Small businesses anticipate slower economic growth, Oct. 2018 WSJ/Vistage survey shows

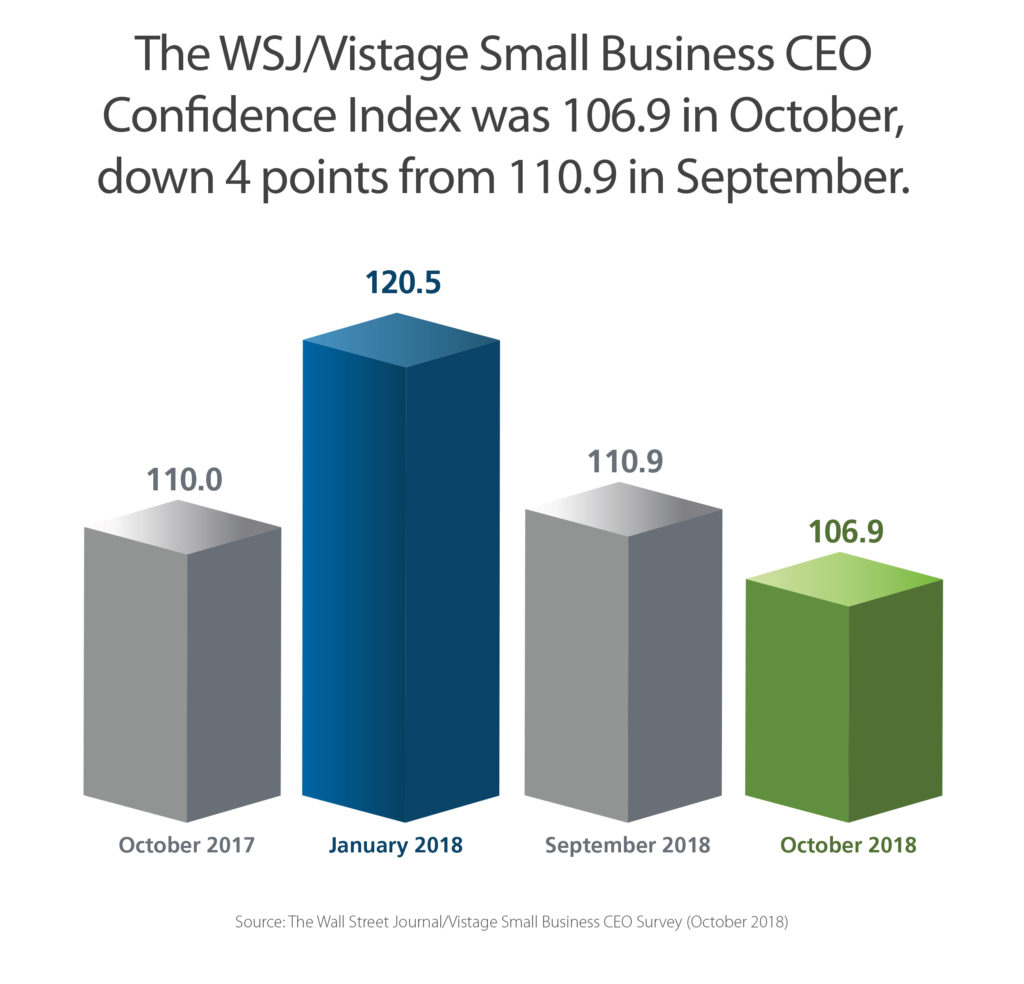

Economic optimism among small business CEOs has slipped to its lowest level since the 2016 presidential election, according to the latest Wall Street Journal/Vistage Small Business CEO survey. The WSJ/Vistage Small Business CEO Confidence Index was 106.9 in October 2018, down from 110.9 in September and 110.0 last October.

Dr. Richard Curtin, a researcher from the University of Michigan, suggested that the index’s decline was not caused by a sudden collapse in confidence, but rather the gradual and slow decline of other factors. These factors include CEOs’ anticipation of slower economic growth during the year ahead and a slight falloff in expected revenues and profits, with the latter serving as a more significant indicator of economic confidence. Despite these declines, the overall level of economic confidence voiced by small business CEOs remains well above the lows recorded in early 2016 and in 2012.

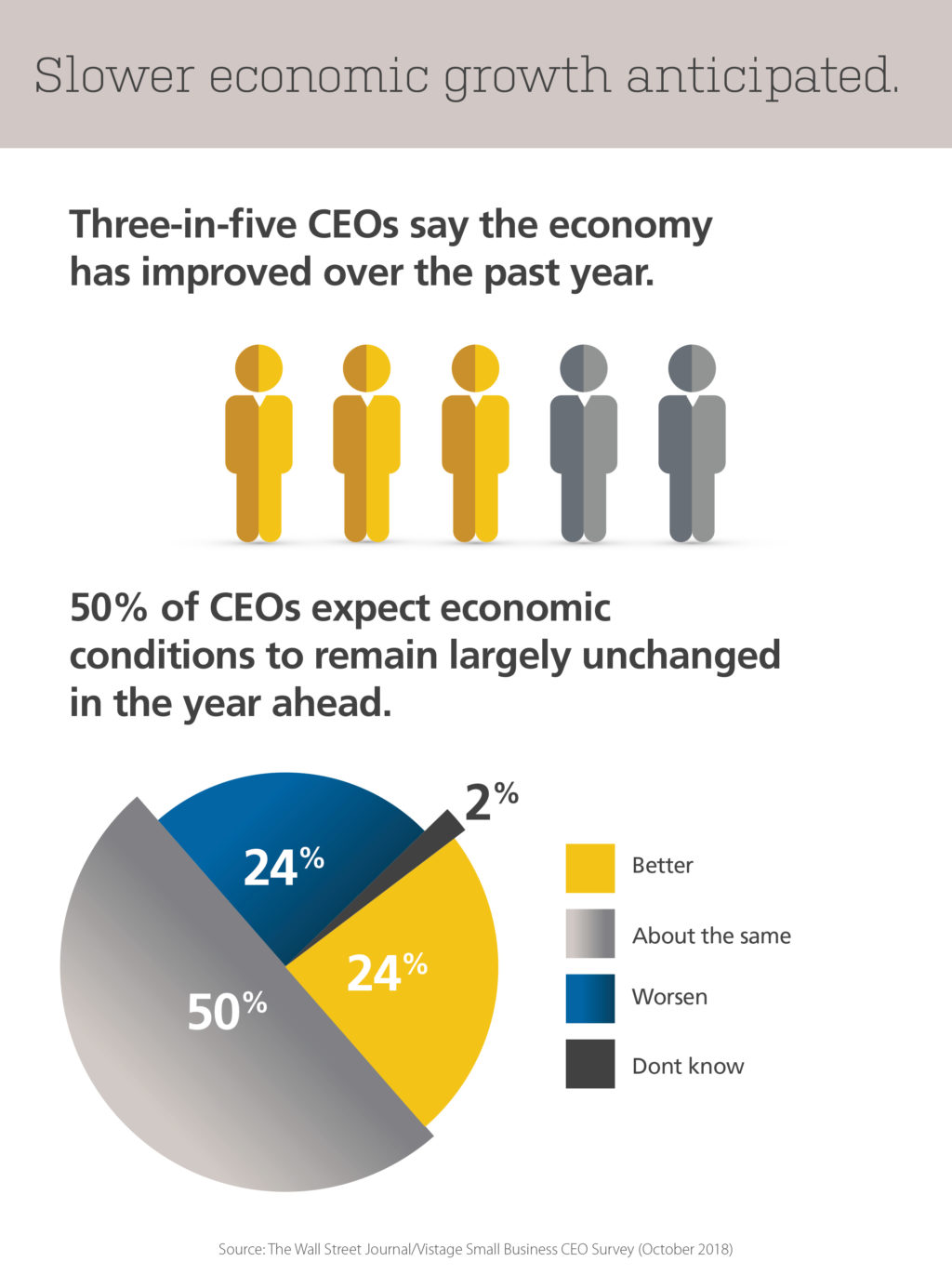

Slower economic growth anticipated by CEOs

CEOs expect that the pace of economic growth will slow in the year ahead. Only 24% of CEOs said they expect continued improvement in the U.S. economy, which is less than half of the 54% peak set in January 2018. Anticipated weakness in economic growth may simply reflect the unusually strong current pace of growth, said Curtin. More than half (60%) of CEOs indicated that the economy has improved over the last 12 months, which is a figure that has held steady over the last few months.

Curtin also suggested that declining expectations for economic growth could be caused by the end of the tax and spending stimulus, the negative impact of trade tariffs, or the anticipation of higher interest and inflation rates during the year ahead. To this point, 42% of CEOs surveyed thought that the most recent round of tariffs would have a negative impact on their business.

Read more on the effects of tariffs:

Tangling with tariffs: CEOs share their strategies

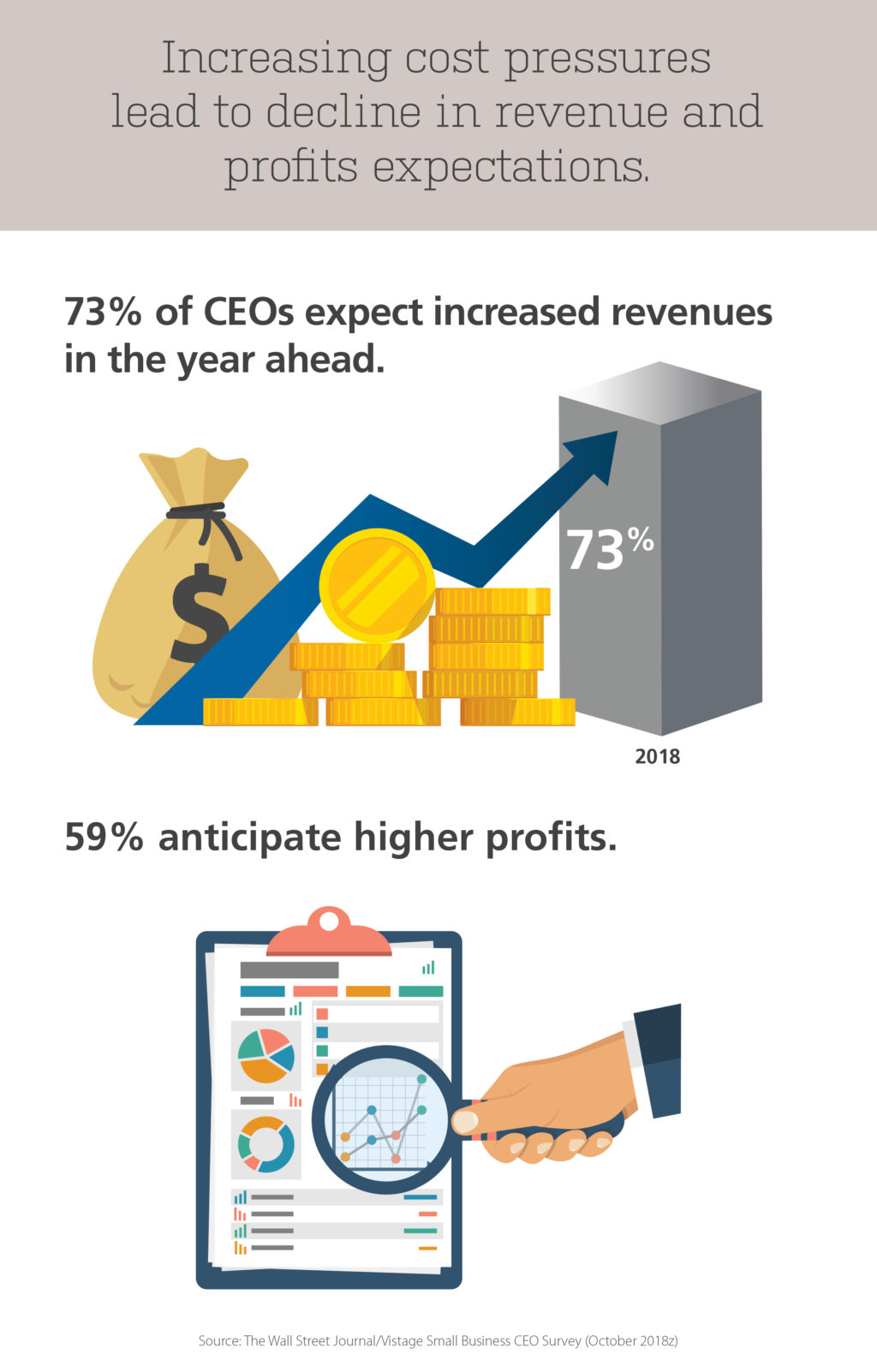

Revenue and profits remain strong despite decline

While expectations for sales revenues and profits have declined by 10 percentage points since the start of 2018, they currently remain at favorable levels. Nearly three-quarters (73%) of CEOs expect increased revenues in the year ahead, and 59% anticipate higher profits. A tight labor market, higher interest rates and new tariffs are contributing to rising costs, and this will likely impact profitability in the year ahead — particularly as wages, interest rates, commodity prices and other costs are expected to keep increasing. These cost increases, which often accompany strong and long economic expansions, are starting to take their toll.

Expansion plans slip but remain robust

The number of CEOs planning to invest in personnel or plant and equipment decreased from last month’s survey. Less than half (46%) of CEOs plan to increase their fixed investments in the year ahead, down from 50% last month. This suggests that CEOs anticipate only a small falloff from the current robust pace of growth, said Curtin. It is important to note that increasing fixed investments was the most common planned use of the savings from reduced taxes.

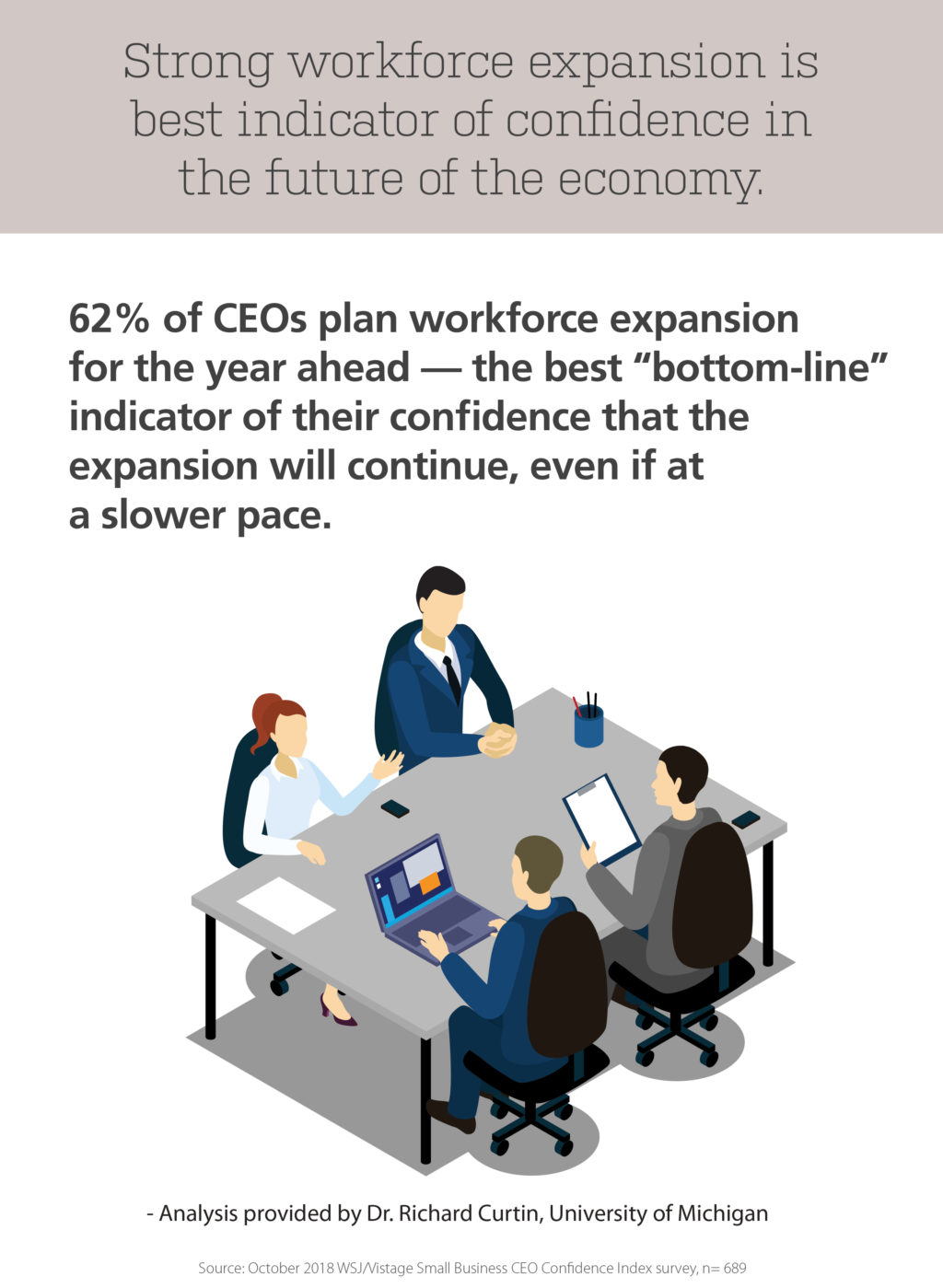

In terms of workforce expansion, 62% of CEOs plan to expand their workforce in the year ahead. This is just below last month’s 65% and equal to last year’s reading.

The willingness of CEOs to expand their firms is perhaps the best bottom-line indicator of their confidence in continued expansion — even if the pace of that expansion is slow.

The WSJ/Vistage Small Business CEO survey reflects the sentiment of CEOs of companies with $1-20 million in annual revenue and measures components tied to the economy, prospects for their business and plans for expansion.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey