The climb to recovery continues

Another month has passed, and the U.S. economy has taken another step towards recovery. Since the economy bottomed out in April, each successive month has seen small but steady progress toward recovery. More organizations are doing better, and fewer are doing worse. We are climbing steadily forward and upward.

The October Vistage CEO Confidence Index survey, which captured the sentiments of 1,247 CEOs and other leaders from small and midsize businesses (SMBs), revealed that revenue and cash flow have continued to improve for SMBs. Equally important, the data showed that profit expectations have improved for the sixth consecutive month. Bouncing off an April bottom, when just 22% of CEOs expected improved profitability in the year ahead, 56% of CEOs expressed this outlook in October, a result just shy of February’s high-water mark of 62%. The same can be said for investment plans, a clear sign of confidence; in October, 39% of CEOs expected to increase investments in the year ahead, more than doubling the 14% recorded in April. Just 14% of CEOs expected to decrease investments, well below the April high of 52%.

While these results indicate we are moving in the right direction, COVID-19 has the potential to stall or reverse this progress. As the northern hemisphere moves indoors for winter, the risk of COVID-19 transmission increases due to the chance of higher viral loads in enclosed areas. Some states have completely opened up restaurants and other indoor venues, while other states still have restrictions in place. As the holiday season approaches, small group and family gatherings could potentially create super-spreader conditions. Until we get the health crisis under control, the economic crisis will remain highly unpredictable.

The revenue rally

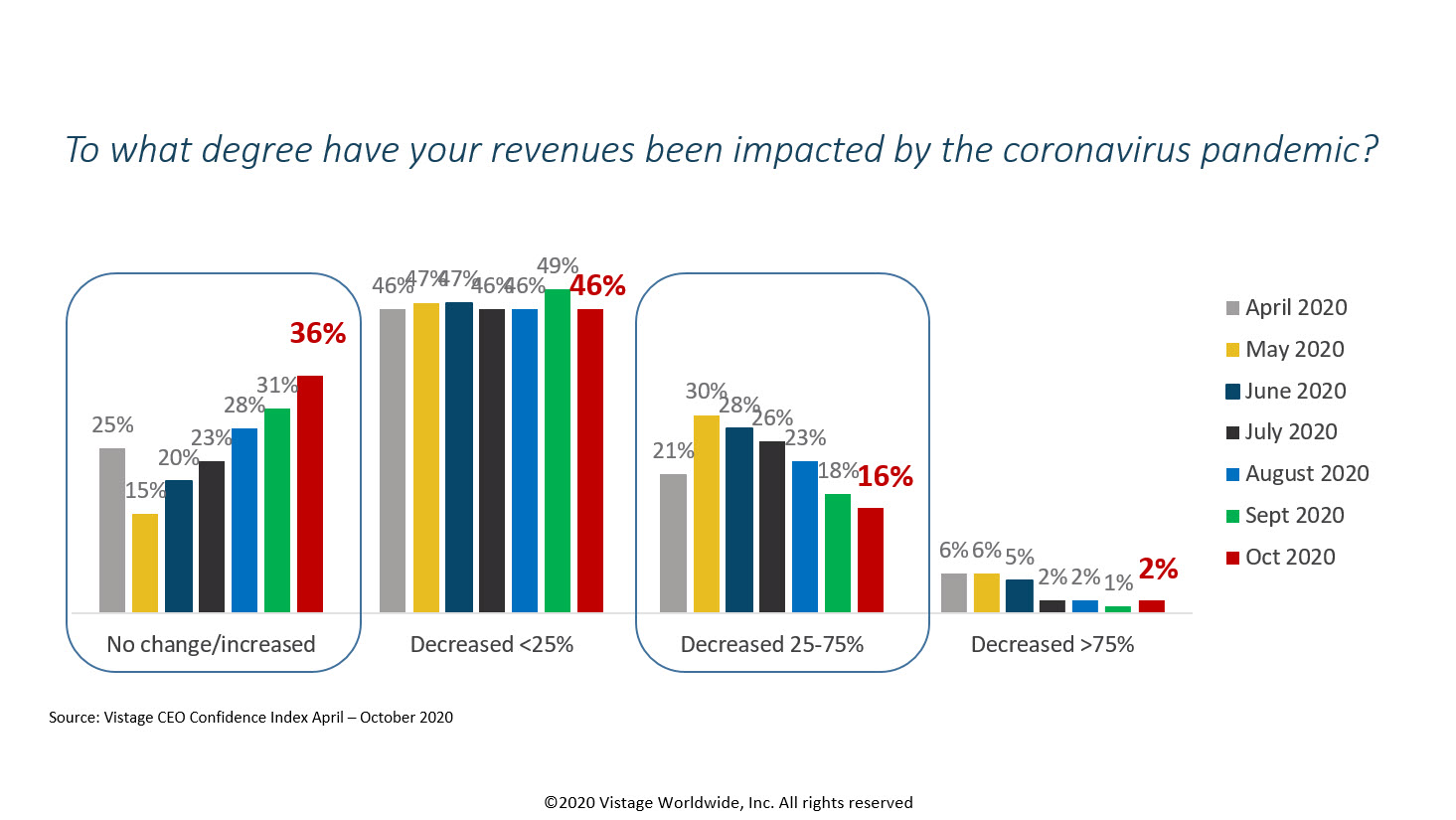

Revenue continues to improve for small and midsize businesses. More than one-third (36%) of CEOs reported that their revenue is now equal to or greater than before the pandemic. This 5-point climb from last month’s survey represents a revenue rally — an important step in the economic recovery. Breaking that figure down further, 22% of CEOs reported seeing revenues increase and 14% reported no change in revenue. Compare that to the lows of May, when just 7% of CEOs had increased revenues and 8% had flat revenues. Another highlight of the revenue rally: The percentage of organizations whose revenues have been hit the hardest — down 25-75% — fell by 2 points to 16%. This is nearly half the 30% recorded in May.

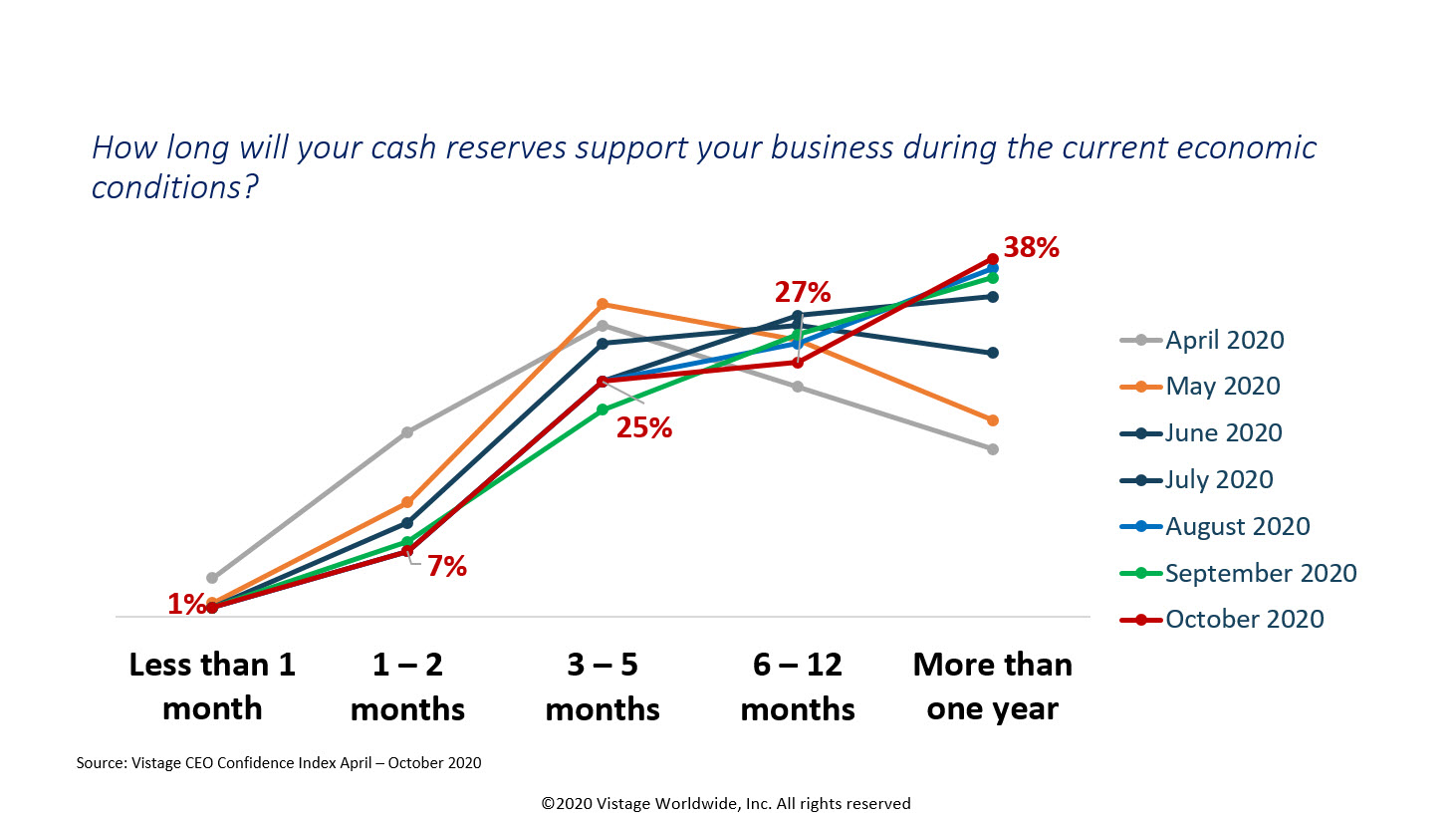

Cash flow continued to improve for SMBs according to the October survey, but the improvements were not as significant as those seen with revenues. Moreover, those small improvements were driven mostly by rising revenues. This means that SMBs — especially those whose revenues remain down — must continue to maintain financial discipline. Congress is unlikely to pass another economic stimulus package in the near term, and especially during the “lame duck” session after the election. This pushes the potential for new financial help into the new year, which may be too late for hard-hit businesses.

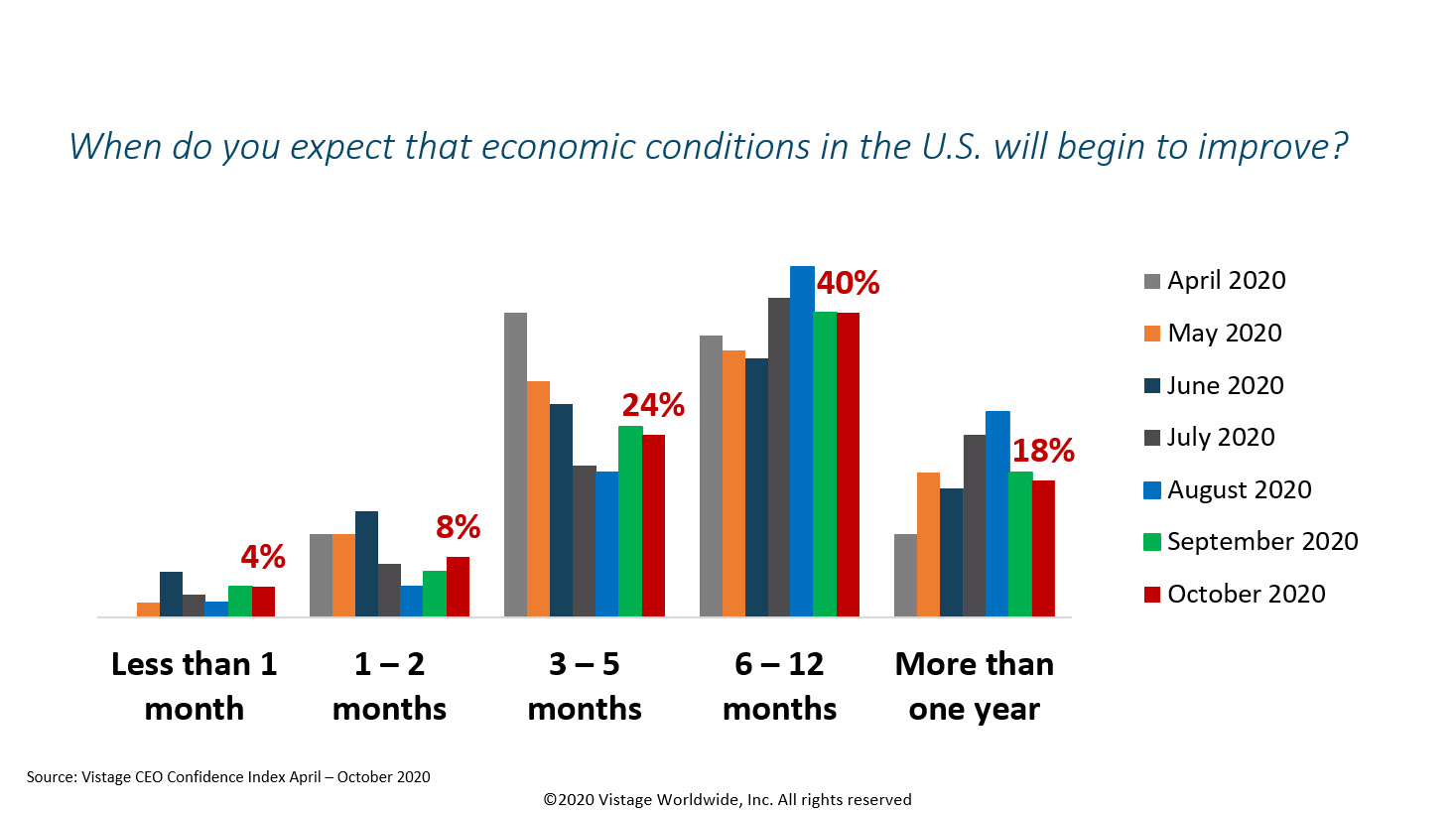

When asked about when the U.S. economy will begin to improve, CEOs expressed mixed expectations. Compared to last month, CEOs’ projected timelines changed only incrementally in October, suggesting the economic recovery may soon pause or plateau.

This outlook makes sense: From this point forward, the recovery will become increasingly more difficult, with hard-hit businesses continuing to struggle while the markets struggle. The early recovery growth is now built in, and future gains will become more challenging to achieve and sustain. Uncertainty regarding the COVID-19 health crisis, economic recovery and volatile political landscape weigh heavy on CEO expectations, with only a resolution to the political question guaranteed in the near term.

Corona-sizing the workforce

A year ago, economic growth was accelerating after a period of decelerating growth. In Q4 2019, the Vistage CEO Confidence Index rose for the first time in eight quarters and SMBs “prepared for prosperity.” We projected a return to faster growth in 2020. Little did we know COVID-19 was waiting to destroy our projections, along with every business’s strategic plans, budgets and forecasts.

Now, with the COVID-19 crisis front-and-center causing an economic crisis, CEOs must make critical decisions about their 2021 goals, objectives and financial plans. This is the most unstable business environment in a decade. Given the decade-long expansion we most recently experienced, for many leaders this is their first time making decisions in a troubled economy.

While data from our CEO Confidence Index projects continued progress towards recovery, there are lurking instabilities that could slow or even reverse this trend. The lack of a government stimulus package will leave many struggling SMBs in the cold. Nearly half (45%) of SMBs have seen their revenues decline by more than 10% during the pandemic. Many large companies — including Fortune 500 companies — have not yet “corona-sized” their workforce to accommodate lower revenue and growth projections. Adding to massive unemployment, the travel industry is shedding thousands of jobs. Apart from the professional services and technology sectors, many industries continue to struggle and will need to make hard decisions for 2021. State and local governments, which are massive employers, will face mega deficits without federal government help, forcing them to make staff reductions. The list goes on.

The American consumer is the driving force behind our economy, representing two-thirds of GDP. With millions of consumers unemployed and the possibility — or even likelihood — of those numbers growing, it is reasonable to believe that progress toward the recovery will slow and take longer than expected. Just last week, we learned of the latest historic increase in unemployment claims and large companies like Disney, AT&T and Allstate joined the airline industry in announcing massive layoffs. Add in the threat of a “winter wave” of COVID-19 cases, and the stage is set for the recovery to plateau — until a vaccine becomes widely available and hard-hit industries can begin to bounce back.

CEOs are in the business of making decisions. Those who make good ones for the 2021 planning cycle will remain in that business, while those who make wrong choices will suffer the consequences. Our advice: Plan for the worst and hope for the best.

Download the full report – October 2020 Vistage CEO Confidence Index

Category : Economic / Future Trends

Tags: CEO Confidence Index