Types of pricing models: Pricing strategies explained

A pricing strategy is a process and method for determining the favorable cost of the goods and services you sell. It helps you identify the factors that influence an optimal price point that you can adjust as needed to maintain profitability. Pricing models also help you identify your ideal customer and how much they’ll pay and provide a framework for calculating base costs and including them in your final price.

The use of pricing strategies allows you to become more competitive with your peers who sell similar products or services while also allowing you to draw in more customers who are looking for the best value. Pricing strategies apply to every category of goods and services, and you can use multiple pricing models at the same time.

Read on to learn more about pricing models, why they’re an important part of making your business profitable, and how they’re applied to goods and services.

Leveraging Data-driven Pricing Research for Smarter Decisions

Why CEOs need pricing data, not just instincts

Many CEOs rely on experience when setting prices, but data-backed pricing decisions outperform gut feelings. The right pricing research can reveal hidden revenue opportunities, customer preferences, and competitor weaknesses.

Key market analysis tools for CEOs

To make informed pricing decisions, CEOs should use advanced research methods, including:

- Conjoint Analysis – Measures how customers value different product features and price points, helping businesses refine pricing strategies.

- Price Elasticity Testing – Evaluate how price changes impact sales volume and revenue. Essential for avoiding underpricing or overpricing.

- Competitive Benchmarking – Tracks market trends and competitor pricing strategies to keep your prices competitive without sacrificing profit.

- A/B Testing for Pricing – Experiment with different pricing models and track conversions to identify the best-performing pricing structure.

Example: A SaaS company used conjoint analysis to test three pricing models. Research revealed that customers preferred a mid-tier package at $49/month over a $29 or $79 alternative. By using this insight, they maximized revenue while maintaining customer retention.

What is a Pricing Model?

A pricing model is a method for determining the right price for your goods and services. Finding the right price point can be challenging because you want your product to sell regularly and you don’t want to turn customers off so few will buy. Pricing too low can increase sales, but it can also lower profits. In contrast, pricing too high is more likely to result in more products left unsold and also reduce profitability.

To avoid the above scenarios, you need to engage in a pricing strategy that strikes the right balance of price versus the customer’s perception of value and the prices offered by your competition. There are different types of pricing strategies that you can use to determine a price point for your goods and services for optimal sales flow and profit. It’s worth noting that a pricing strategy is not a price point because you’re using observation to determine the best possible price for an individual service or product.

What Should You Consider When Pricing Products and Services?

Determining the most appropriate pricing model for your business is tricky and takes considerable research, planning, and testing before full implementation across all of your products and services. Of particular concern to many business owners is the impact of price model changes on the customer and their standing among the competition.

When determining how to best price your products and services, consider:

- The current positioning of your products and services: Are they positioned as low-cost options, luxury offerings or somewhere in the middle? The pricing of your products and services must be aligned with how they are positioned in the marketplace. The higher the quality of your products and services, the higher the price you can command from customers.

- Your customers: Will your customers tolerate a change to the pricing model for your products and services? If so, how much change will be tolerated? How much “lead time” is necessary before implementation? How will pricing affect the demand for your product?

- Your costs: What are your costs for producing your products and services? Consider not just the current costs but also expectations around increases in costs in the near future based on the industry, suppliers, competition and demand. You don’t want to have such an exact pricing model based on current costs, as pricing must be changed within a few months.

Don’t skip researching what is commonplace for your industry, for the region, or among your competition. This doesn’t mean you must mimic what everyone else is doing. But you should know what is being done and what is not. Inevitably, others have done their research, and there may be a good reason why a particular pricing model is not used for products and services similar to what you offer.

Types of Pricing Strategies and Models

There are multiple types of pricing models that you can apply to your goods and services. Each addresses a specific selling environment and the cost basis used to arrive at the best possible price. Some industries use one pricing model exclusively, while others use different strategies for different products.

Industry-specific pricing strategies for maximum profitability

Pricing is not one-size-fits-all — what works for a tech startup won’t necessarily work for a manufacturing firm. Here’s how different industries should approach pricing:

Technology & SaaS companies

- Best Pricing Models: Subscription-based, tiered pricing, freemium models

- Why? Recurring revenue is king in tech. SaaS companies use tiered pricing to capture different buyer personas — offering basic, pro, and enterprise versions.

Retail & e-commerce

- Best Pricing Models: Psychological pricing, dynamic pricing, discount strategies

- Why? Retail thrives on price perception. Psychological tactics like charm pricing ($9.99 instead of $10) and strategic discounting boost sales.

Manufacturing & B2B Services

- Best Pricing Models: Cost-plus pricing, value-based pricing, bulk pricing

- Why? Manufacturers must balance production costs and bulk orders. Many adopt cost-plus pricing but enhance profitability through value-based premiums for specialized services.

Example: Tesla uses value-based pricing. Customers don’t just buy a car; they pay for innovation and sustainability. This allows Tesla to charge premium prices while maintaining strong demand.

Do your due diligence when looking at these models and strategies before deciding on the ones that work best for you.

Cost-plus pricing

This model is frequently used to maximize profits within the business. It entails adding up all of your costs associated with offering a product or delivering a service and adding on a percentage for profit.

One example of cost-plus pricing is keystone pricing, where you take the base cost, double it to buy more of the same product in the future, and add a percentage to the doubled price for profit. This method also helps with managing rising costs because you can use your per-piece profit to pay for an increase in your wholesale pricing.

Value-based pricing

This model entails setting the price for your products and services based on the perceived value to the customer. The price to one customer may be different than the price offered to another customer. The price you charge for your goods or services is much higher than your base cost and delivers higher profits. Value-based pricing relies on the customer feeling that the price being charged is fair and reasonable, with the product or service meeting the perceived value.

Hourly pricing

For businesses that offer services, you may choose to offer hourly pricing (time and expense) for your services. In such a situation, you invoice the client for all expenses (such as mileage to the client site, etc.) and for each hour of work at a set hourly price, depending on the services being offered.

To determine your hourly pricing, combine the cost of your time and labor, the cost of materials, fuel for your vehicle, if applicable, and other incidental costs. Then, divide the costs by a 40-hour work week to come to an hourly price, adjusting the final price accordingly. You should calculate a percentage of your base hourly rate and any parts you sell for profitability.

Fixed pricing

This model charges the client a set price for a service offered. For example, a project-based company may charge a client a price of $25,000 to complete a project regardless of how many hours are expended or how many resources are involved. Of course, in determining your fixed price model, you’ll want to consider the complexity of services and, on average, how much time and resources must be committed to the project. Without a true understanding of the costs, a business can lose money on fixed-price contracts.

Performance-based pricing

In performance-based pricing, you invoice your customer based on the performance of the product or service you deliver. Such a pricing model might only be used for certain clients and in specific situations, as it requires significant agreement (in writing) between you and your client. You must spend the time upfront setting guidelines for performance-based pricing models and developing very clear and unambiguous metrics for the achievement of the objectives. If you are in a rush or getting pressure from the client to move forward, do not attempt performance-based pricing models.

Competition-based pricing

Competition-based pricing involves finding out the pricing of a similar or same product or service from a competitor and using it for your own pricing. There are sub-categories to this type of pricing strategy that include:

- Comparative pricing: Comparative pricing is a strategy in which two companies, such as gas stations, keep their prices exactly the same or within a few cents of each other.

- Aggressive pricing: Through aggressive pricing, you don’t engage in a pricing competition with your competitors and instead keep your prices at their current levels or go lower.

- Dismissive pricing: With dismissive pricing, you set a price at a level that you prefer and ignore the competition’s prices. This strategy works well for companies with premium products.

The purpose of the different types of competition-based pricing is to have a lower price or better value than the competition for the same product or service.

Dynamic pricing

Dynamic pricing is based on the demand for a product and commodity price. The base price of some products fluctuates daily and influences the base price of a product, and consumer demand puts pressure on supply levels. With commodity pricing, the price of a finished product goes up and down, depending on how much it costs to purchase future supplies. Consumer demand puts pressure on a product or service to slow down demand when supply and availability are low and increase demand when sales slow down.

Premium pricing

This type of pricing is used for selling luxury goods and white-glove services. The higher cost indicates that the service or good being offered is of higher value than similar products. The price is justified by delivering a service that goes beyond the customer’s expectations and selling a good made from the highest-quality materials and construction. Premium pricing reflects the perception and reality of quality, and there is no such thing as pricing too high.

Freemium pricing

Freemium pricing is mainly used by SaaS providers who offer tiered pricing of their products, but it can be applied to any product or service to attract customers. The free product is typically a basic or limited version of the software and has just enough functionality to make it useful to the user. If the user wants more from the software, they have to pay a fee for access.

Subscription pricing

The subscription pricing model consists of a customer signing up for a recurring delivery or access to goods and services. It’s most commonly seen in SaaS and for goods that need frequent replacement, such as personal care products, household cleaners, and food. Sellers have the option to use tiered or flat-rate pricing, depending on what’s being offered and how willing the market is to pay a specific price. Informing customers of price increases is an important part of this model due to the fact you have to pass along cost increases from your suppliers.

Bundle pricing

Bundle pricing involves bundling multiple services and/or products together for a single price that’s lower than what they would cost if bought separately. Customers view this as improving pricing for services they need to access regularly. This type of pricing is often used in the communications industry by providers of television, internet, and phone services, but it can be used in combination with subscription pricing for just about any product or service that customers use frequently.

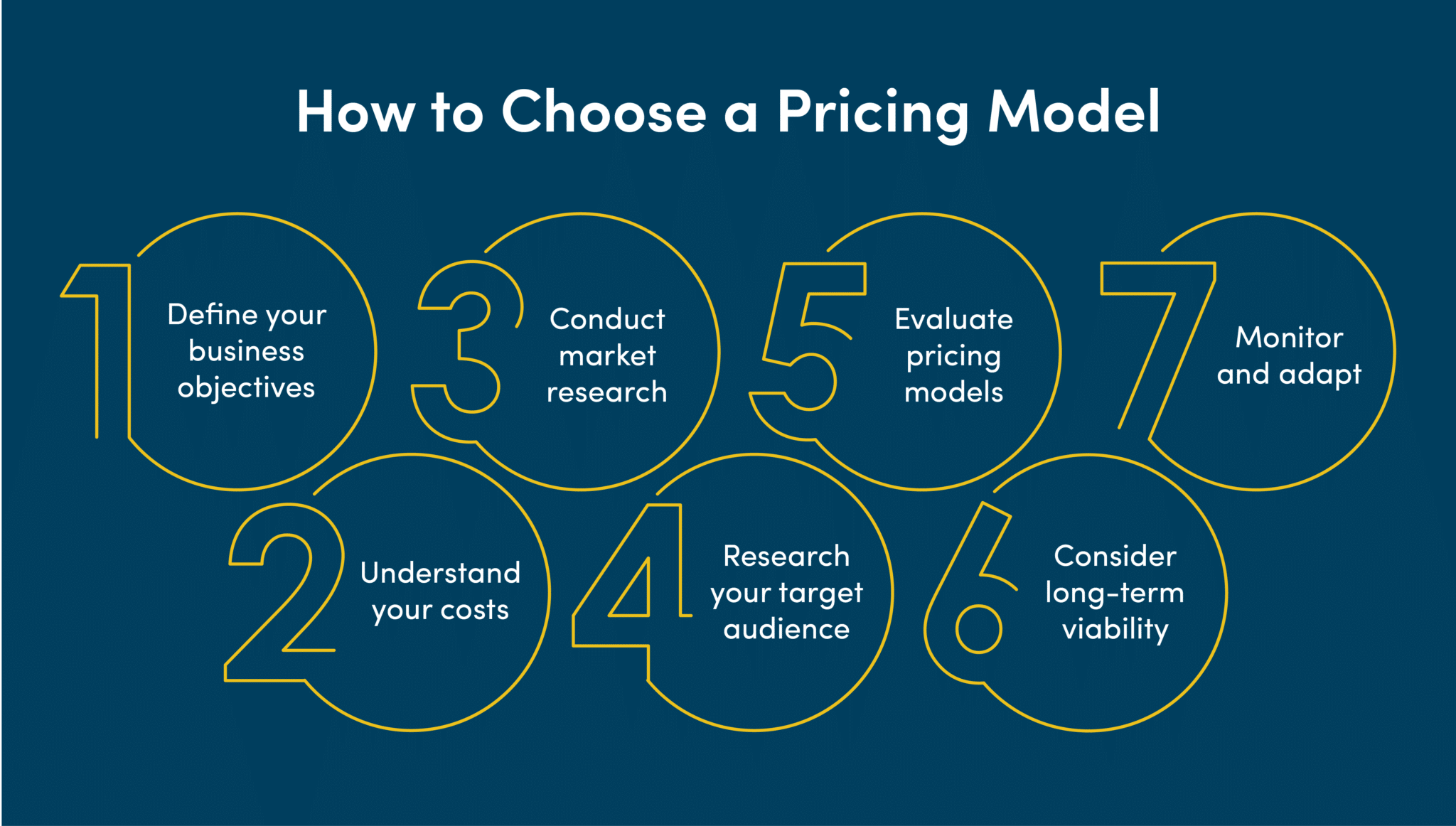

How to Choose a Pricing Model

The pricing model you choose depends on the type of business you run, your objectives, and the amount of effort that goes into selling your goods or services. To ensure you choose a pricing model that works well for both your audience and business, follow these steps:

1. Define your business objectives

Your business objectives are the results you’re looking to achieve, and the pricing model you choose is part of those objectives. You want to become profitable and keep your business in that state for as long as you run it. Profitability helps you maintain your business at your comfort level and enables you to experience growth through stronger purchasing power. With your objectives in mind, you can choose a pricing model that helps you achieve your goals.

2. Understand your costs

Every business has costs that need to be paid in order to maintain its operations. You need to understand how those costs affect your pricing and how to price your products and services in a way that pays for costs plus profit. Some of the costs that come with running a business include wholesale costs of products, labor, rent, and utilities. Make sure that you track all of your costs, so you can cover all of them as you’re figuring out your pricing strategy.

3. Conduct market research

You should conduct market research to learn what the competition is charging, even if you’re selling something unique. Knowing the prices your competitors are charging serves to help you figure out if you’re able to sell at the same or a lower price. It also informs you as to the profitability of the products and services you want to sell.

4. Research your target audience

Researching your potential customers helps you position your product or service and helps you determine the cost of your goods and products. For example, if you’re selling an expensive product that appeals to a wealthy audience, you need to know more about the individuals who make up the audience, how much money they have to spend, and their price tolerance. Knowing how much your target audience has to spend serves to inform you on how much you should charge.

5. Evaluate pricing models

It’s a good idea to evaluate your pricing model before and after you put it into action. Different types of pricing models can be used for the same service or good. You may find that the one that made the most sense winds up not being as effective as you expected. This isn’t a failure of your decision-making skills so much as it’s the market not responding to the pricing model you chose.

6. Consider long-term viability

The pricing strategy you choose today may or may not hold up over time. Pricing models are subject to external forces such as demand, consumer perception, and wholesale pricing. There may come a point where you have to change up your pricing model by making adjustments within its framework or switching to an entirely different one.

7. Monitor and adapt

Keep an eye on your prices and sales numbers over time. The resulting data tells you about the effectiveness of your pricing strategy and lets you know if it’s working or not. You may find sales improve if you increase or decrease the price and if you should discontinue selling something altogether because of low sales.

How Pricing Psychology Shapes Customer Perception

The power of perceived value

Customers rarely judge prices rationally. Instead, they assess value based on brand perception, emotional connection, and social proof. Luxury brands use high pricing to reinforce exclusivity, while discount retailers highlight savings to create urgency.

Anchoring: Why first prices matter most

Anchoring is a cognitive bias where the first price a customer sees influences all future price perceptions.

- Apple releases its newest iPhone at a high initial price — later reducing it when a new model launches. This keeps the older model appearing more affordable without devaluing the brand.

- Restaurants use high-priced “decoy” items on menus — making mid-range dishes seem like better deals.

Discounting done right (Without hurting your brand)

While discounts drive quick sales, excessive discounting can weaken brand value. Here’s how to use discounts strategically:

- Limited-time offers – Creates urgency without long-term devaluation

- Bundle pricing – Encourages higher spending per transaction

- Loyalty-based discounts – Rewards high-value customers without harming margins

Example: A high-end fashion brand wanted to increase sales without aggressively discounting. Instead of slashing prices, they offered exclusive “members-only” sales, keeping the luxury appeal intact.

Wrapping Up: Choosing the Right Pricing Strategy

Choosing the right pricing strategy can help make your business profitable, allowing you to reliably generate revenue and profits. Pricing models let you determine the best possible price, include pricing buffers so you can raise and lower the price point, and offer satisfactory pricing to your customers. Make sure to go through the different types of pricing strategies to determine which ones are applicable to your business model and goods or services for the best results.

At Vistage, you can join peer advisory groups that can help you further understand different pricing strategies and help you identify the ones that work best for you. Joining a peer group of successful business owners and CEOs lets you gain access to an amazing database of living business knowledge from people who have years of experience behind them. Vistage makes it easy for you to learn more about running a business and how to achieve the growth you’re seeking.

This topic and more are included in Vistage Connect™ peer advisory sessions.

Gina Abudi is president of Abudi Consulting Group, LLC, which provides strategy and implementation for projects, processes, people and technology to businesses of all sizes. She can be reached via her website, AbudiConsulting.com.

Related Resources

Developing pricing strategies while navigating uncertain times

Category : Product & Pricing

Tags: Sales Strategy

Meticulously Explained all! Thank you for this beautiful, insightful article!

Interesting and straight forward. I was hoping to hear more about pricing strategy versus the model itself. Would you not be uncomfortable sharing any published or private works on what sort of decision process to use in order to decide on a pricing strategy?

Thank you for your comment @Don! Gina Abudi shared a couple links with us in response to your question about the decision process. Please read below and let me know if you have additional questions. Thank you!

“Here are two links that may be valuable to share. The second, from American Express, pretty much covers many of the steps we took at Abudi Consulting Group in order to decide on our pricing strategy for our clients. Specifically, we considered the following:

• Our client base

• Our competition’s products and services

• Our key differentiators

HBR: https://hbr.org/2018/09/the-good-better-best-approach-to-pricing

American Express: https://www.americanexpress.com/en-us/business/trends-and-insights/articles/get-it-right-pricing-strategies-that-work-mtmc/

I hope this helps!

Best,

Gina”