Merger and acquisition trends in 2019: 10 steps to optimize your valuation

It’s the best of times and the worst of times to be a business owner. For many, the promise of a liquidity event represents the culmination of their life’s work. But how do you optimize your valuation or determine the ideal timing of the event? The public marketplace doesn’t like uncertainty, and our socioeconomic conditions are fluid to say the least.

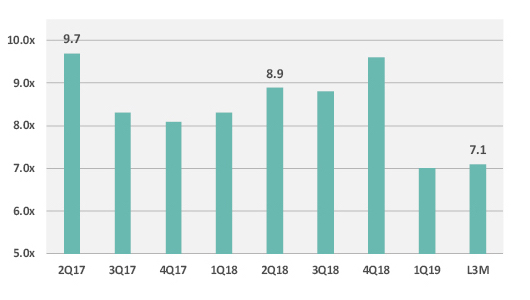

Valuations (stated as multiples of EBITDA) for private companies were down sharply in Q1 due to a number of factors including the trade war, concerns about an economic downturn, rising wages, Brexit and slowing in China. But as our data will show, acquirers are also running out of companies to buy. So how do you optimize your valuation for a possible sale?

2019 is framed by a 2018 M&A market where:

Deal flow was strong. Pitchbook reported its fifth consecutive year of $3 trillion in deal value, with average multiples of 9.6x. Valuations rose in Europe where interest rates were artificially low and declined in the U.S. where interest rates were rising. Recent fed statements suggest that rates will remain stable or potentially even decrease in 2019.

U.S. valuations were impacted by trade rhetoric. Chinese investment in U.S. companies waned in the tail end of 2018.

Deal-making was driven by institutional investment. Private equity firm acquisitions comprised 34 percent of deals in 2018. In fact, they are so active that the premiums payed by strategic buyers have eroded and in some deals, financial sponsors actually outbid strategics.

Consolidation drove value at the top. Deals of more than $100 million were the highest proportion on record.

Vertical integration was omnipresent. According to PwC, one-third of U.S. transactions were “cross-sector” deals, such as non-technology companies buying technology companies. The digital mashup including the advent of artificial intelligence and internet of things is driving activity.

Valuations vary dramatically by sector. Markets are highly fluid. For a review of valuation by sector, see this analysis by NYU.

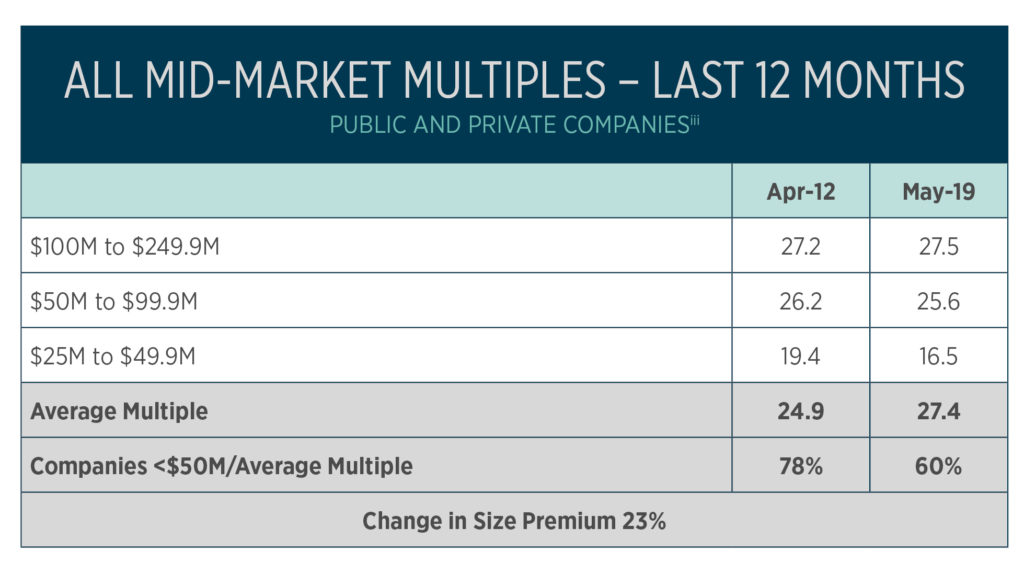

While business owners intuitively understand that size matters in terms of valuation, the “size premium is escalating.” While many small companies sell for 4 to 5x EBITDA, the average U.S.-based public company is trading at about 20x earnings. When comparing 2019 data to 2012, the variance between larger deals and smaller ones has grown.

Historically, recessions have coincided with less M&A activity and lower multiples.Yet U.S. companies are flush with cash. According to Ernst & Young, private equity firms still have $700 billion in “dry powder” on the sidelines, which provides a floor of valuations. While a slowing of the U.S. economy is expected, the market may already have lower valuations built in.

To prepare for an exit and optimize your valuation:

1. Start with the end in mind.

Think like a buyer would. In addition to a growth plan, a buyer will want to understand the strategic value your company adds to their portfolio, the diversity of income and customers, and the likelihood that management will stay (which may matter less to a strategic buyer than to a financial buyer).

2. Include your team in the process.

Many private company owners are skittish about sharing information regarding a potential exit with their management teams. Whether it is appropriate to do so is dependent on a number of variables, including the sophistication of the team. Senior managers are going to find out eventually, and utilizing their talents to drive valuation is often a success factor. Handcuffing them through a long-term incentive plan (LTIP) is an important best practice (as opposed to providing them equity). It’s is just good business to reward the people who get you there.

3. Focus on the growth story.

The single most important variable in optimizing value is being able to demonstrate consistent, predictable revenue void of too much concentration risk in a few customers. The business owner must maintain laser focus on growth in the three to five years before the sale. Any buyer will want proof that the business can “scale.”

4. Secure the right advisers early.

Many business owners talk to wealth advisers, strategic planning consultants, transactional attorneys and investment bankers late in the process. Create a team of advisers who can collaborate for several years in advance and have the pieces in place when you are ready to sell to optimize your valuation. Assign a “quarterback” to drive a seamless process.

5. Formalize your exit plan.

After you have met with your team and advisers, formalize your company’s strategic plan and exit plan. Your exit will need to coincide with a succession plan. Note that a majority of “earn out” consulting agreements do not pan out. While there may be tax benefits to having a consulting agreement post-transaction, make sure you understand their limitations when you’re trying to optimize your valuation.

6. Understand valuation.

Every business owner thinks their business is worth more than it actually is. Get an expert business valuation done, in part to set the basis for your long-term incentive plan.

7. Minimize tax liability.

Too many owners wait far too long to consider their tax liability during a transaction, and they end up giving away a sizable chunk of their gain in taxes. The right advisers may have you consider relocation for the business or the owner, or other tax-mitigating strategies such as forming an ESOP. This is why a CPA who knows M&A is so critical to optimize your valuation.

8. Ensure you have solid financial statements.

A fatal flaw that will end a process before it begins is a lack of financial controls. Buyers will immediately discount any company that does not have solid financial statements and performance for at least three years.

9. Be patient.

Selling in a down cycle can be costly. Waiting until you have assembled the right team, advisers and financial history can dramatically increase valuation. As private equity becomes interested at about $5 million in EBITDA, crossing this threshold is important in maximizing value

10. Develop your life plan.

Owners often have a sizable portion of their financial wealth wrapped up in their businesses and make invalid assumptions about the cost of retirement.

Many Vistage owners who have exited suffer disappointment and even depression. Just like having a strategic plan for your business, you need to have a life plan for yourself including a financial plan. It’s critical that you sit down with your family and chart out what you want the rest of your life to look like.

Related articles

2019 Trends Affecting Business (Marc Emmer)

Category: Mergers & Acquisitions

Tags: Business Strategy, Business Valuation, exit planning, M&A