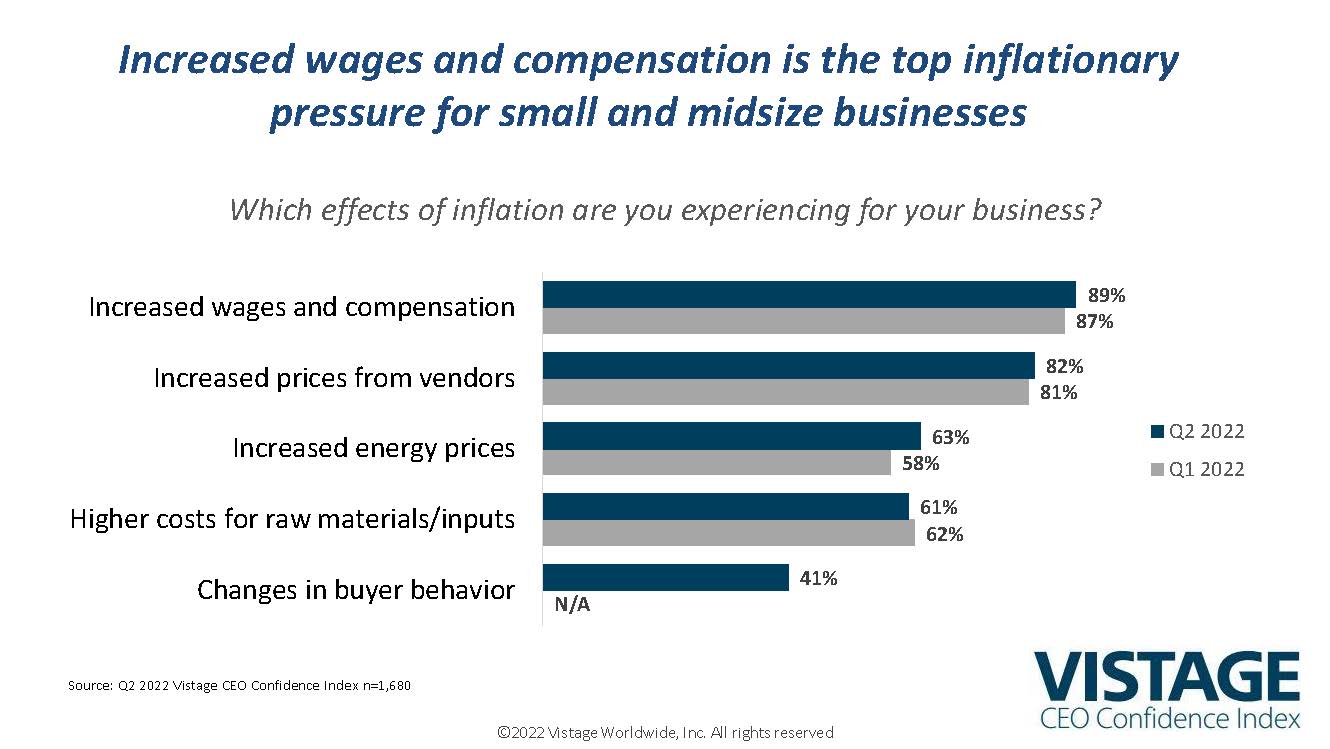

89% of CEOs said increasing wages and compensation is their top inflationary pressure. While future hiring plans slowed, 52% of CEOs plan to increase headcount in the year ahead, and 51% report that they have already increased headcount since the start of the year.

2. Increased costs are at record levels and are being passed down the line.

75% of CEOs report plans to raise prices in the next 12 months. Higher costs for raw materials and other inputs are a result of high demand and a slowly healing supply chain. Energy costs have fallen recently but have no limits on their bottom or top. Each factor feeds on the other in a death spiral of rising costs.

3. Changing customer behavior.

The pandemic brought major changes to buyers’ behaviors. Our research report, Marketing Matters, revealed that 78% of CEOs said that buying behavior had changed as a result of the pandemic. Buyers wanted a more digital experience and wanted to engage in a virtual selling cycle. Some buyers moved more quickly to stockpile essential components while others slowed down. Now, inflation has doubled down on behavior change. In our most recent survey, 41% of CEOs linked inflation to changes in buyer’s behavior as sales cycles slow down, projects get deferred and customers become more cautious in their buying and decision-making.

Supply chain in rehab

Supply chain issues continue to be a significant contributor to inflation for small and midsize businesses. The inability to get the components needed to meet demand both raises costs and slows down growth. Shutdowns on both sides continue to plague the supply chain’s recovery, with random shutdowns in China disrupting the flow while the workforce shortage of longshoremen and truck drivers halts deliveries.

As demand slows, the supply chain does show signs of improvement, albeit slowly. There has been a 10% shift since the Q1 survey from “getting worse” to “slowly getting better.” This improvement will gradually continue to get better as all the factors see continued improvement. However, it is unlikely it will ever recover to pre-pandemic levels. Concentrated volatility will continue to disrupt the efficiencies of a stable global economy and steady, predictable demand of the global consumer.

Pressure on pricing

Higher prices from vendors, higher prices for raw materials and goods, and increasing labor costs are all part of the inflationary spiral that feeds on itself. The rising cost of everything is forcing CEOs to increase their prices. Three-quarters (75%) of SMBs say they will increase their prices in the year ahead, down from 83% in Q1.

Before the pandemic, CEOs focused on improving efficiency or increasing sales to drive revenue. Now, CEOs raise prices to just keep up, forgoing opportunities to be smart and conscious about pricing and resulting in fumbled messages to already exhausted customers.

To help small and midsize businesses maximize value without losing customers, Vistage speaker Casey Brown shares her expertise on pricing strategies and tactics.

Demand an answer

Econ 101 taught us the rules of supply and demand, and prices rise or fall based on that relationship. The stimulus-fueled consumer frenzy following the relaxing of COVID protocols far outstripped the available supply. Demand now becomes the answer as bank accounts grow thin and consumers become more cautious. Typically, as economies slow and recessions approach, unemployment grows, further shrinking the consumer’s spending. That isn’t happening. Instead, there is a shift in consumer spending from “things I want” to covering the increasing costs for “things I need.”

Underscoring the factors shared above — slowing demand, improving supply, higher interest rates, rising prices and higher wages — is the unstable cost of energy, which has gone down recently but could just as quickly go back up. The result is a state of concentrated volatility forcing CEOs to make critical decisions on a shifting landscape. However, the recently hard-learned lessons from the pandemic should prepare CEOs to manage through the volatility, understanding that the next shift will only lead to the next one.

Related Resources

Stimulus hangover crashes CEO confidence [Q2 2002 CEO Confidence Index]

Category : Economic / Future Trends