CEO confidence slips in June WSJ/Vistage survey

The latest Wall Street Journal/Vistage Small Business CEO Survey indicates that the economic optimism of small-business CEOs has weakened but remains at good levels.

The June 2018 survey, which captured the opinions of 772 small-business CEOs in the United States, recorded a Confidence Index of 110.8. This is lower than May (112.4) and January (120.5) but nearly equal to one year ago (110.4).

“It now appears that the January peak was an outlier, reflecting excessive exuberance due to the tax reform legislation,” said Dr. Richard Curtin, a researcher from the University of Michigan who analyzed the results.

Below, a summary of key findings from the June 2018 survey.

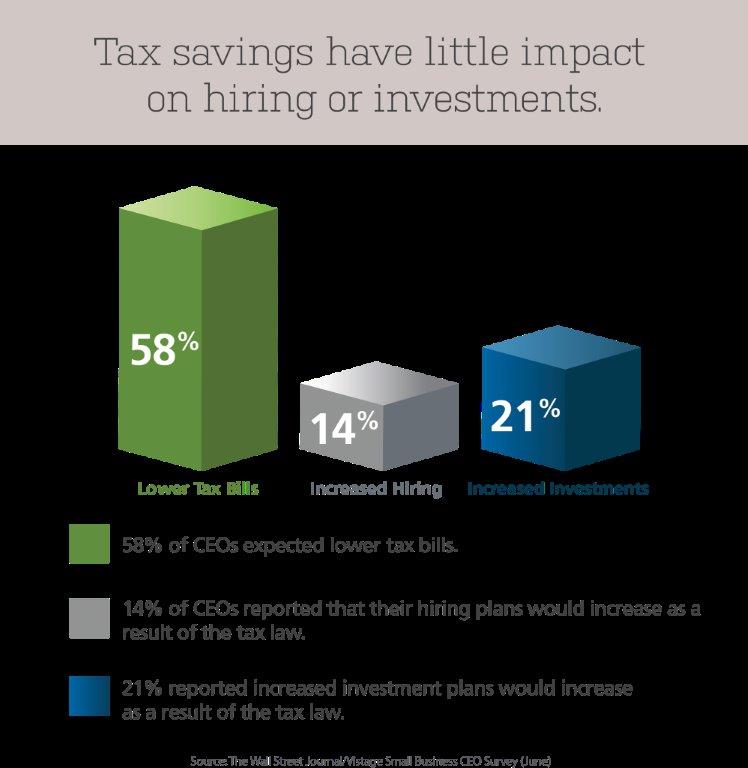

Hiring and investments unchanged by tax reform

Hiring and investments unchanged by tax reform

Most CEOs (58%) participating in the June survey said that they expect to have lower tax bills as a result of the new tax law.

However, “those savings have not quite translated into investments,” said Curtin, who noted that only 12% of CEOs planned to increase their workforce as a result of the tax law. In addition, only 18% of CEOs said they planned to increase their net investment plans due to tax savings.

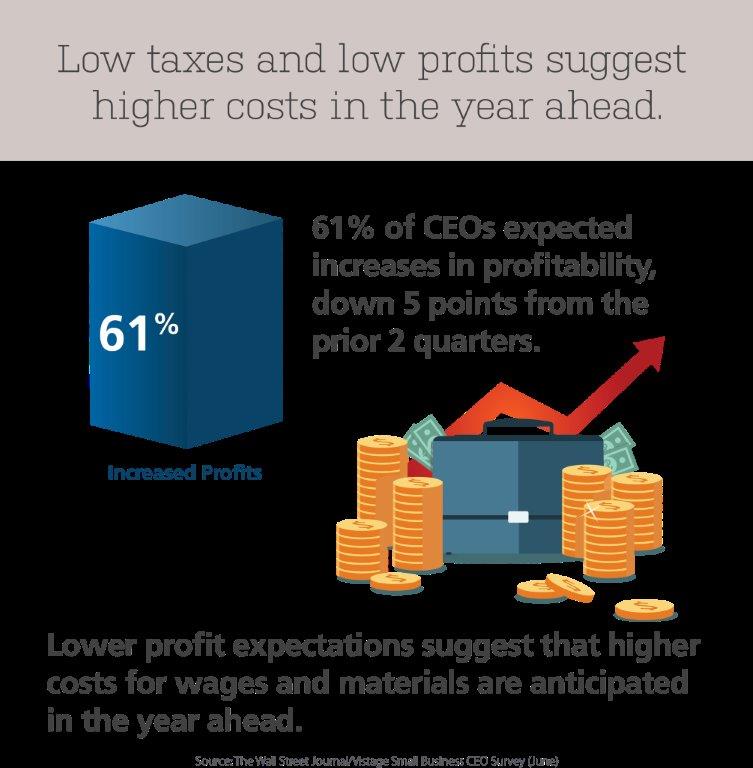

Fewer firms expect revenue and profit growth

Fewer firms expect revenue and profit growth

While expectations for revenue and profit growth declined in June, they continued to hold at favorable levels. More than 60% of CEOs said they anticipate revenue and profit growth in the year ahead, while less than 10% expected their revenues and profits to decline.

Specifically, 77% of CEOs expect higher revenues in the next 12 months, compared to 81% one month ago and 73% one year ago. Only 4% anticipate that their revenues will fall. Similarly, 61% of CEOs expect higher profits in the next year, compared to 63% one month ago and 60% one year ago. About 9% of CEOs expect their profits to decrease.

“Note that the proportion of small firms that expected profit increases was near its low point in the past year, despite the fact that 58% anticipated a lower tax bill due to the reform legislation and 27% expecting declines of 10% or more,” said Curtin. “Lower profits and lower taxes could suggest that small firms anticipate higher costs for wages and materials in the year ahead.”

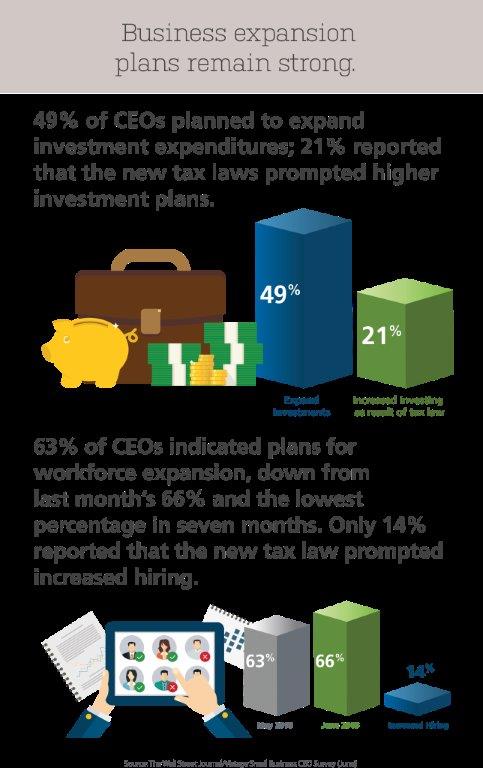

Plans for business expansion remains strong

Plans for business expansion remains strong

The majority of small-business CEOs plan to increase their hiring and investment expenditures in the year ahead, although the number of firms with these plans has decreased. Curtin noted that “the overall decline was quite small, and still reflected a strong preference for continued expansion.”

In the June survey, about half of CEOs (49%) said they plan to expand their investment expenditures in the next 12 months. This is similar to last month (52%) and last year (50%). Less than one-quarter (21%) of CEOs said that planned investments were spurred by the new tax law.

Nearly two-thirds (63%) of CEOs plan to increase their hiring in the next year, which is lower than last month (66%) and the lowest percentage of the past seven months.

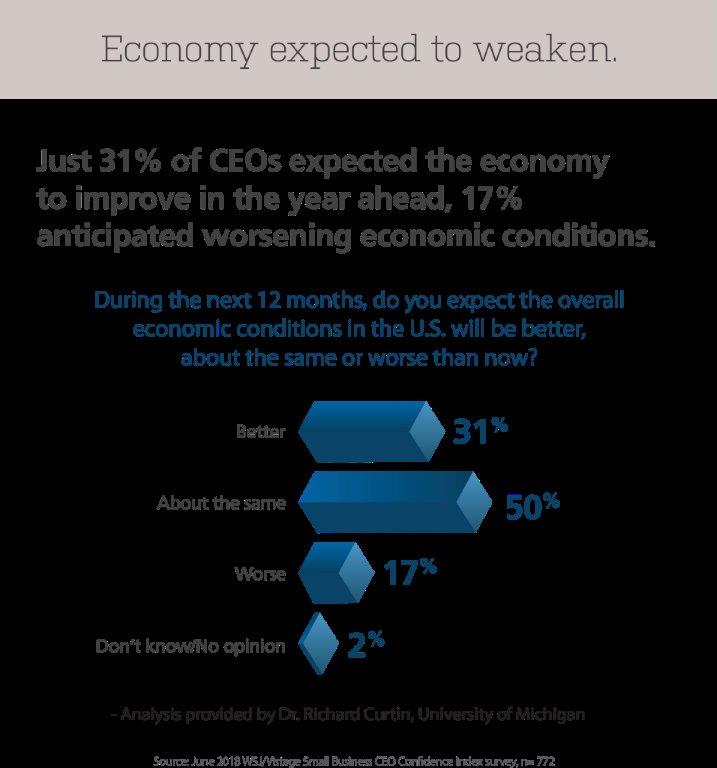

CEOs expect economy to weaken

CEOs expect economy to weaken

Some CEOs expect economic growth to slow in the next 12 months. Less than one-third (31%) of CEOs participating in the survey said they expect the economy to grow this year, and 17% expect the economy to worsen. Half expect the economy to stay the same.

“This was the least favorable outlook for the national economy since [October 2016] and may be an anomalous result that will be reversed in July,” said Curtin.

Category : Economic / Future Trends

Tags: WSJ Vistage Small Business CEO Survey