Fiscal Health: Strategic financial insights for the post-pandemic reality

The CEO’s Journey: Fiscal Health Conference on May 21 challenged hundreds of Vistage members from around the world to stop protecting the past, and start inventing the future. (And do it faster than the competition.)

Keynotes and business resources provided proven tactics to help attendees take control of the why, what, where, when and how of investing in the health and growth of their businesses, with ample time throughout for connecting one-on-one and in small groups to share perspectives.

“No one has ever been through anything like these past 15 months,” shared keynote Geoff Colvin, Senior Editor-at-Large of Fortune, setting the stage for a day of embracing victories in leadership thus far, and highlighting what would be needed to persevere.

Below I’ll explore key learnings from Geoff’s presentation, as well as from keynote Karen Gordon Mills, Senior Fellow at Harvard Business School and Administrator of the U.S. Small Business Association 2009-2013. I hope you are inspired to take action as we continue on the path of an economic rebound like none other.

GEOFF COLVIN

Someone is going to win — why shouldn’t it be you?

Geoff Colvin had an important message gleaned from 40 years at Fortune. The companies who win most, have leaders who summon the courage to act in spite of great uncertainty. In “Recalibrate: How to succeed in this business climate,” he provided six directives for CEOs to stay in a winner’s mindset, no matter the circumstance.

DIRECTIVE No. 1: Manage the whiplash effect.

At the onset of the pandemic, our economy declined at the rapidest rate in history. Fast forward to today, and many companies are recovering at a speed also never seen before. On the flip side, others that unexpectedly boomed at the height of the pandemic find themselves slowing down.

There is order to be found in this boomerang, Geoff shared. Leaders can overcome with a laser focus on compensation, working capital discipline, and pricing.

|

MEMBER INSIGHTS: What is your number one priority, right now?

|

DIRECTIVE No. 2: Define your core and make sure you support it, no matter what.

Companies that cut costs first and most deeply are least likely to come out as winners. Instead, in the face of crisis, take time for introspection. What truly makes you who you are? What is your company’s essence? To bring the concept to life, Geoff referenced the singular marketing of DeBeers, most notably at Christmastime 2008, the depths of the Great Recession. To ensure it stayed top-of-mind with customers, rather than cutting budget, DeBeers increased it — bolstering long-term longevity.

DIRECTIVE No. 3: Innovate your business model.

It is imperative to find unique ways to deliver on your brand promise. As an example, Geoff shared the 2020 creative initiative of the Mandarin Oriental. With a brand promise of pampering and luxury, the hotel stayed relevant and continued to deliver by going so far as to offer room service to loyal customers — in the comfort and safety of their own homes.

DIRECTIVE No. 4: Focus on your most valuable asset – your people.

Right now is a great opportunity to take action on:

- Assessing your people. When things are going well, it’s easy to fool yourself into thinking you have a team of A-players. When things get tough, you find out who the real A-players are.

- Stealing stars. Quality talent is more easily accessible right now. Make a list, and make contact.

- Keeping your own stars. Now that you know who your real A-players are, make sure they’re being differentiated and shown the love they deserve.

DIRECTIVE No. 5: Be an effective crisis leader.

Now more than ever, people want to be led. If you’re in charge, be in charge.

- Be decisive. You will never have all the information you want. Still, you must make the call.

- Explain the crisis in a larger context. People do not perform if given a message of uncertainty.

- Define reality and give hope. Be transparent with your people. Let them know you see the way forward.

|

MEMBER INSIGHTS: What is your number one priority, right now?

|

DIRECTIVE No. 6: STAY OPTIMISTIC.

Based on World GDP per capita data, you have good reason to. In close, Geoff said he foresees a major elevation in the mood of the country, about not only dollars and cents, but the intangibles that effect the economy so profoundly.

In his own words: “Face the world with a smile on your face, get out there, and win.”

KAREN GORDON MILLS

You are the path to the American Dream.

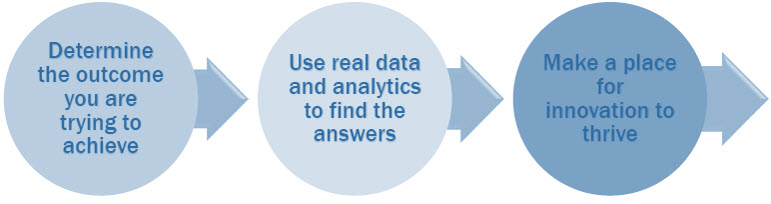

“The 2009 financial crisis was a blip compared to the COVID crash,” Karen Gordon Mills shared to open her presentation, “A playbook for small business growth and success.” Karen’s playbook is defined by reverse engineering success via the following three actions, which I will describe in depth below.

ACTION No. 1: Determine the outcome you are trying to achieve.

- Pick a reasonable timeframe. (3-5 years.)

- Define what victory looks like.

- Create a plan with distinct milestones.

Important: Always bear in mind the basics. (How much cash/financing is required? What human capital do I need? How do I manage my supply chains?)

ACTION No. 2: Use real data and analytics to find the answers.

- Ask: What are my most profitable products?

- Ask: Who are my most profitable customers?

- Cross-reference the frontrunners to get a clear picture of your needs.

ACTION No. 3: Make a place for innovation to thrive.

How much does your business need to change? Will your workplace culture accept it? Embark on the journey strategically:

- Develop internal innovation processes.

- Establish innovators in a team separate from those in more traditional roles.

- Devote money and attention from the C-level.

- Stop and reassess.

- Integrate the innovators back into the organization.

Looking ahead, Karen advised CEOs pay as much attention to their supply chain of human capital, as they do their supply of goods. It’s a sentiment in keeping with Conference attendee priorities — 76% of those responding said hiring, training and retaining talent was at the top of their list.

Karen encouraged attendees to take heart amid the many challenges of the current economic environment. “If you weren’t gutsy, you wouldn’t be in business,” she shared. In tandem with courage she reaffirmed the need for a solid plan, and a support structure of coaches and peers to buoy you in your path forward.

“Ask yourself the tough questions, and do the work to answer them,” she concluded. “That marks the difference between a successful and difficult outcome.”

To those that joined us May 21, I hope you found value in your experience, and gained actionable tools to lead boldly forward. Thank you to the business resources who made this conference possible.

And don’t forget to register for upcoming events in the Vistage National CEO Conference Series!

|

MEMBER INSIGHTS: What is one learning you’ll take from the conference?

|

Category : Business Growth & Strategy