CEO confidence slips in February WSJ/Vistage survey

The economic optimism of small-business CEOs has declined slightly but remains high, according to the latest edition of the Wall Street Journal/Vistage Small Business CEO Survey.

The economic optimism of small-business CEOs has declined slightly but remains high, according to the latest edition of the Wall Street Journal/Vistage Small Business CEO Survey.

In the February 2018 survey, the Wall Street Journal/Vistage Small Business CEO Confidence Index measured 117.0 — a decline of 3.5 points from January’s 120.5 index. However, the current index is similar to the 117.3 index recorded two months ago.

The decrease in economic confidence “could be attributed to the initial enthusiasm about the passage of tax reform fading,” said Dr. Curtin of the University of Michigan, who analyzed the survey results. “But it is more likely that small firms anticipate that, while reform may stimulate the economy, it may also result in slightly higher inflation and interest rates.”

Other highlights from the survey, which had 741 respondents, include the following.

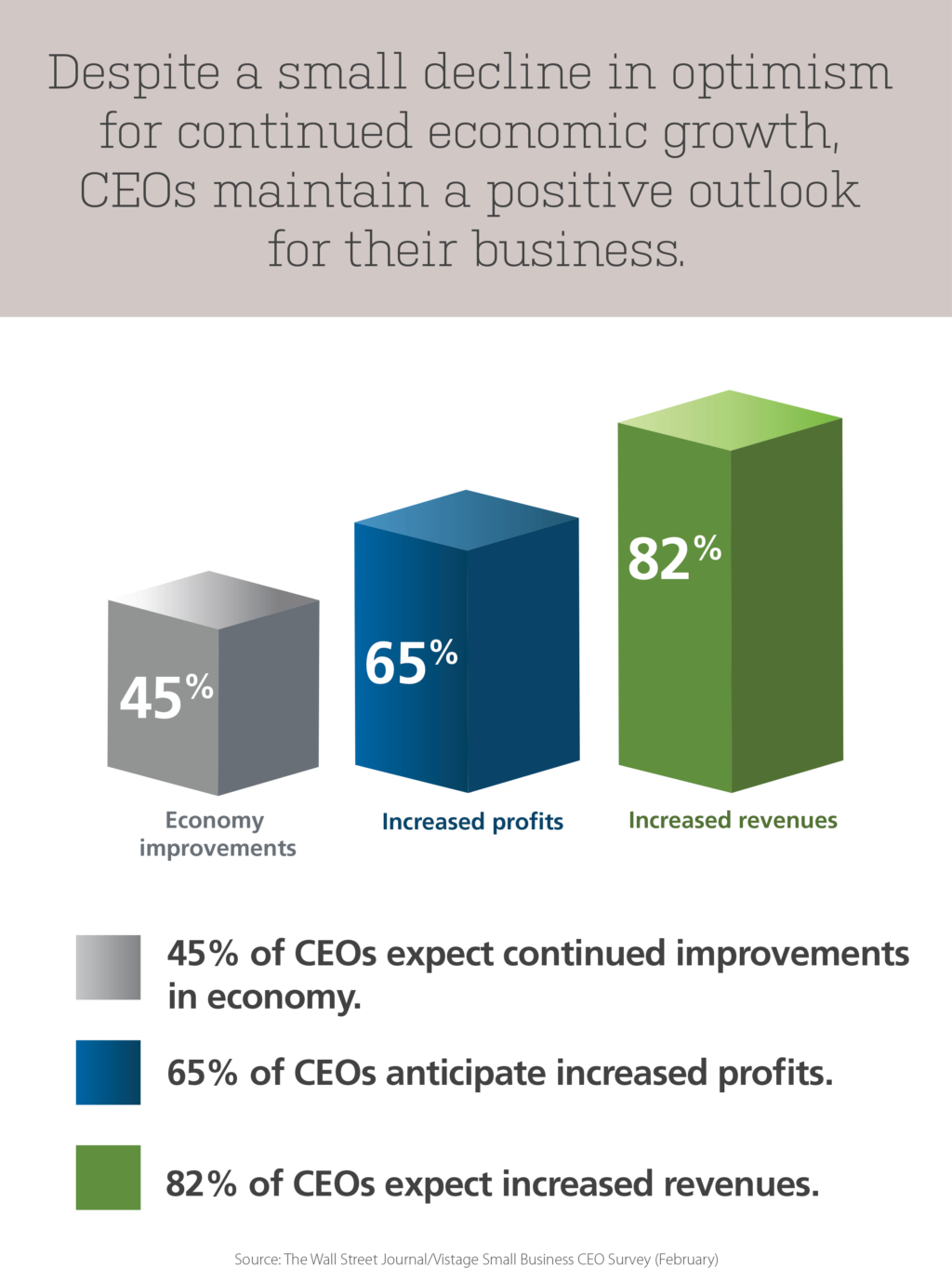

CEOs say economic conditions have improved

In the February survey, two-thirds of small-business CEOs (66%) said that economic conditions in the United States have improved in the past year. By comparison, these figures were 70% one month ago and 47% one year ago. However, less than half (45%) of small-business CEOs said that they expected continued economic gains in the next 12 months, a decline from the 54% recorded last month and one year ago. Another 42% said they expected economic conditions to stay the same, while 11% expected them to worsen.

“While additional declines in confidence in the months ahead cannot be ruled out, it is more likely that continued growth in the economy will smooth the acceptance of modest increases in relatively low inflation and interest rates, as has been true in past expansions,” said Dr. Curtin.

CEOs anticipate revenue and profit growth

Looking ahead to the next 12 months, 82% of small-business CEOs said that they expected their firm’s sales and revenues to increase. Another 15% said they expected sales and revenues to stay the same, while only 3% expected them to decrease.

Similarly, 65% of CEOs said that they anticipated their profits to increase, while 28% expected them to stay the same and 6% expected them to decrease. These percentages are nearly equal to those recorded in last month’s survey.

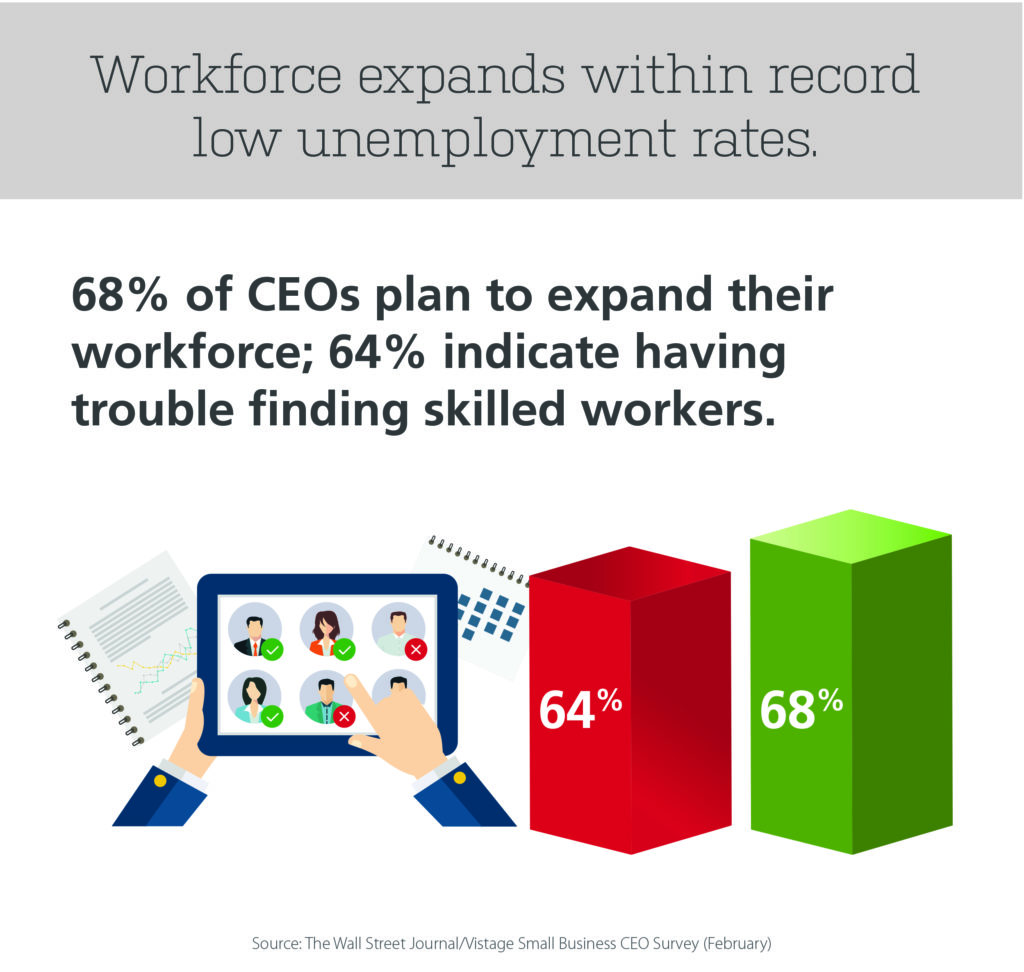

Small firms to increase hiring

The majority of CEOs (68%) said they planned to increase the number of employees at their small firms in the year ahead. This is nearly equal to last month’s 70%. About one-quarter (28%) of CEOs said that the size of their workforce would stay the same, while only 3% said they planned to decrease the number of employees in their firms.

More than half of CEOs (64%) said they are facing a shortage of skilled workers. To address this issue, CEOs said they were planning to implement a number of different strategies. These included increasing recruiting (87%), boosting wages (59%), partnering with a local community college or other institution (46%) and reskilling workers so they can take on new roles (38%).

“Given the widespread perception that skilled workers are scarce, it is likely that firms will need to offer higher salaries or engage more extensive training programs to meet their needs,” said Curtin. “Rising wages may indicate the potential for increase in interest rates as well as overall inflation; it is likely these factors have slightly diminished CEO optimism about the economic future.”

Planned investments hold strong

For the third month in a row, 52% of CEOs said that they expected to increase their investment spending in the next year. This percentage is the highest recorded by the survey since it began in 2012.

Another 41% of CEOs said that their total fixed expenditures would stay the same in the next 12 months, while 6% said they would decrease their spending.

Tax reform has minor impact on business decisions

As a result of tax reform, two-thirds of small firms (66%) anticipate that their tax bill will decrease.

However, most CEOs (61%) say that the legislation has not impacted their decision to sell their company or make an acquisition, and the vast majority (90%) have no plans to change how their company is structured.

Overall, 76% of CEOs say that the tax law has not led them to make other changes to their business.

Category: Economic / Future Trends

Tags: Economy, Hiring, WSJ Vistage Small Business CEO Survey