Concocting The Right Business Strategy: Organizational Value Quadrants

A cornerstone of corporate strategy is knowing your organization’s true value proposition and using that knowledge to innovate the business model so that existing customers can be better served and share of markets can be extended. Developing effective strategy requires business leaders to examine their value statements and to learn how to utilize and navigate the Organizational Value Quadrant (OVQ)1 model. The four quadrants of organizational value define distinct operating models that relate the company’s positioning relative to the markets served by the business. Knowing which quadrant your business lives in and understanding how to navigate within the OVQ form the backbone of every strategic plan. This article explains the organizational value quadrants, and what they mean to a business in terms of strategy and investment.

A cornerstone of corporate strategy is knowing your organization’s true value proposition and using that knowledge to innovate the business model so that existing customers can be better served and share of markets can be extended. Developing effective strategy requires business leaders to examine their value statements and to learn how to utilize and navigate the Organizational Value Quadrant (OVQ)1 model. The four quadrants of organizational value define distinct operating models that relate the company’s positioning relative to the markets served by the business. Knowing which quadrant your business lives in and understanding how to navigate within the OVQ form the backbone of every strategic plan. This article explains the organizational value quadrants, and what they mean to a business in terms of strategy and investment.

Value Proposition; how well do you know it and live it?

For any business, understanding the company’s value proposition is the first step in strategy formulation and must be addressed as a key input to the OVQ discussion.

A value proposition can be thought of a business or marketing statement that summarizes why a consumer should buy a product or use a service. In essence, this statement should help the firm connect with a potential target market in a way that differentiates a particular product or service as to how it will add more value or solve a problem better than other similar offerings.

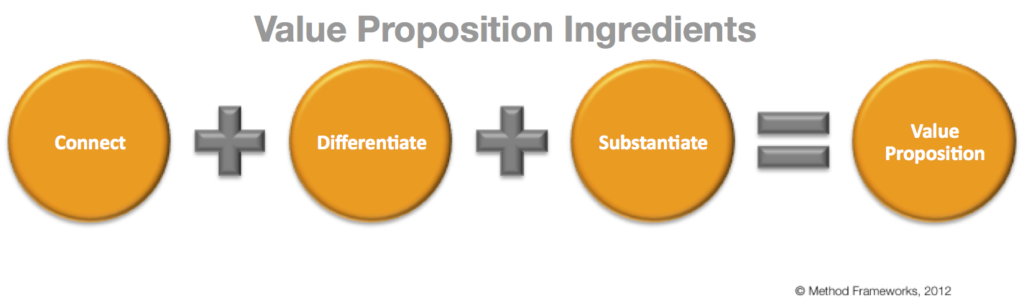

The purest three elements of a value proposition are:

The connection: What is it that makes the product or service inspirational and innovative? The connection must compel the customer to want the product and say, “I need this”.

The differentiation: What is it that makes the product or service indispensable? The differentiation should help eliminate the thought of substitutes in the mind of the buyer.

The substantiation: What facts can you state about the product or service to help create credibility and trust? The substantiation should help the potential buyer to believe in the product or service and take action.

Organizational Value Quadrants

Businesses operate on models designed for value creation that are in alignment with their stated value propositions for each class of products and services. While the value proposition helps communicate the marketing and sales message, the business model must deliver the value promised. That leads to the discussion of value quadrants.

Strategists should always be thinking in terms of value quadrants when considering their firm’s competitive positioning. Method Frameworks focuses on four primary quadrants to classify the business model a company is following. The quadrants are shown in the graphic below:

Each quadrant represents the focus of a company or business unit and can be thought of as the strategy and business model generally being followed. Below is a synopsis of each quadrant:

The Customer Intimacy & Synergy Quadrant

Companies operating in the Customer Intimacy & Synergy Quadrant focus on the customization and tailoring of products / services. Their missions are geared toward know their customers well, delivering what specific customers want and “personalizing” the experience.

Customers of businesses in this quadrant have the expectation of a close relationship that is solution-based for their needs. In return, they are willing to accept a higher cost for the goods or services they are purchasing.

The Operational & Organizational Excellence Quadrant

Companies operating in the Operational & Organizational Excellence Quadrant focus operational efficiencies, supply-chain optimization, maintaining low overhead and accomplishing more with lean structures. Their missions are focused on creating predictability in delivering quality, low price, no-hassle purchase experiences and ease of use.

Customers of businesses in this quadrant have the expectation of low cost and best pricing. In return, they are willing to accept less in the areas of service and relationship intimacy.

The Customer Enrichment & Fulfillment Quadrant

Companies operating in the Customer Enrichment & Fulfillment Quadrant focus on helping their customers reaching and fulfilling their potential. Their mission themes relate to creating better lives for their customers and the opportunity for self-actualization.

Customers of businesses in this quadrant have the expectation of enjoying an experience and learning through exploration and discovery. In return, they are willing to accept a higher cost for the goods or services they are purchasing.

The Product / Service Superiority & Innovation Quadrant

Companies operating in the Product / Service Superiority & Innovation Quadrant focus on creating superior or unique “One-of-a-Kind” value-add services or products. Their missions are geared towards innovation and creating the best products and services available in their class.

Customers of businesses in this quadrant have the expectation of receiving high quality and benefiting from innovation in the products or services being purchased. In return, they are willing to accept a higher cost for the goods or services they are purchasing.

Utilizing The Quadrants In Strategic Planning

Each quadrant groups companies relative to their value propositions and respective customer expectations. Most companies standardize on a business model and force a fit of that model to all their customers. Although it may seem illogical to combine a strategy of individual service (custom-tailored and expensive) with a model of operational excellence (where cost-minimization requires a high degree of process standardization), it can and has been done successfully. A business does not have to be entirely committed to an exclusive relationship with only one category and can use strategy to navigate and position themselves in different quadrants of the OVQ.

Sales organizations have developed impressive sophistication in analyzing their customers and segmenting them appropriately. Likewise, CFOs are highly tuned into profit analysis and many have developed the equivalent of “heat maps” for profitability. Together, they have analyzed their sales and profit data and have developed a clear understanding of which customers are providing them with high sustained profitability. With this combined insight, customer segmentation can then be applied to strategically approach these profit areas with segment sub-strategies. Segment strategy can be applied to invest resources in securing and growing key customer relationships through integration of the company’s operations with those of the key customer’s in a tailored and effective approach. When this approach is followed, the investments can result in lowering key customer’s cost while increasing the profits of the supplier business.

Customer integration within a value quadrant can be accomplished by tuning customer inventories, smoothing order patterns and even deploying substitute products in carefully-selected situations. The key is to partner with key customers and shift the focus of supply chain efficiency initiatives from optimization solely within the organization’s supply-chain ecosystem to an optimization of the joint vendor-customer supply chain domain. This shift creates enormous new efficiencies for both organizations and helps increase the cost of switching vendors for the customer in the future.

The example above illustrates how an organization can straddle both the operational excellence and the customer intimacy quadrants. With strategic positioning companies can begin to dominate in other quadrants through the creation of other differentiated serving models for important customer segments. Through careful strategic planning and follow-though in execution, a business can actually implement and sustain multiple parallel service models to operate successfully across quadrants.

Recap

Business leaders must begin with a clear and realistic understanding of their value proposition, the first step in strategy formulation that must be addressed as a key input to the Organizational Value Quadrant analysis. A value proposition can be thought of a business or marketing statement that summarizes why a consumer should buy a product or use a service.

The purest three elements of a value proposition are the connection, the differentiation and the substantiation. While the value proposition helps communicate the marketing and sales message, the business model (represented by quadrants of the OVQ model) must deliver the value promised. Each quadrant represents the focus of a company or business unit and can be thought of as the strategy and business model generally being followed. The four primary quadrants to classify the business model a company are:

– Operational & Organizational Excellence

– Product / Service Superiority & Innovation

– Customer Enrichment & Fulfillment

– Customer Intimacy & Synergy

Most importantly, a business does not have to be entirely committed to an exclusive relationship with only one category and can use strategy to navigate and position themselves in different quadrants of the OVQ.

Suggested Reading:

– Corporate Strategy: 5 Critical Alignments To Assess

– Value: Create – Capture – Share

– Corporate Strategy: Multinational Organizations

1 – Organizational Value Quadrant based on the work of Edgar Papke

Category : Strategic Planning

Hi Joe,

Thanks for sharing your thoughts about this matter, you deliberate it well here.

Thank you for you comment, Dorris.