Risk Management: The High Risk of Lost Opportunities

We face greater risk when on defense than on offense. Right? Wrong! It’s true that we normally think of risk management and control as defensive activities. But while we are busy avoiding lost ground, we often miss out on important opportunities to gain ground. At the end of the day, touchdowns count more than lost yards.

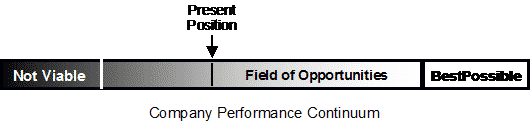

Most enterprises have an expansive field of opportunities between where they are and where they can be. This “profit gap” warrants primary attention. Ignoring it can be costly in terms of stalled progress, flagging morale, and lack of profits to fuel growth.

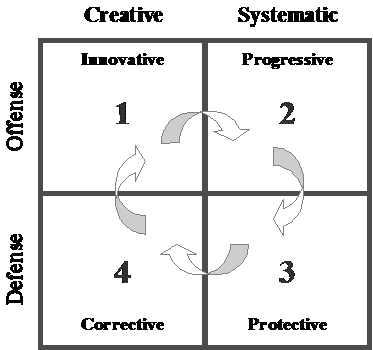

There are four natural modes of leadership and management. We humans offensively seek pleasure and defensively avoid pain. We use our right brains to creatively plan what we are going to do and our left brains to systematically to get those things done. Also, it is natural to protect our successes in Mode 3 until we are forced to make Mode 4 corrections and adjustments.

The 4 Natural Modes of Leadership depicted here will help visualize the concept.

Good leaders and managers resist natural cycles through all four modes and maximize their time going after prioritized opportunities for advancement. The more time we spend on offense, the less need we have for defense. And besides being more exciting, offense is more rewarding.

In my 47 years of pioneering the field of enterprise optimization, I’ve never seen a defensive company gain ground on their competition. When focused on darkness, there’s little likelihood of advancement toward the bright end of the performance continuum.

Put in these simple terms, the choice between offense-based and defense-based leadership is clear. But certain business traditions can muddy the view. For example, cost-based posturing is inbred into accounting systems that favor avoiding sure losses over pursuing speculative gains.

The answer is to use readily available decision-support tools commonly known as Enterprise Resource Planning (ERP) and, best of all, profit optimization software. Such tools will minimize the risk of going after illusive or suboptimal opportunities.

Recessions are seen as periods of high risk; as times for belt tightening and prudent caution. However, they are actually the best time to gain market share and improve competitive position. It costs money to make money.

Looking for areas of waste is always a good idea, but reducing company strength because that’s what your competitors are doing only adds to the high cost of lost opportunities. If your company has a 5 percent market share, it has 95 percent room to maneuver. Recessions are great times for creative maneuvering. Even during our recent so-called Great Recession, our dip in GDP was just a few percentage points. That left a lot of customers looking for quality products and reliable service.

We are familiar with the concept of “opportunity costs” but seldom take them as seriously as we should. These costs are very real. While not visible on our income statements and balance sheets, they are permanent forfeited profits that result from not reaching beyond low-hanging fruit to harvest the ripest and sweetest of all. That’s the essence of the Field of Opportunities and going for BestPossible.

There are many kinds of risks. Some involve offense and others defense. But all opportunities for advancement call for offensive leadership. The risks of setbacks pale compared the rewards of deliberately and systematically going after the best of our here-and-now opportunities.

The major risks of defense-based leadership are:

- o Lost profits

- o Lost market share

- o Lost enthusiasm among stakeholders

The main advantages of staying on offense while others hunker down are:

- o Improved profits and competitive position

- o Increased market share

- o Heightened enthusiasm among stakeholders

To summarize: A good offense really is the best defense.

Category : Risk Management