CEO Climb Event: The Power of Perspective in Uncertain Times

Discover actionable strategies to evolve and thrive during times of uncertainty with Dr. Corinne Hancock Scott!

Read More

The hardest climb is not Denali, K2 or even Everest. It isn’t at 24,000 feet. The hardest climb lies deep within. It’s the mental climb. Gain an insider’s edge to power your ascent with events purpose-built for driven CEOs and business owners. Learn from subject-matter experts and build connections with high-impact business leaders at Vistage events.

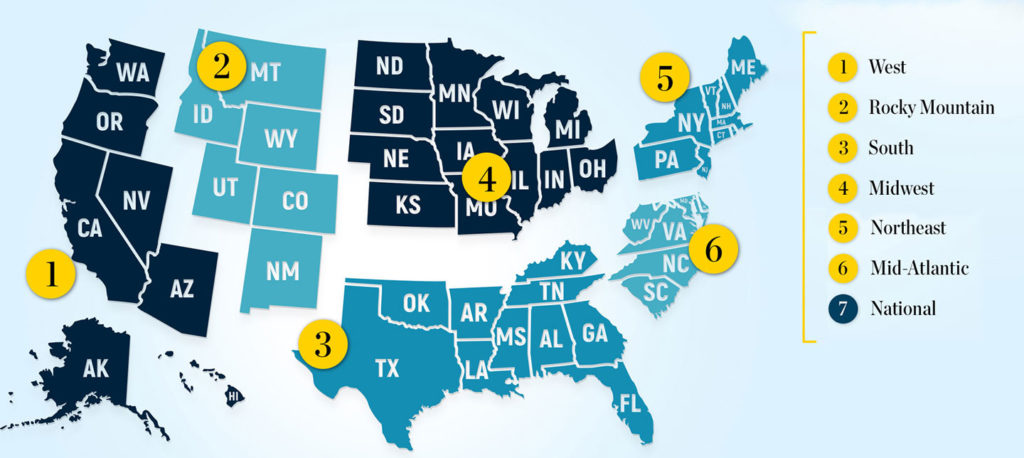

Gain insights, make connections, and elevate your leadership at a Vistage Executive Summit. These exclusive in-person events bring together members and qualified candidates for market forecasting from economic experts and Vistage Research, targeted learning breakouts with industry leaders, and high-impact peer networking. Walk away with actionable strategies, fresh perspectives, and a stronger connection to your greater Vistage community.

Get insight into how Vistage members rely on their community, Chair (executive coach) and each other to make better decisions and get better results for their companies.

Expand your network and strengthen your leadership community at a Vistage CEO Social—an exclusive event designed for CEO members to connect in a relaxed, engaging setting. These in-person experiences bring together top business leaders for unique social gatherings. Build meaningful relationships, gain fresh insights, and share perspectives with fellow CEOs in an atmosphere that fosters connection and collaboration.

Engaging, value-packed, virtual experience featuring lively group discussion on a relevant business/leadership topic, and content tailored to candidates not familiar with Vistage.

Discover actionable strategies to evolve and thrive during times of uncertainty with Dr. Corinne Hancock Scott!

Read More

CE and SB Tri-State members are exclusively invited to connect with fellow CEOs while cheering on the New York Yankees.

Read More

Join the leaders shaping the future of business at the Vistage Executive Summit! Build meaningful connections and gain actionable economic and leadership insights. Be part of a thriving community rooted in shared perspectives and growth.

Read More

Join the leaders shaping the future of business at the Vistage Executive Summit! Build meaningful connections and gain actionable economic and leadership insights. Be part of a thriving community rooted in shared perspectives and growth.

Read More

CE and SB Charlotte members are exclusively invited to connect with fellow CEOs at the NASCAR Hall of Fame.

Read More

Join the leaders shaping the future of business at the Vistage Executive Summit! Build meaningful connections and gain actionable economic and leadership insights. Be part of a thriving community rooted in shared perspectives and growth.

Read More

CE and SB San Francisco members are exclusively invited to connect with fellow CEOs aboard a Hornblower Cruise during Fleet Week.

Read More

Join the leaders shaping the future of business at the Vistage Executive Summit! Build meaningful connections and gain actionable economic and leadership insights. Be part of a thriving community rooted in shared perspectives and growth.

Read More

CE and SB Orange County members are exclusively invited for a day of connecting with fellow CEOs.

Read More

Join the leaders shaping the future of business at the Vistage Executive Summit! Build meaningful connections and gain actionable economic and leadership insights. Be part of a thriving community rooted in shared perspectives and growth.

Read More