Strategizing Your Way Out Of A Threatened Business Model

Why is it that successful companies find themselves needing to reinvent their business models over and over in order to survive? Sometimes technological shifts drive companies downward in the competitive food chain or render all businesses in a particular industry to the status of outdated relics. In other cases, consumer preferences change or commerce regulations are rewritten. The sad fact for all organizations is that change happens and eventually a company’s business model can outlive the value it once offered the marketplace. When it occurs, the business must proactively change as well and do so with thoughtful strategy. Failing to do so consequently be doomed to join the ranks of failed companies that were once dominant players in their industries. This article explores the art of strategizing your way out of a threatened business model with three important actions executives should start taking now.

Why is it that successful companies find themselves needing to reinvent their business models over and over in order to survive? Sometimes technological shifts drive companies downward in the competitive food chain or render all businesses in a particular industry to the status of outdated relics. In other cases, consumer preferences change or commerce regulations are rewritten. The sad fact for all organizations is that change happens and eventually a company’s business model can outlive the value it once offered the marketplace. When it occurs, the business must proactively change as well and do so with thoughtful strategy. Failing to do so consequently be doomed to join the ranks of failed companies that were once dominant players in their industries. This article explores the art of strategizing your way out of a threatened business model with three important actions executives should start taking now.

Don’t Let Your Business Model Run Out Of Gas Before Checking It

If IBM had simply stuck to building typewriters, they would have vanished long ago. Instead, they found new ways to remain viable by offering both new and continuously updated suites of products and services that are valued by the customers in their markets. Change happens and successful businesses adapt and prosper. Winning businesses have incorporated forward-looking planning combined with operational execution that is dialed-in to key metrics attenuated to their strategic objectives. Strategic planning that includes environmental threat surveillance helps any business to navigate choppy waters, plan accordingly and signal the alarm when things are not working.

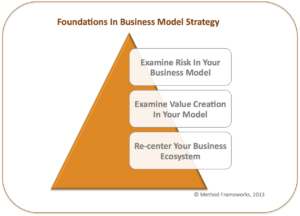

The following three strategic actions can make a difference:

– 1. Examine Risk In Your Business Model

– 2. Examine Value Creation In Your Model

– 3. Re-center Your Business Ecosystem

We will now examine each of these actions in more detail.

1. Examine Risk In Your Business Model

Some companies don’t fully explore their business model risk, instead choosing to continue doing what they’ve been doing. Companies that fail to adapt their business model to changing market conditions and manage their level of risk accordingly will encounter trouble.

The Gravity of Risk Can Slowly Crush Business Models

Executives must proactively assess their business model, and do so on a regular basis. What was once a great business engine can grow less viable years later because it has become outdated or ineffective due to market shifts or new developments in industry’s business environmental conditions. It is the course all businesses must run, facing the need to change along the way in order to survive.

Risks are about events that, when triggered, cause problems. Hence, risk identification can start with the source of problems, or with the problem itself. It is important to remember that risks emanate from threats, but the manifestations are much broader and may be internal or external to the organization.

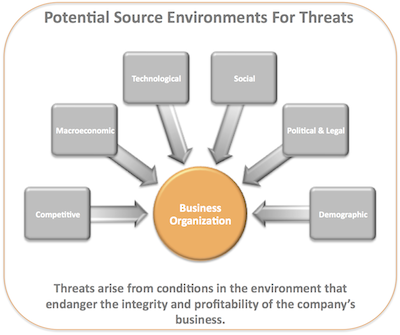

A strategic threat is any significant aspect of the external environment that can negatively effect the organization’s business model and potentially undermine the strategy and strategic vision. Strategic threats can be identified through environmental scans that explore factors in each of the major environmental regions that serve as the most common sources of business threats.

This graphic below summarizes these major sources of threats.

For instance, the globalization of production and markets may pose both an opportunity and a threat to a manufacturer. The opportunity being the lower barriers to cross-border trade as well as the likely ease of foreign investment. A threat might be the national differences in cost and quality factors in production. On the flip-side, the lower barriers to entry could also pose a threat, if competitors seek to mimic the manufacturer’s moves. This could lead to intensified rivalry.

Strategic threats arise because of change. For example, markets and technology are continuously in flux. Distribution channels change over time, as do social trends that may decrease or kill demand for old products and services.

Strategic threats to a business model, unless recognized, guarded against and countered can result in significant negative outcomes for the organization.

Identification of Risks

Risks are related to the identified threats from SWOT analysis, so that is a valid reference to tap during the risk identification process. When either the source or problem is known, the events that a source may trigger or the events that can lead to a problem can be investigated. For example: Banks withdrawing funding support for expansion; confidential information may be stolen by employees; weather delaying construction projects, etc.

Additionally, other methods of risk identification may be applied, dependent upon culture, industry practice and compliance. For instance, objectives-based risk identification can focus on any potential threats to achieving strategic objectives. Any event that may endanger achieving an objective partly or completely can be identified as risk.

Scenario-based risk identification is another method. In scenario analysis, different scenarios are created. The scenarios may be the alternative ways to achieve an objective, or an analysis of the interaction of forces in, for example, a market or battle. Any event that triggers an undesired scenario alternative is identified as risk.

As a final example, a taxonomy-based risk identification can be utilized, where the taxonomy is a breakdown of possible risk sources. Based on the taxonomy and knowledge of best practices, a questionnaire can be compiled and the answers to the questions used to reveal risks.

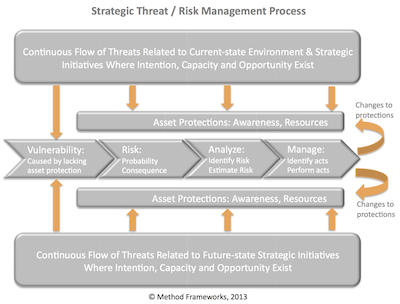

A sound strategy, robust strategic planning process and management discipline are the keys to business survival. Businesses will always face threats to their business models. Threats may come in the form of cheaper imports available from a foreign market, new legislation that forces business model tweaks or game-changing disruptive technologies that alter the buying trends of a core market. Long-term survival is dependent on environmental surveillance connected to good strategic planning and the protections that are put in place to safeguard against damage to organizational assets.

The following framework demonstrates this point and can serve as a model to be incorporated into the strategic planning framework of an organization.

2. Examine Value Creation In Your Model

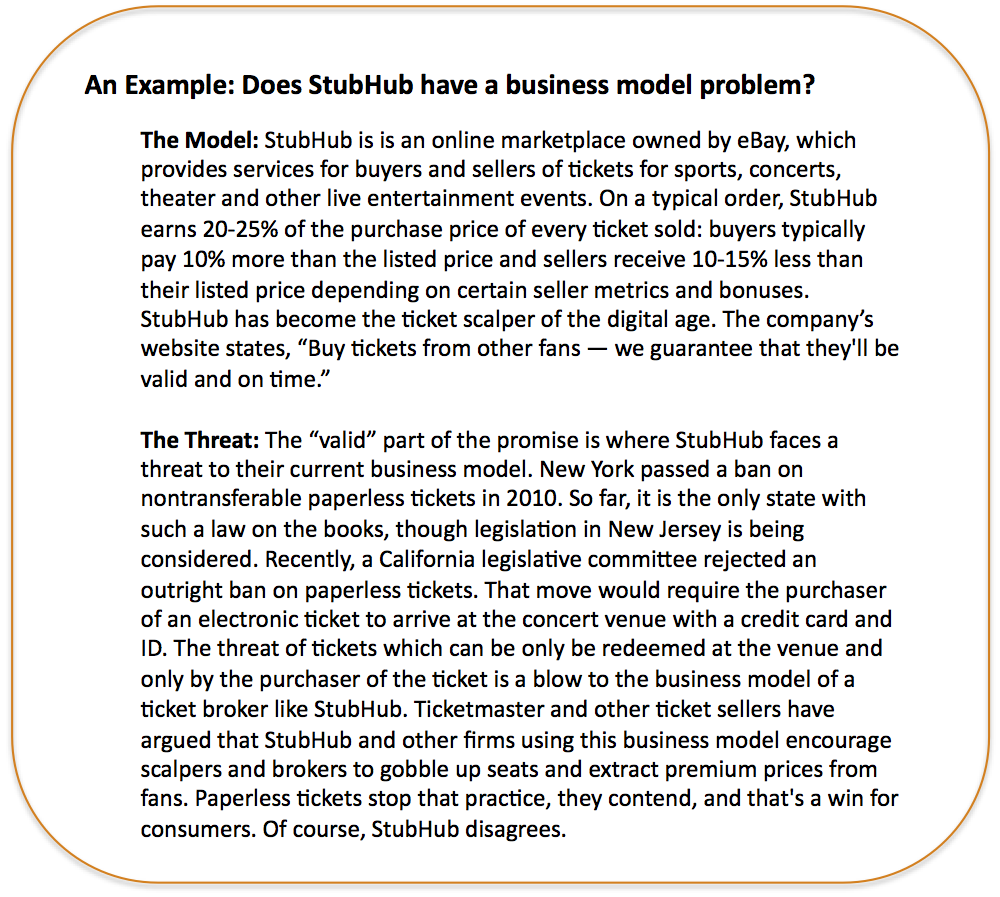

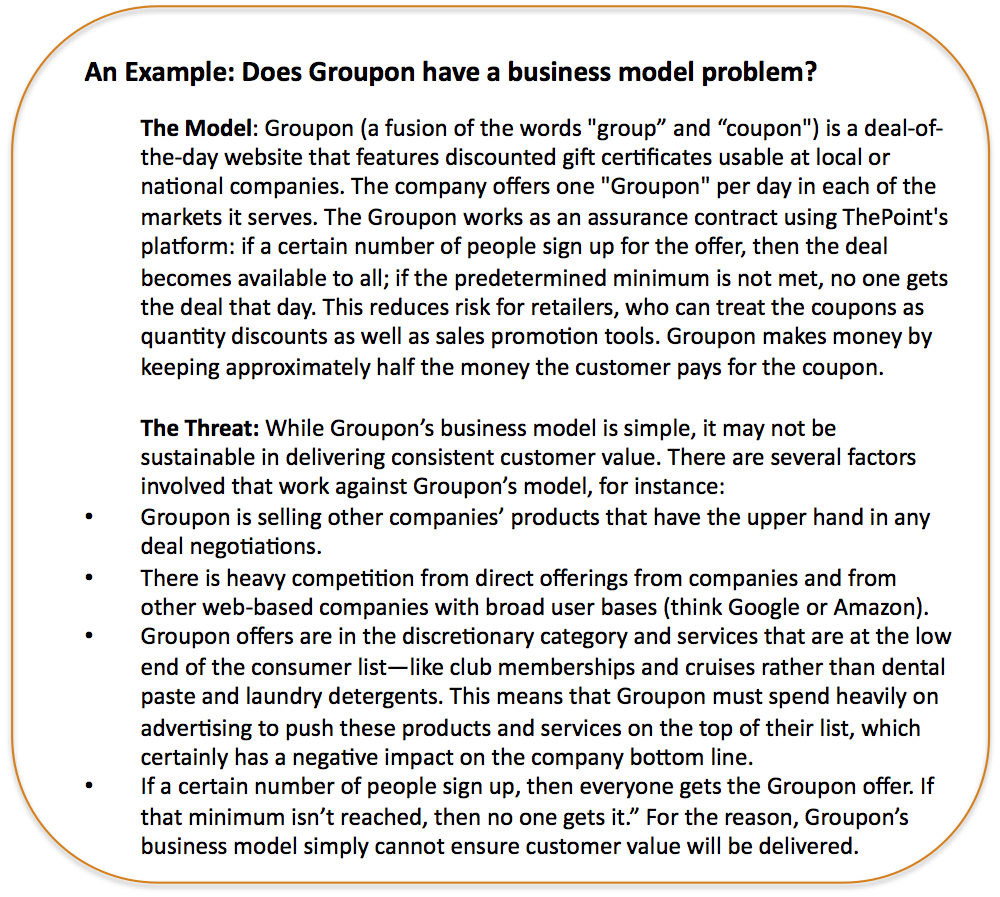

If you do not know if your business is truly creating outstanding customer value, you’d better discover how to do so and fast. Business models that promise value to customers and fail to deliver in the long-run will eventually fail. The same is true for those businesses that have models built on gaining profits through customer exploitation, with no intention of creating a long-term relationship with the buyer.

Investing In Value Creation During Lean Times Is Difficult

“Do more with less” and “Create Value”, two of today’s popular business mantras. But what do these sayings mean to our business models?

Value is created anytime an action is taken for which the benefits exceed the costs, or anytime an action is “prevented” for which the costs exceed the benefits.

The Great Recession put tremendous pressure on virtually all organizations to do more with less while continuing to deliver value to customers. Although the economy is now slowly recovering, leaders of organizations still face the realities of needing cost-cutting measures to take priority in order to reach a bottom-line targets and objectives. As a result, strategy investment towards customer value creation through innovation initiatives sometimes slip into second place behind overhead reduction plans. For forward-thinking executives, this creates an internal struggle with managing this dichotomy – maintaining balance between internally focused overhead reduction strategy goals on one side and those related to the creation of customer value on the other.

In recent years, corporate planning became overly focused on creating shareholder value, sometimes to the exclusion of customer value. This has created a gap for some companies which served to allow market share to be taken away by more nimble competitors that focused on creating a better value proposition for their customers and planned accordingly. The gap poses a risk of a loss of competitive advantage.

Competition drives the need to innovate and create more value. Businesses that create the most value will survive or do better than their rivals. Rest assured, however; business rivals will make darn sure that consumers capture most of that surplus value. This is why “competition” and “information” (which drives competition on the buying side) are so important for market efficiency. In highly competitive markets, businesses must increase profits through value creation because trying to capture more value without creating more will make many customers go to competitors. It fact, it is competition that forces the close link between capturing value and creating value. One thing is for certain. You can’t capture value without creating it, but you can capture more value while creating less.

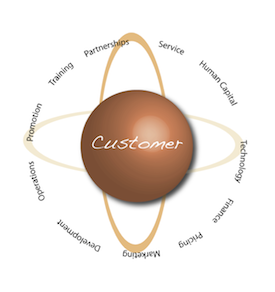

3. Re-center Your Ecosystem

The enterprise ecosystem can be viewed as a system of interworking components that surrounds the organization’s customers. When planning accounts for the organization’s internal dimension (e.g. people, process, structure, etc.) in balance with addressing the external attribution of the ecosystem (which includes, suppliers, partners, customers) – the resulting state of equilibrium produces the operational excellence of a well-oiled machine.

Look at IKEA as an example of an organization with a well-balanced and customer-centered ecosystem. IKEA is a privately held, international home products company that designs and sells ready-to-assemble furniture such as beds and desks, appliances and home accessories. The firm is known for the attention it gives to cost control, operational details and continuous product development, allowing it to lower its prices by an of average 2 to 3% over the decade to 2010, while continuing its global expansion in the next decade.

Regardless of what you may think about IKEA’s furniture or their sense of style, the company has achieved a level of operational excellence that places the customer at the center of their ecosystem while tuning all aspects of their operations to work in harmonious synchronization. From the moment you walk into IKEA, you sense the attention to detail paid to the customer experience. Childcare facilities are provided to make the shopping experience more enjoyable for parents. A strategically located restaurant in the center of their stores provide a nice break for lunch amidst the trek through the vast network of aisles lined with models of fully-assembled kitchens, bedrooms and living areas. Even the checkout experience caters to weary shoppers who can get a sugar high off cinnamon rolls while paying out.

Regardless of what you may think about IKEA’s furniture or their sense of style, the company has achieved a level of operational excellence that places the customer at the center of their ecosystem while tuning all aspects of their operations to work in harmonious synchronization. From the moment you walk into IKEA, you sense the attention to detail paid to the customer experience. Childcare facilities are provided to make the shopping experience more enjoyable for parents. A strategically located restaurant in the center of their stores provide a nice break for lunch amidst the trek through the vast network of aisles lined with models of fully-assembled kitchens, bedrooms and living areas. Even the checkout experience caters to weary shoppers who can get a sugar high off cinnamon rolls while paying out.

The IKEA example demonstrates how the overall customer experience can be improved by orienting the business ecosystem around the customer. They have tuned the ecosystem’s “behind the scenes” operations to provide cost savings to their customers without sacrificing on quality. Likewise, their culture is tuned into satisfying the customer’s needs while visiting the store. Their in-store processes ensure you will stay longer and not have to leave to eat, take a break or entertain the kids.

Concluding Thoughts

There will be early evidence that a business model is in trouble, so don’t ignore or dismiss signals. Over time, once profitable segments might see margin deterioration as the market commoditizes, making them less desirable. In some cases, new product innovation will lag behind competitors.

The signs of business model trouble are there and can be proactively addressed, so long as trends are not ignored when they begin to show themselves. It may begin with missed sales or profit projections – a quarter here and there are come in unexpectedly lower, accompanied by a slowly shrinking pipeline and backlog. These may be signs of stalled growth or declining margins and the causes need to be determined so that appropriate actions may be taken.

The signs of business model trouble are there and can be proactively addressed, so long as trends are not ignored when they begin to show themselves. It may begin with missed sales or profit projections – a quarter here and there are come in unexpectedly lower, accompanied by a slowly shrinking pipeline and backlog. These may be signs of stalled growth or declining margins and the causes need to be determined so that appropriate actions may be taken.

If one or more core markets have truly reached an inflection point, the business will soon begin to note reduced profitability as orders fluctuate in predictability, overhead becomes too high and materials and labor costs are harder to manage. Once this cycle has taken hold, morale issues ensue and attrition begins to become a problem as the competition begins stealing top sales people away.

Full recognition that things must change happens only when it is far too late, and then change is much more painful than it had to be.

***

Resources for Taking Action

Complimentary Strategic Planning Article Compilations and PDFs:

Strategic Planning Monthly Archive

Strategic Planning Articles Library

– Complimentary access: Strategic Planning White Paper PDF Downloads

– Complimentary access: Strategic Planning White Paper PDF Downloads

Category: Business Growth & Strategy

Tags: Business Model, Management, Risk, Strategy