5 things busy executives need to know about mindfulness at work

Mindfulness is the new corporate buzzword, trending on Twitter and pretty much everywhere else. If meditation has been on that (ever-growing) list of things you’ll get to when you’re on vacation or things “finally quiet down,” you’ve come to the right place.

As one of the first 30 certified teachers of the Search Inside Yourself program developed at Google, I travel around the country as an executive meditation coach to Vistage members and other leaders. Here are some of their top questions:

1. What is mindfulness?

Founder of Mindfulness-Based Stress Reduction (MBSR) Jon Kabat-Zinn defines mindfulness as the “awareness that arises through paying attention, on purpose, in the present moment, non-judgmentally. It’s about knowing what is on your mind.”

This brief video narrated by “10% Happier” author and ABC news anchor Dan Harris, explains how the ability to know what’s happening in your mind without acting on it can be a life-changing skill.

2. Why is mindfulness so popular now?

We live in an increasingly complex, interconnected world that requires focus and clarity, flexibility and creativity. Yet 66 percent of employees report difficulty focusing on tasks at work because of stress. Dubbed the “health epidemic of the 21st century” by the World Health Organization, stress is estimated to cost American businesses up to $300 billion a year.

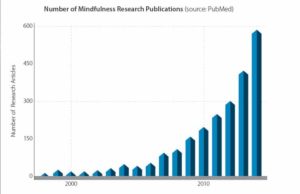

There’s been an explosion of research showing how mindfulness meditation improves focus, attention and other skills necessary for high performance, while reducing stress and anxiety and enabling a healthier mind.

Mindfulness practice can actually change the brain – the “software” can shape the “hardware.” As noted in a “Harvard Business Review” article, “recent research provides strong evidence that practicing non-judgmental, present-moment awareness (a.k.a. mindfulness) changes the brain, and it does so in ways that anyone working in today’s complex business environment, and certainly every leader, should know about.”

3. How can mindfulness at work help leaders and organizations?

From the Seattle Seahawks to Aetna and Google, organizations across industries and around the world are bringing mindfulness programs to work.

Workplace mindfulness enhances emotional intelligence, notably self-awareness and the capacity to manage challenging emotions. Neurologist and psychologist Viktor Frankl describes, “Between stimulus and response there is a space. In that space is our power to choose our response. In our response lies our growth and our freedom.”

Mindfulness can help us create some more space between “stimulus and response” – in other words, so you don’t send that email you wish you hadn’t, or you handle a difficult conversation more skillfully.

As McKinsey partner Manish Chopra reflects, meditation can help leaders observe more and react less.

4. Sounds great – but I’m really busy and my mind is way too active to be quiet.

I am going out on a limb and will assume you’ve been breathing since you started reading this piece – and I suspect you were breathing even before you started reading!

So let’s try going from breathing to being aware of breathing. Maybe you feel some air coming into your nose, the rise and fall of your chest, or a sense of your whole body breathing.

Now, notice your body sitting (if you’re sitting). Again, just a few moments ago your body was sitting, but perhaps you weren’t aware of sitting, your feet on the floor. What’s it like to be aware of sitting – or lying down, or standing, or walking.

And what about thoughts? You may have been aware of what you were thinking about, or it may have been running on its own in the background. So what’s it like now to be aware of thinking? Not needing to think about anything in particular – or needing your mind to be quiet – just being aware of thinking.

What you just did was train your attention through mindfulness. It only takes a few seconds to shift from doing to being aware of doing and you can do it anytime, anywhere. And that is the foundation of moving from “reacting” to “responding.”

5. How can I get started practicing mindfulness?

I find that many executives like to get started with an app – such as Headspace, Calm, Happify or Simple Habit, where I am instructor. It’s also useful to sustain your practice by working with a certified teacher and/or as part of a community or group – such as through a university (like UCLA) or a mindfulness-based stress reduction program.

Every moment is an opportunity to practice awareness. Some suggestions:

- Take three breaths – in the car before you go into the office, when you first sit at your desk, or before returning home after work.

- Connect with your intention before a meeting: how do I want to show up?

- Agree to begin meetings with a moment of silence to help everyone fully arrive and focus their attention.

- Bring mindful awareness to a specific activity that you do regularly. Some ideas are:

- Drinking your first cup of coffee or tea in the morning

- Taking a shower

- Washing the dishes

- Petting your dog or cat

- Brushing your teeth

And you can always remember to breathe – you’re doing it anyhow!

Category : Leadership Competencies