What if You Buy a Red Ocean?

Do mergers and acquisitions work in these challenging times? What if your growth strategy was to expand your business through acquisitions, only then to find your company in deep, “bloody red” water? You thought you were getting new revenue streams or better efficiencies. Instead, your new business is centered in a red ocean of bloody competition.

I wish this was an occasional occurrence but we find it happening all too frequently: as a business fails, another company acquires it…or as a growth strategy, a company tries to find a related business or industry in which to make an acquisition or a merger.

Three recent illustrations:

- A REIT acquired another which they thought was larger and healthy, but found that their acquisition had forged a lot of complex deals on less-productive properties that were going to be difficult to unwind or turn into better performers. Due diligence aside, sometime the power of consolidation thinking and the emotions of “we can grow it” take over from the reality of “if they aren’t making their numbers, why do we think we can turn them around?”

- Another was a Canadian company that had a successful coffee business, a red ocean itself of bloody competition. The owner was expanding into new lines of business as his growth strategy. His latest acquisition was a company that had failed but had a unique process for purifying water—reverse osmosis. He was struggling to open new market space in which the bottled water and home water cooler industries were both already over-supplied.

- A third was in the office furniture business. The owner had been thrilled when his competitor decided to retire and sell him his business. Now he had even more supply in a market of diminishing demand.

For mid-market companies, not global giants, there is little room for error in changing times. If you are thinking about an acquisition or a merger, Blue Ocean® thinking might help you evaluate an upcoming decision with fresh eyes.

Let’s think about this without your brain’s emotions hijacking your business logic:

#1) In trying to find a nonuser and create new markets, it’s okay to stay in your current industry if you can add value in innovative ways. Southwest is still an airline but it has changed the flying experience, and very profitably. As it buys other airlines, like Air Tran, consumers now expect the Air Tran experience to become the Southwest experience.

If you merge or buy, will you be adding value to the other company or to your own in innovative ways so that consumers see the growth as added value for them? Will the merger bring you increased resources, new technology or new methodologies to apply to the problems you are currently solving? Is there real differentiating utility that you are bringing to the market through this consolidation? If no, rethink your strategy, and quickly.

#2) Maybe you are making an acquisition, like the water system company mentioned above, that will diversify your portfolio and expand your customer base. Great idea. But are you buying new value for those consumers or just duplicating solutions that others already have mastered? Did the company you’re buying fail because of activities that you can address, fast, or because there was too much supply and too little demand at the prices they were charging?

This might be a good time to think again about your marketing and business development strategy. Basically, you have two obstacles to overcome: pricing and customer adoption hurdles. With the first, can you offer high value at a low cost—an essential part of Blue Ocean thinking. If you can, by eliminating unnecessary costs (from too much complexity to too many steps in the buying process), can you offer better value at a better price with a suitable margin? If not, there is probably a problem coming.

With the second problem, adoption hurdles, have you really done your research on the customer buying process, their pain points and how you can overcome them, so that your product or solution can penetrate the market and push out the competition? All too often, people try to drive sales in the same old way despite the fact that they have new products, services and solutions available through an acquisition.

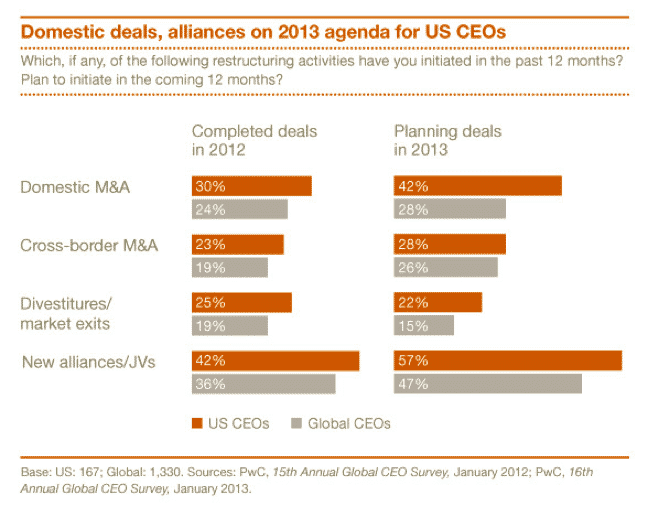

The recent publication of the PWC Annual Survey of CEOs is worth reading if you are thinking about a merger or acquisition as part of your growth plans for the next 1-3 years. As you see in the chart, the US CEOs are rather bullish on acquisitions compared with their global colleagues. PWC’s research suggests that these 1600 surveyed CEOs are focused in three major areas:

#1: Building resilience to disruption. Focus is on collaboration with partners and diversification.

#2: Taking the home-field advantage. Focus on the US market with consolidation for US customers.

#3: Siding with the customer. “Expect interest in predictive analytics and other customer-oriented strategies to keep growing. CEOs are setting the customer as their beacon to build businesses that last.”

Keep this in mind as you focus on organic growth strategies in your current “red ocean,” expand your presence through a merger or acquisition in your same industry sector, or seek new “blue ocean” opportunities where you can create new market space, with or without buying or merging.

Category : Innovation