SMB recovery on hold despite increase in CEO confidence [Q4 2020 CEO Confidence Index]

“Hold please” is one of the most frustrating things you can hear when trying to resolve a problem. After wading through the voice response system to finally get to a human, getting placed on hold means everything stops for a while. Hopefully you get connected to the right resource and proceed. Worse case you get disconnected and have to start all over. While it doesn’t appear that we will have to completely restart the economic recovery, there is little question the economic recovery is on hold.

Download the full Q4 2020 Confidence Index Report

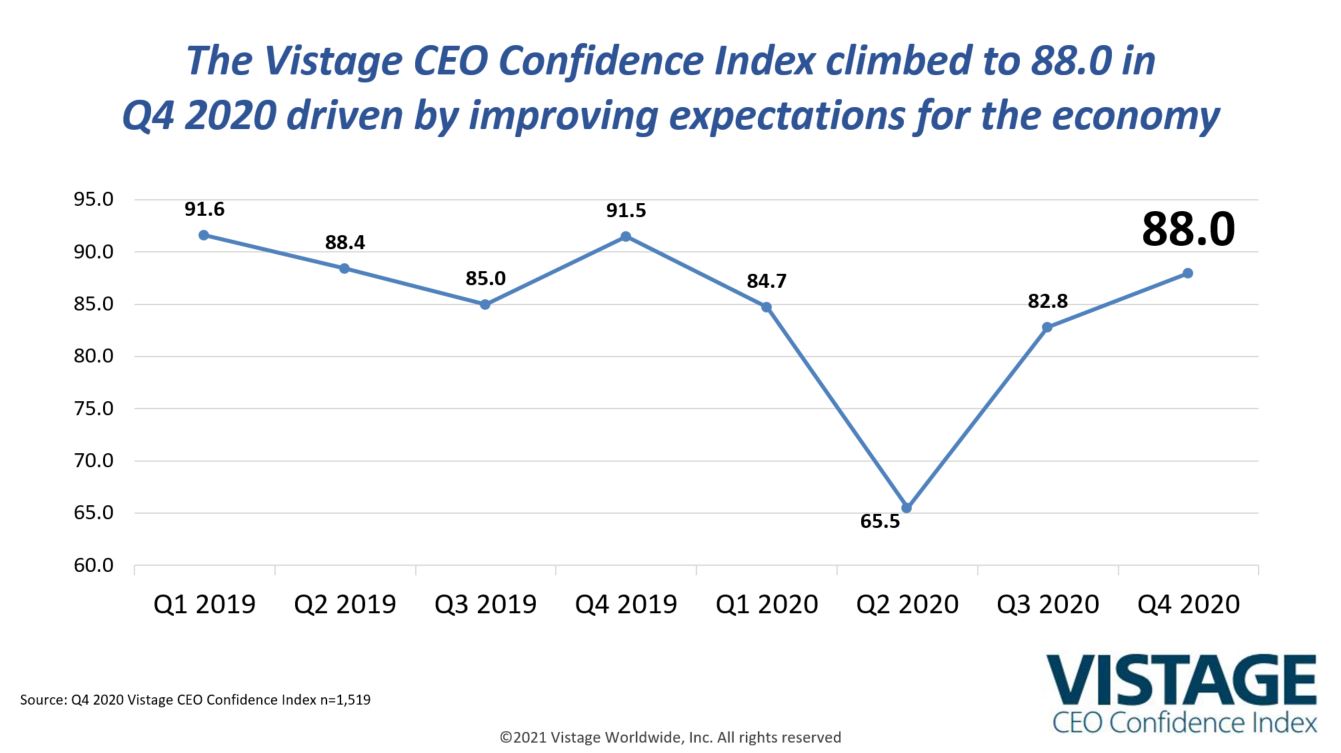

In the Q4 Vistage CEO Confidence Index survey conducted in early December 2020, while 1,519 CEOs reported increased optimism for the future, the data also illuminates their feeling that no economic progress has been made in the past three months.

The CEO Confidence Index increased to 88.0, up from Q3 and well off the bottom of 65.5 in Q2. It also stands just a few points below where we were in Q4 2019. The major difference between then and now is a worsening global pandemic, hospitals reaching capacity and the death toll seemingly setting records every day.

Despite these factors, CEO optimism for the future is founded on the introduction of the vaccine and the hope of “herd immunity” sometime later this year will lessen restrictions and increase business activity.

Revenue impact flat-lines

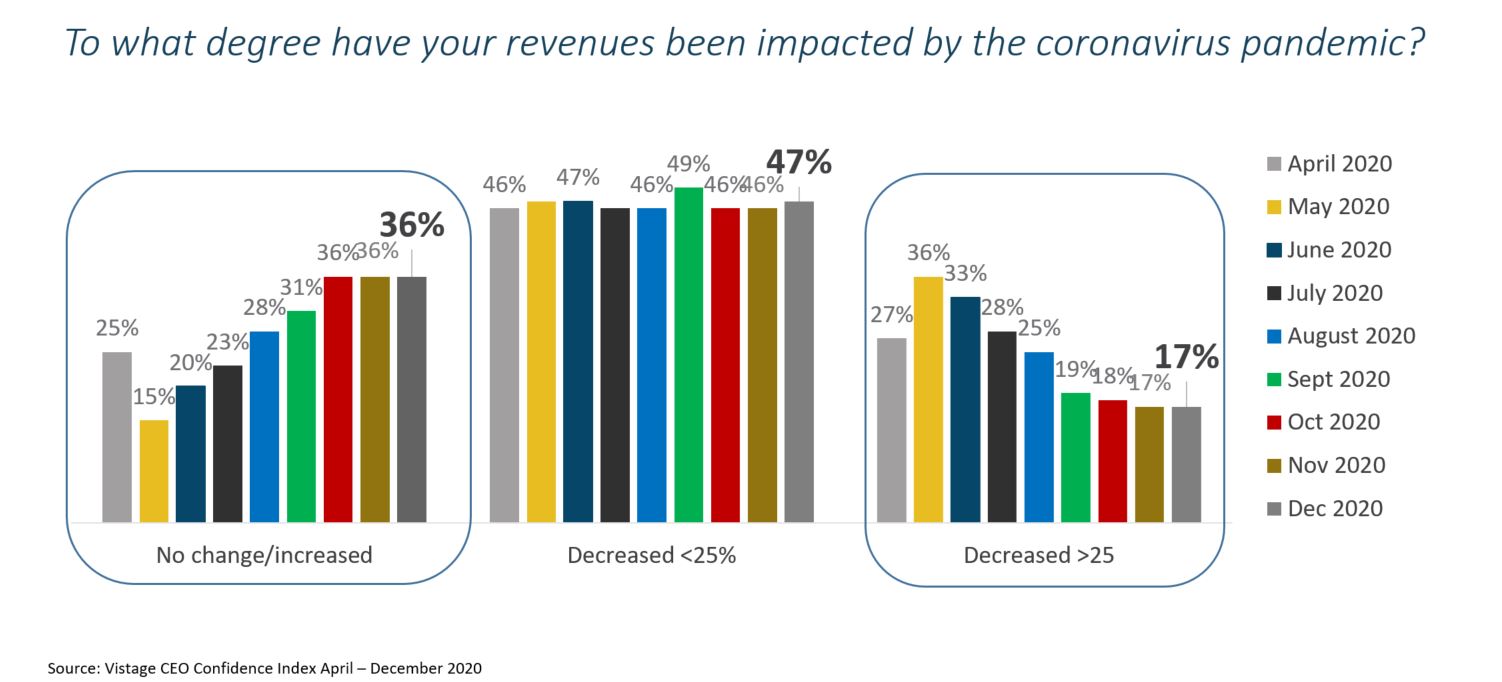

The revenue impact of COVID-19 on small and midsize businesses has flat-lined based on the last three months of Vistage survey data.

Since the October survey, the proportion of SMBs that have seen their revenues remain the same or increase has held steady at 36%. Those reporting revenue declines up to 25% has held at just under half (46%) and those reporting revenue declines greater than 25% remain at 17%. This suggests that the economic recovery is on hold until the vaccine distribution has increased and restrictions lessen, which will stimulate more activity. We’ve reached an economic plateau that won’t change until either the vaccine gains traction and restrictions are lessened, or the post-holiday surge forces us into a more restrictive level of quarantine much like the UK imposed.

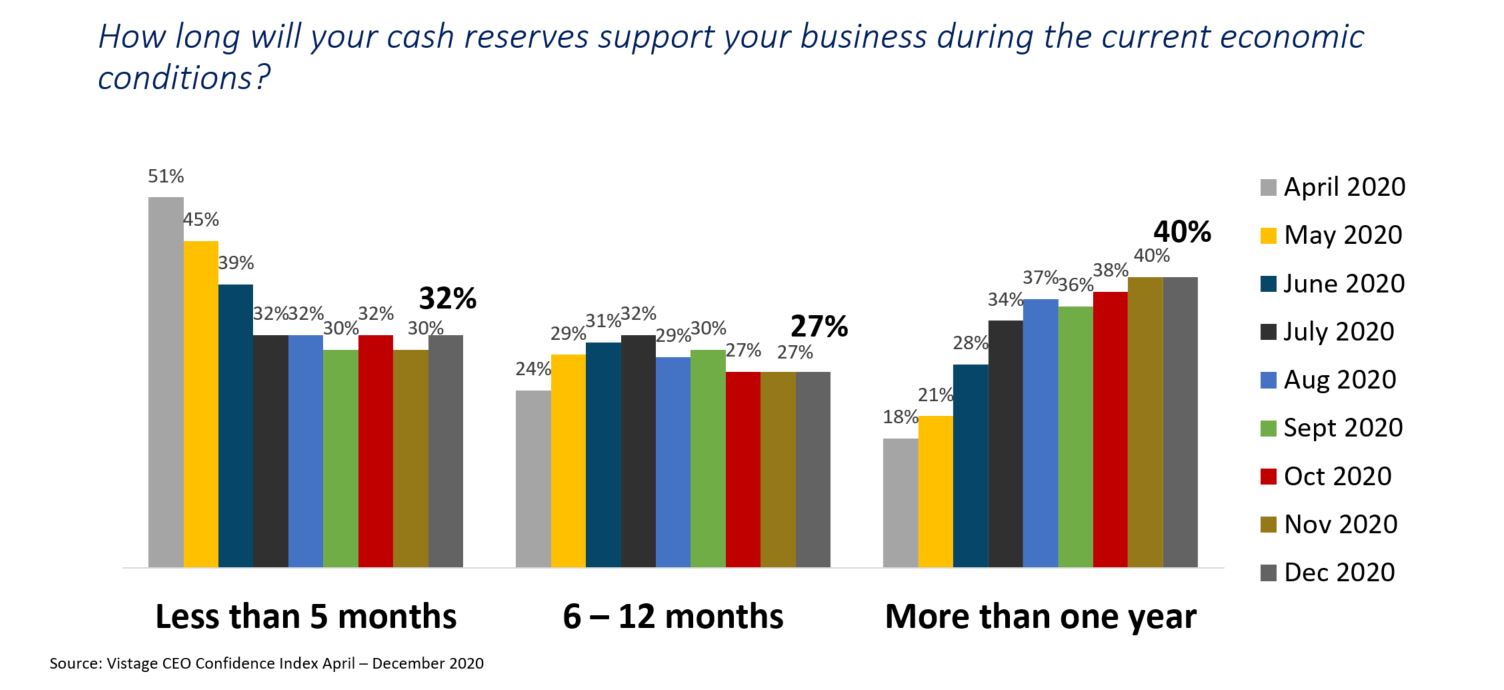

Cash reserves follows a similar pattern with little to no movement in cash positions over the last three months; nearly one-third (32%) of CEOs reported cash reserves that will last less than 5 months in the December survey. This may improve in the new year as the latest round of Paycheck Protection Program kicks in targeting those most in need versus the broad stimulus rolled out hastily in the spring.

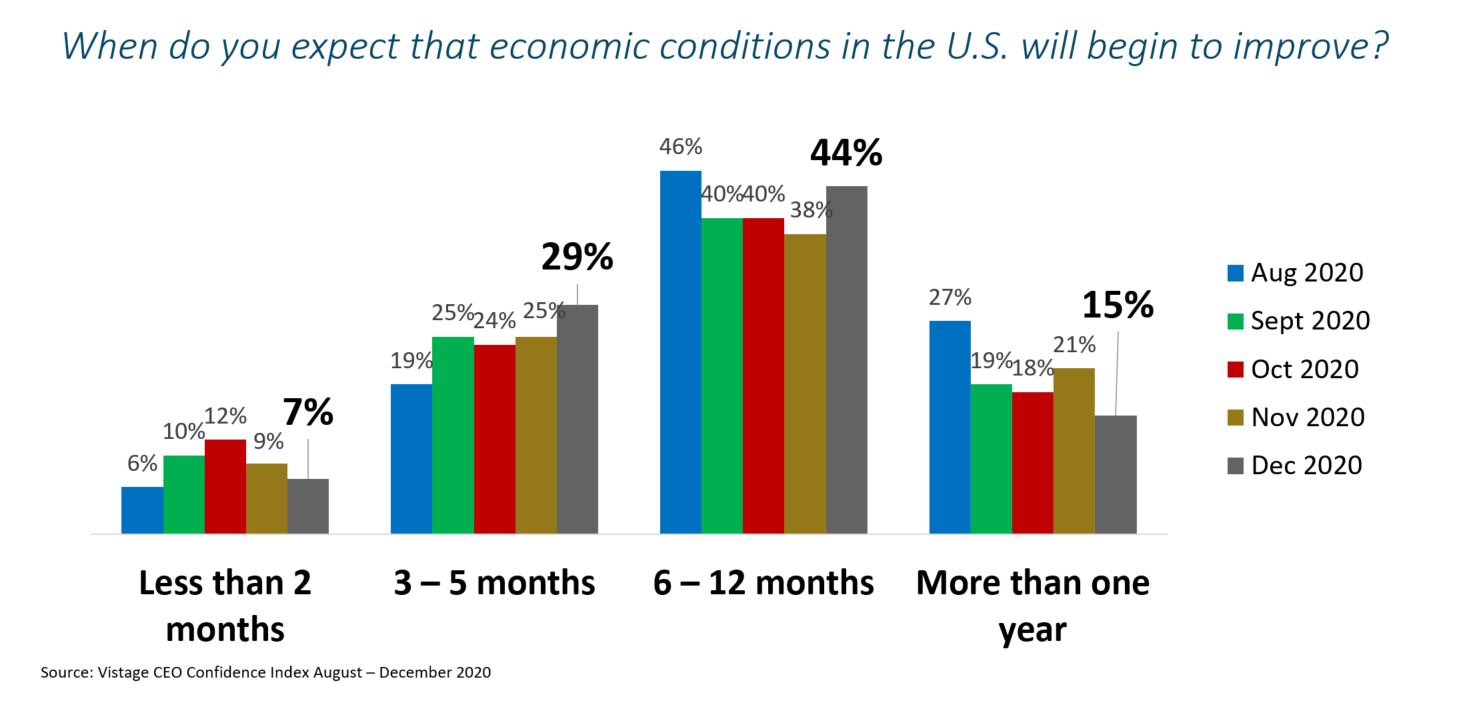

While it may get darker before it brightens, the timeline for economic improvements in the year ahead advanced sharply. The proportion of CEOs expecting economic improvements in the year ahead (59%) is on par with last quarter, we see that the majority expect improvements in 3-12 months. This shift is built on the belief that as the vaccine takes hold, restrictions will loosen, pressure on the healthcare system will abate and we’ll begin to realize the new reality of a post COVID-19 world in the second half of 2021.

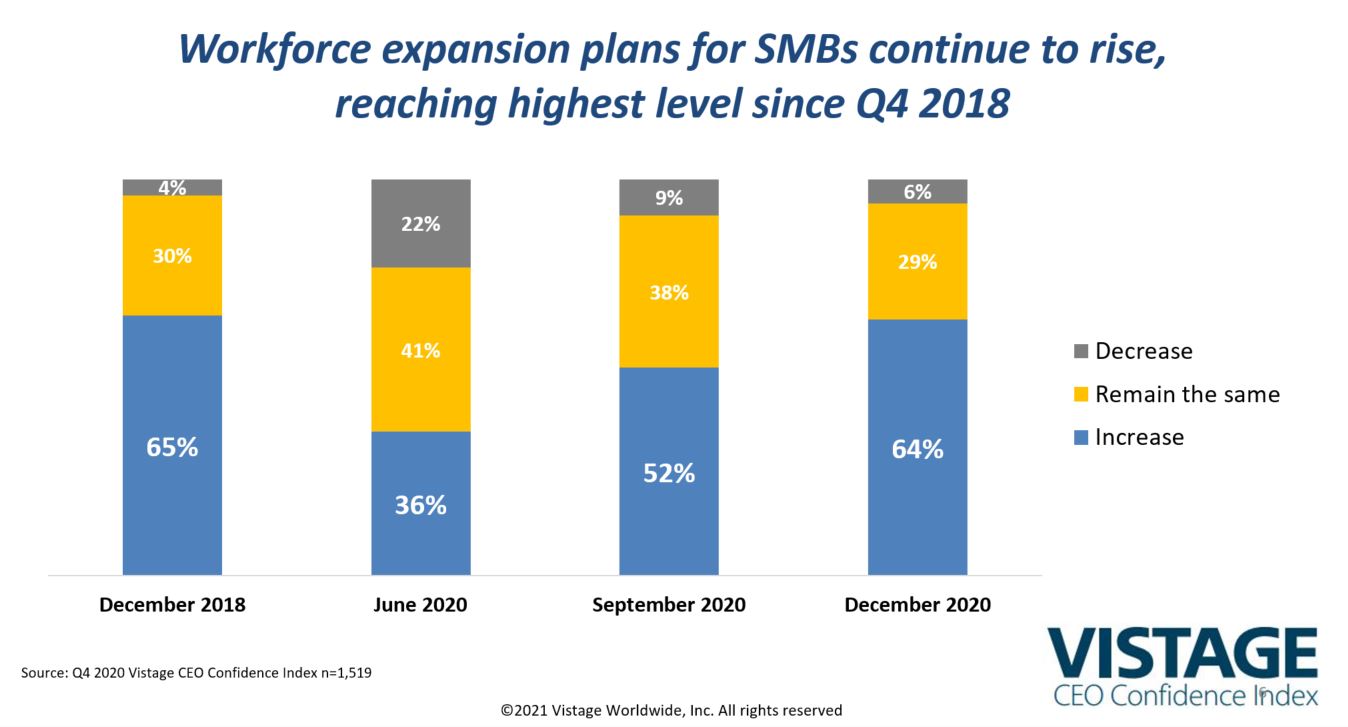

In fact, the components of the Index tied to expansion plans and revenue and profitability projections all close to where they were in Q4 2019 when the expectation of 2020 was to prepare for prosperity. CEOs planning to increase their workforce rose 12 points to 64% from last quarter’s 52%. More than two-thirds expect increased revenues in the year ahead.

Economic stimulus: Part 2

The recently passed stimulus package provides a bridge to help workers and SMBs directly impacted by the pandemic. We’ll also see the new administration’s strategy take shape in the spring, and those actions will help carry SMBs through the balance of the pandemic.

In addition to the continued unemployment benefits and a one-time cash payment for workers, the extension of the Paycheck Protection Program clarified the tax implications from the first program and targeted those SMBs in greatest need with an additional $325 billion. Another $20 billion was set aside for the Small Business Administration’s traditional Emergency Injury Disaster loan (EIDL) program.

For greater insight, analysis and details, read our blog 8 things for small businesses to know about coronavirus relief bill and listen to the briefing with Vistage speaker and CEO of TGG Accounting Matt Garrett, who once again clarifies and provides great perspectives into the program and the key decisions CEOs face.

It’s hard to imagine what our thinking would be if we didn’t have the promise of vaccines already in play. It’s a safe bet to say the vaccine rollout will take longer than expected and there will be issues anticipated and unexpected, but the promise of a post pandemic life is real. Pent up demand by consumers and business will propel an economic surge that may last years. As CEOs must continue to ride out the pandemic, even those that have done well should begin to evaluate how they will capitalize on the growth cycle ahead and the economic forces that will deliver the next phase of economic expansion well beyond 2021.

Download the full Q4 2020 Confidence Index Report

Related resources

Category : Economic / Future Trends

Tags: CEO Confidence Index