Small and midsize businesses pause on their climb to recovery

Following five straight months of progress, the climb to economic recovery for small and midsize businesses has been put on hold. The key indicators — which include revenue impact, cash flow and economic expectations — had been improving each month since the bottom in May but have now flattened, according to our November survey. The quick and steady rebound from the depths represented the easy part of recovery. Uncertainty has finally taken its toll as the real work to accelerate business activity begins.

Conducted the week following the U.S. election, the November CEO Confidence Index survey captured input from 1,173 CEOs, whose sentiment was impacted by news of a new administration, the lack of progress on an economic stimulus bill and surging cases in every state. The prospect of a new administration equally represented the worst or the best thing that could have happened according to the CEOs surveyed, with many in the middle.

A contentious transition and the prospect of a divided government ahead adds little optimism for a strong or quick stimulus package in the face of rapidly expiring benefits from the prior stimulus. The pandemic is exploding across the country, taxing our healthcare system and exhausting healthcare professionals.

The bright star in all this is the amazing progress on highly effective vaccines from multiple pharmaceutical companies, raising hope that an end to the pandemic is in sight and there is promise for a better year ahead. In the meantime, there will be a lot of patience required until we reach that new reality.

Key indicators flatten

Growing CEO concerns about their businesses, customers and the health of their employees in the face of the surges in COVID-19 has resulted in a pause in their recovery.

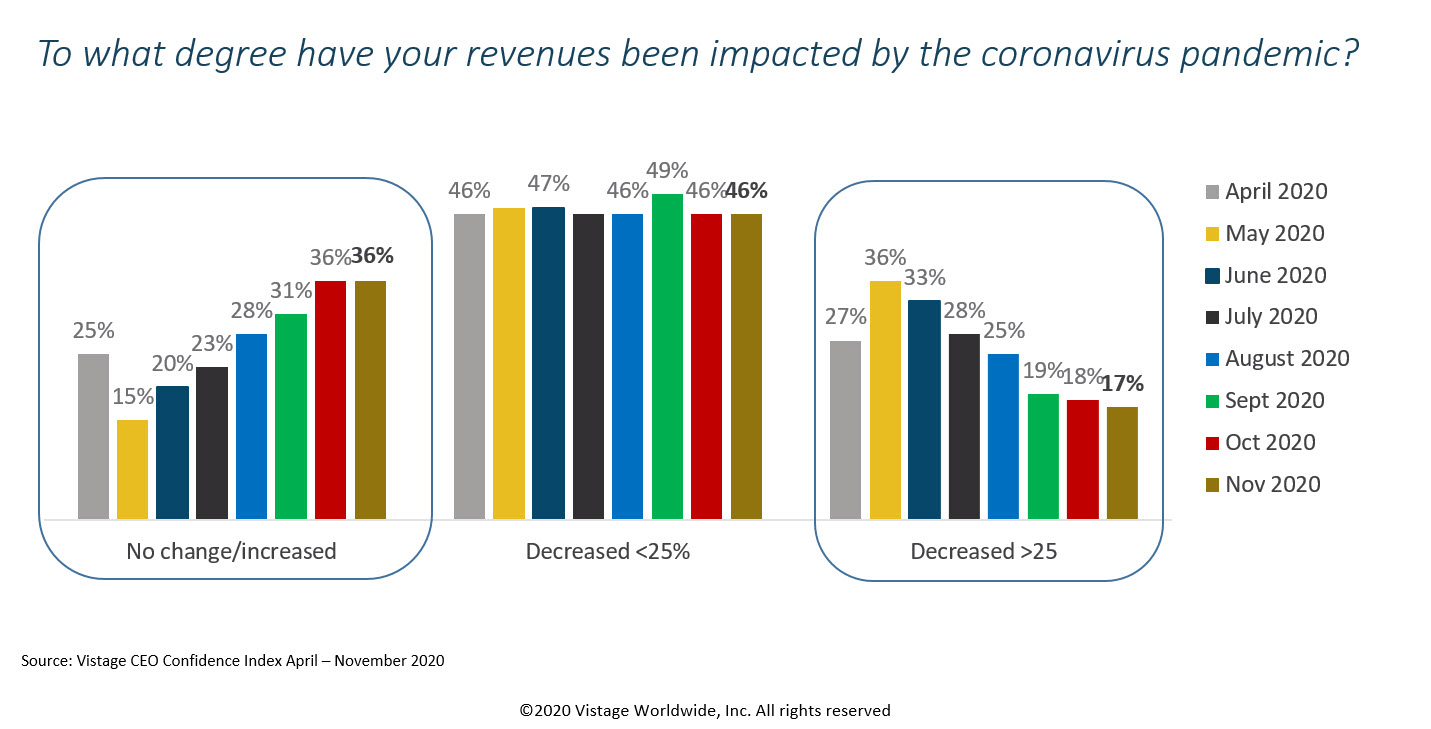

As more states reinstate restrictions with potential lockdowns looming and consumers becoming more cautious about their spending and employment prospects, the hardest hit industries have to take a step backwards. The improving trend in the revenue impact of the pandemic has stalled with no changes between October and November.

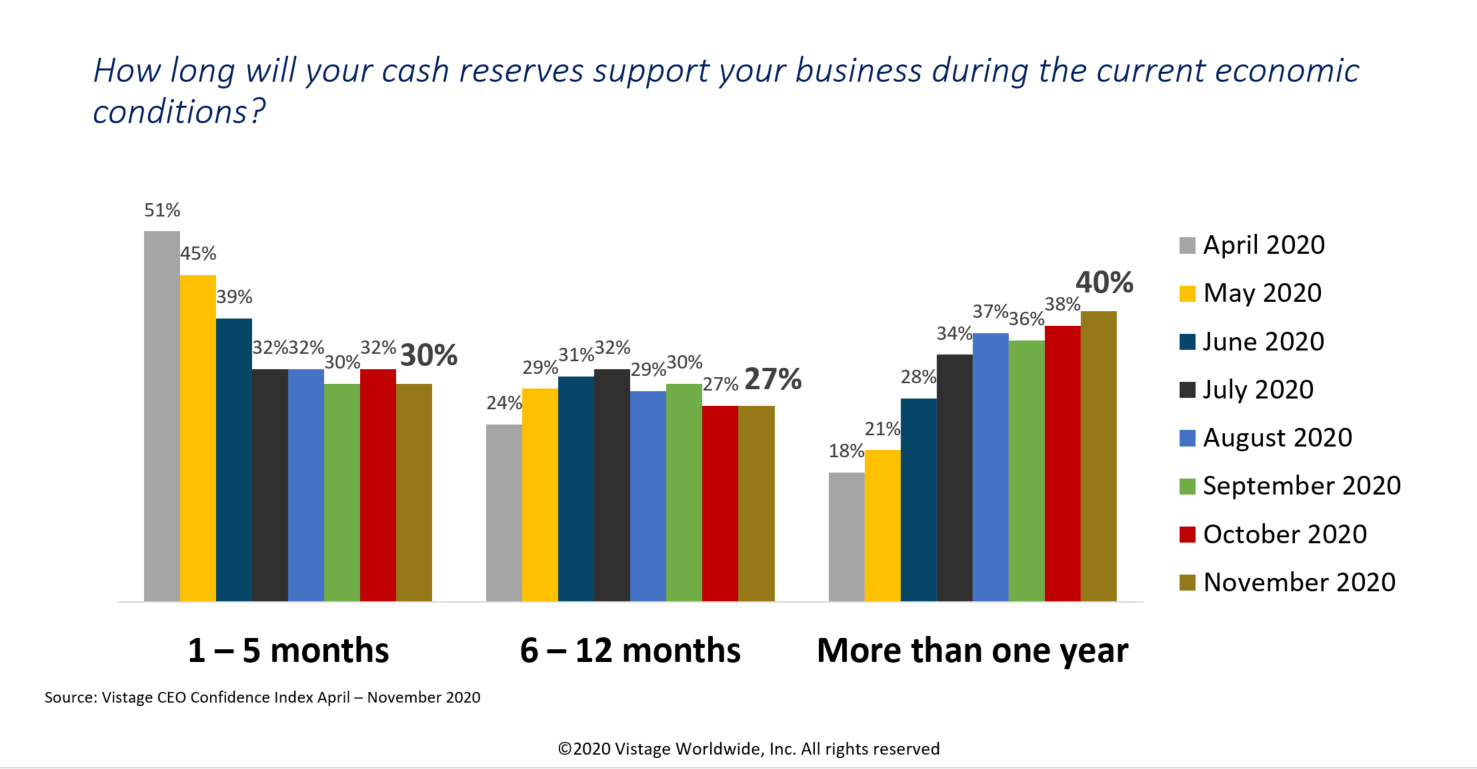

Improvements in cash flow also paused with no real movement in either direction — a troubling situation considering there is no stimulus package in sight and the existing protections for businesses are set to expire at year end.

The good news is, again, the prospect of a vaccine and the hope of effective distribution across the country that will accelerate the economic recovery and reduce the strain on cash.

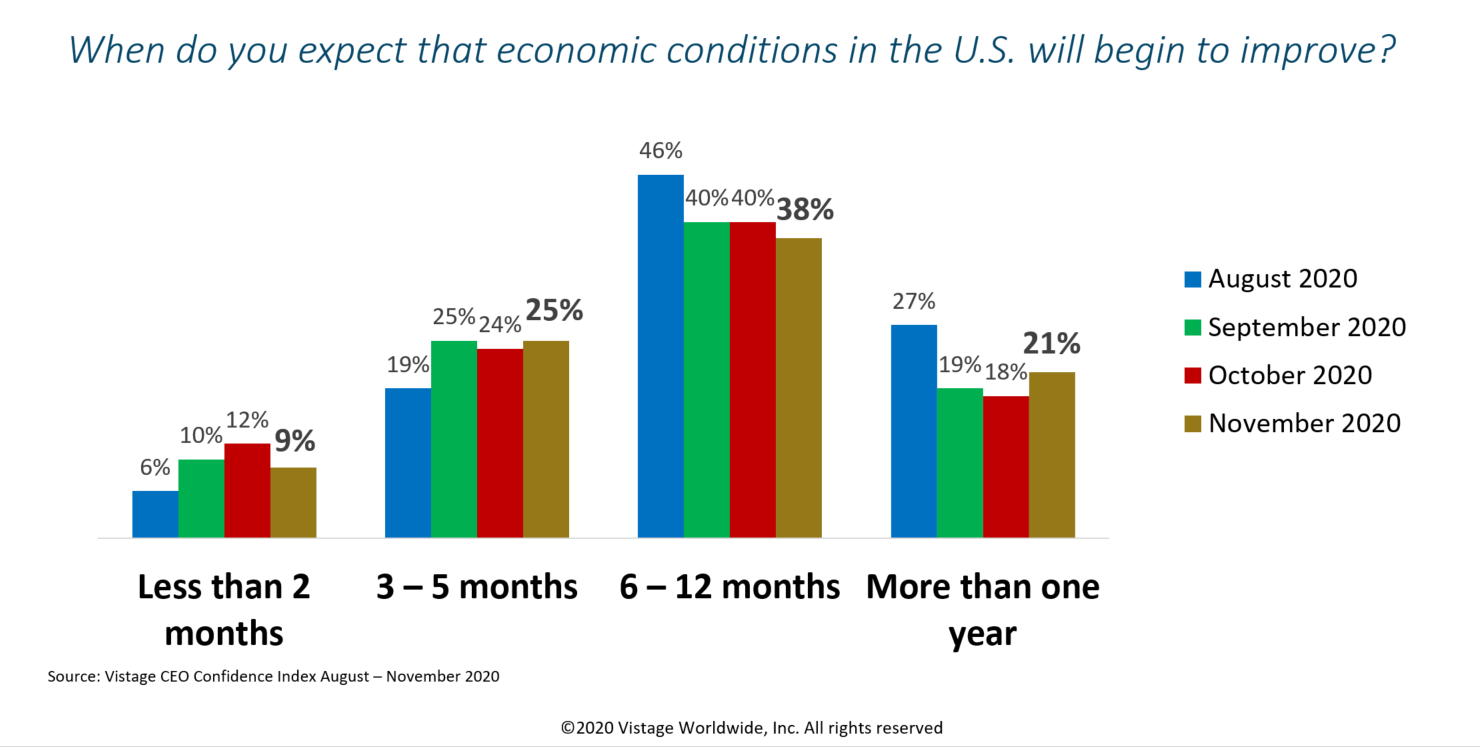

CEOs’ expectations for economic improvement showed little movement according to their survey responses. This is understandable considering CEOs are weighing multiple moving targets — the continuing political uncertainty, absence of progress on a stimulus package, and the news of a growing nationwide pandemic offset by progress with vaccines.

Looking ahead to prospects for their business, 63% of CEOs expect revenues to increase in the year ahead, down from 66% in October, which further confirms the economic plateau in November. Moreover, 22% of CEOs expect their revenues to remain the same, which is on par with last month, and just 13% expect their revenues to decline, a 2 percentage point increase from October.

Can you spare me a stimulus package?

Government relief helped many businesses and individuals through the pandemic-related shutdown in 2020.

In May, our survey determined that 82% of Vistage member companies took advantage of the highly successful Paycheck Protection Program (PPP), while millions of unemployed or furloughed workers benefited from provisions in the CARES Act.

At year end, the forgiveness process for the PPP kicks in for small businesses that received loans, and the CARES Act expires. This leaves the millions of unemployed workers facing extreme cash flow issues and potential evictions. Unemployment numbers slowly recede but remain at historical highs compared to pre-COVID days. Until the inauguration in January, the government has to wrestle with a slow transition, new political realities and a reluctant lame duck president. While political leaders agree on the need for stimulus and relief, there is much debate on the details of how, what, when and how much.

When asked about the government policies that are most critical to the health of their businesses or industry, CEOs identified three areas as their clear priorities:

- 58% indicated economic stimulus as their top priority. While 38% of CEOs report stable to increasing revenues as the result of the pandemic, 62% have been impacted by revenue declines at some level. These impacts are compounded by dwindling cash flow to maintain their workers and support their customers, making stimulus a top priority for CEOs.

- 51% indicated taxes as a policy priority. CEOs are driven by concerns about what the new administration might attempt to change in the corporate tax rate.

- 51% indicated public health policies are a third priority. This response reflects the need for the national, state and local governments to quickly coordinate, collaborate and execute on a national distribution plan to slow the pandemic and distribute the vaccine, which is unnecessarily complicated by transition politics.

2020 will go down in history as a watershed year. From the bright prospects of January to the dark days as we close out the year with cases, hospitalizations and deaths reaching new records every day. Strategic planning has never been harder with so many shifting variables in place. Like never before there are more questions than answers, yet CEOs that focus on their major decisions, top investments and key priorities will be best positioned to navigate the uncertain months ahead.

Category : Economic / Future Trends