Tariffs dim CEO confidence, according to July WSJ/Vistage survey

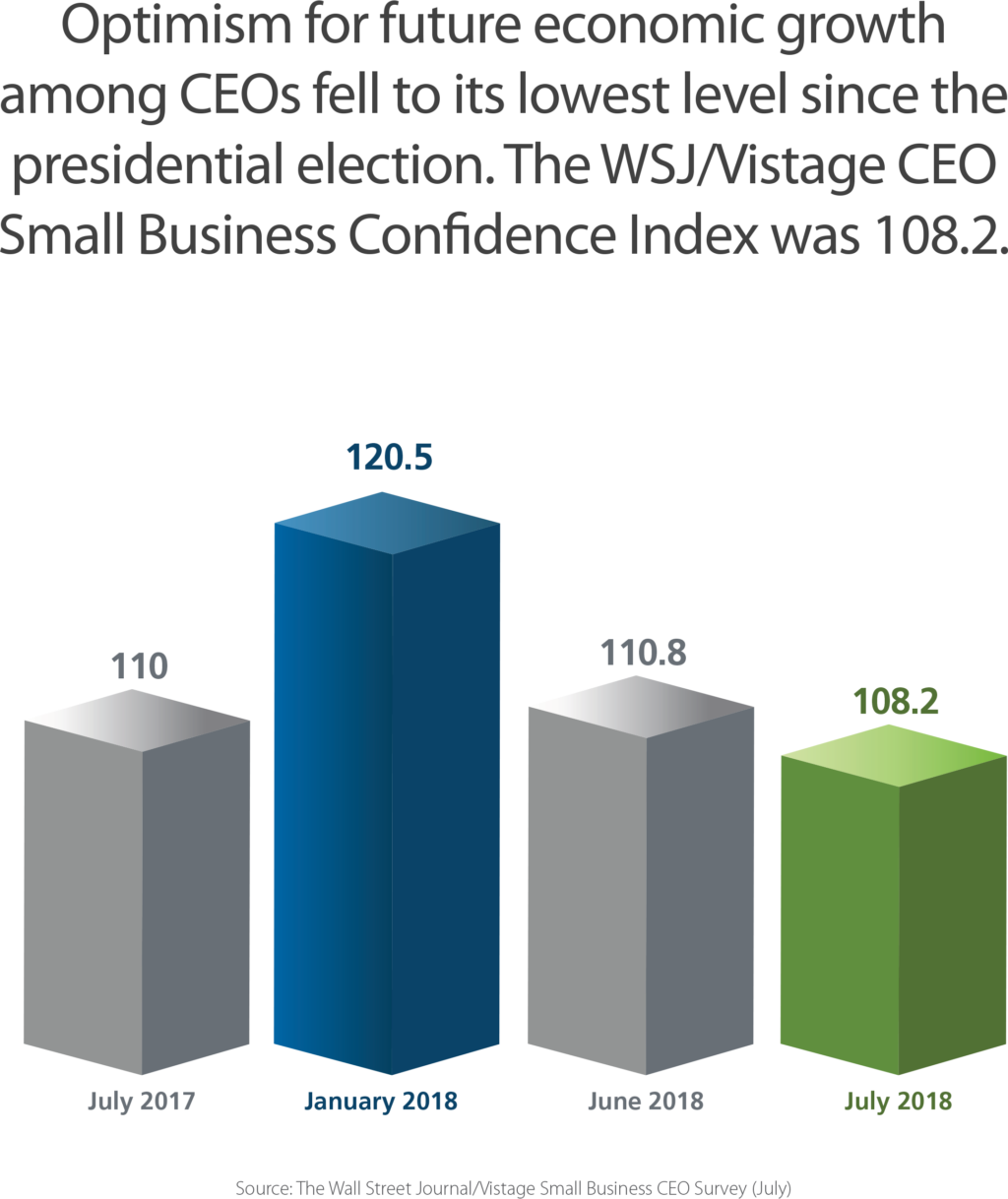

The economic optimism of small-business CEOs continues to decline, according to the latest results from the Wall Street Journal/Vistage Small Business CEO Survey. The CEO Confidence Index measured 108.2 in the July 2018 survey, compared to 110.8 one month ago and 110.0 one year ago. This is well below the peak of 120.5 recorded in January and the lowest level since the 2016 presidential election.

The economic optimism of small-business CEOs continues to decline, according to the latest results from the Wall Street Journal/Vistage Small Business CEO Survey. The CEO Confidence Index measured 108.2 in the July 2018 survey, compared to 110.8 one month ago and 110.0 one year ago. This is well below the peak of 120.5 recorded in January and the lowest level since the 2016 presidential election.

“The January peak was likely due to the tax reform legislation, and it is not surprising that the initial enthusiasm has faded,” says Dr. Richard Curtin, a researcher from the University of Michigan who analyzed the survey results. “The continued declines over the past six months suggest that other factors aside from tax reform may be responsible, and the current administration’s trade policy may be the primary reason. Whether one agrees or disagrees with the aim of the policy, the imposition of tariffs will cause economic disruptions.”

Other key findings from the July 2018 survey, which had 791 respondents, include the following.

Concerns over tariffs weaken economic outlook

Concerns over tariffs weaken economic outlook

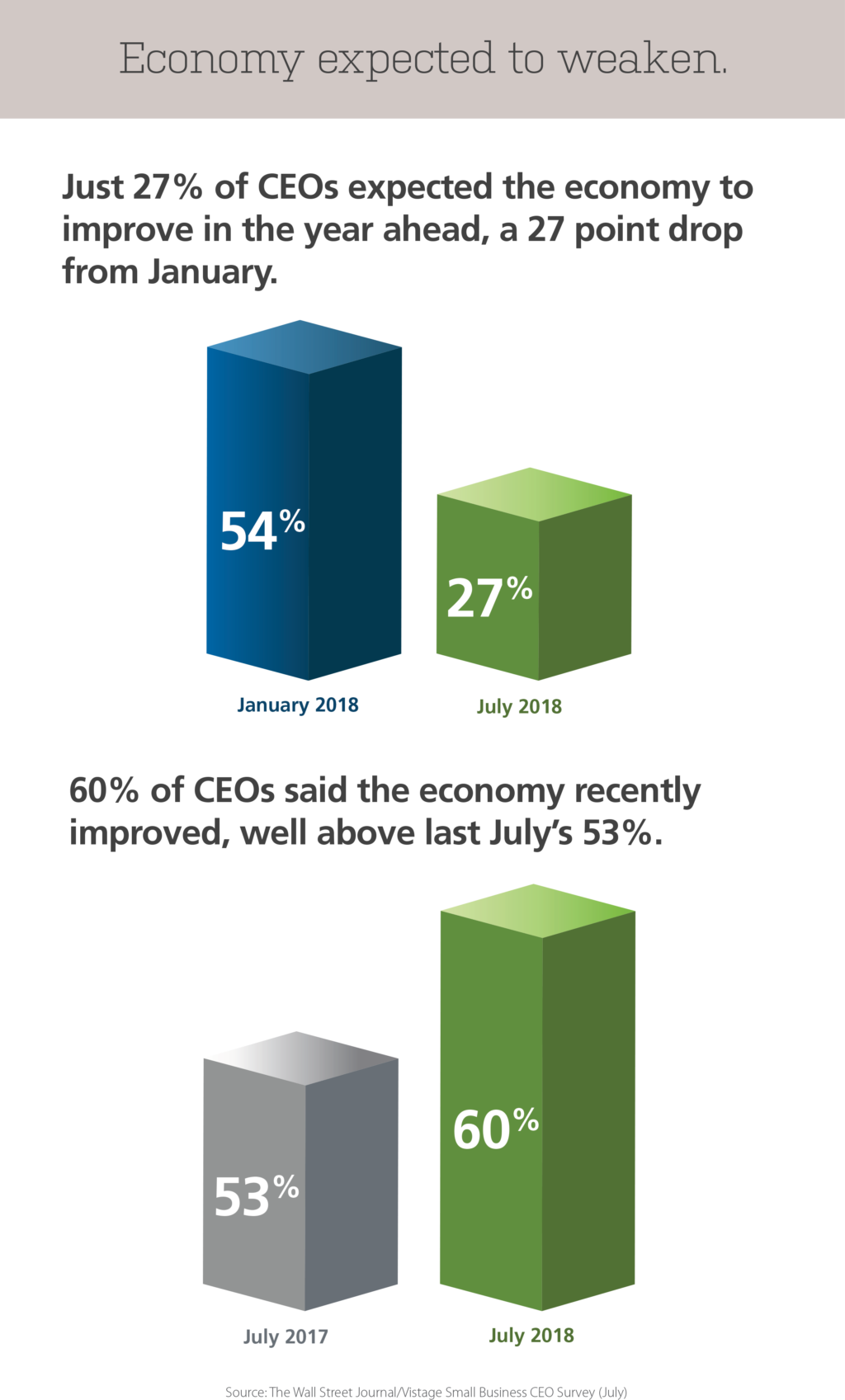

In the July survey, less than one-third of small-business CEOs (27%) said they expect the economy to grow in the year ahead. By comparison, in January, more than half of CEOs (54%) were optimistic about economic growth.

About 60% of CEOs thought the U.S. economy has recently improved, which is consistent with the past several months but higher than what was recorded one year ago (53%).

Tariffs appear to be the main reason for declining optimism. “Since the size and timing of the tariffs is unspecified, it is only natural that uncertainty about future economic prospects would increase,” says Curtin. “While CEOs may be uncertain about whether their business will be directly affected, they could have inferred that the overall pace of economic growth in the domestic economy will slow in the year ahead.”

Most CEOs anticipate revenue and profit growth

Most CEOs anticipate revenue and profit growth

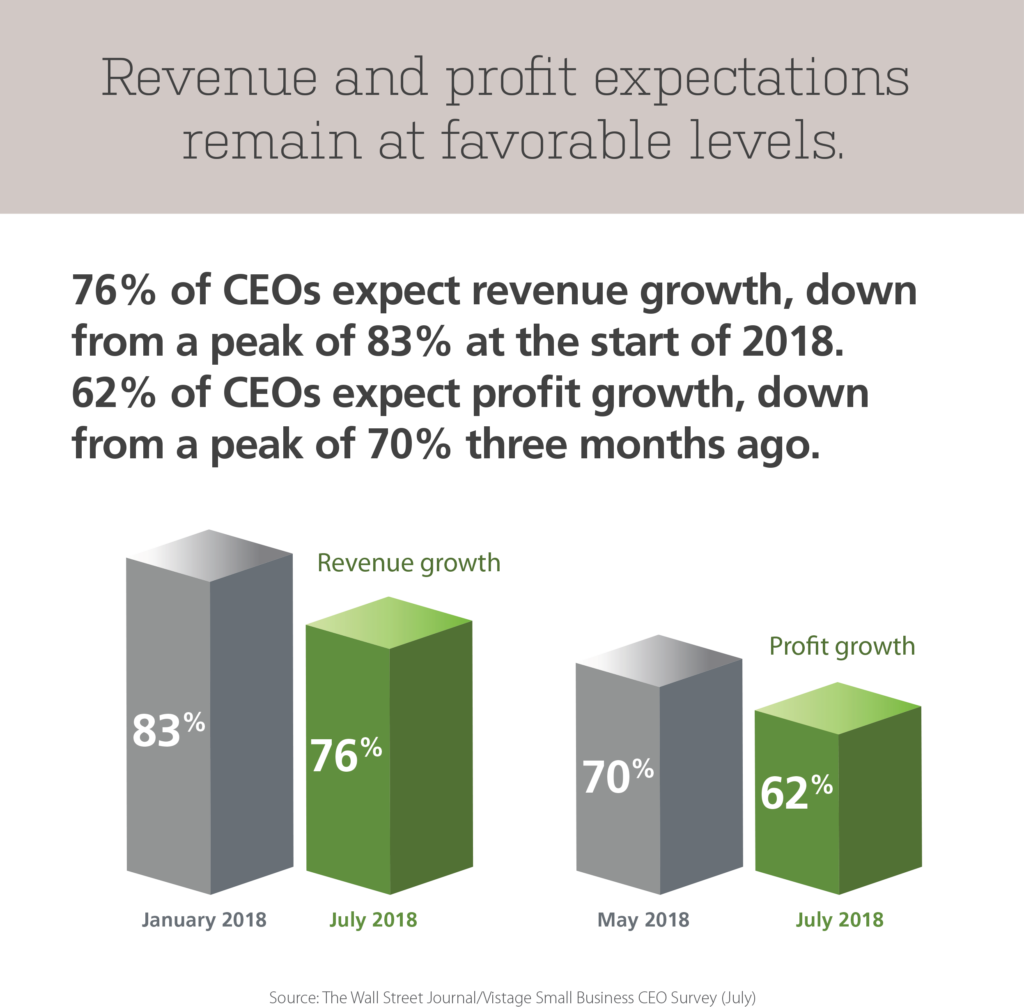

Expectations for revenue and profit growth fell from peak levels but remained at favorable levels in the July survey.

More than three-quarters of CEOs (76%) said they anticipate revenue growth this year, compared to 83% at the start of 2018.

Nearly two-thirds (62%) said they expect profit growth this year, compared to the peak level of 70% recorded three months ago.

Consistent with one year ago, only 5% of CEOs said they anticipate revenues to decrease, and only 8% anticipate declining profits.

Fewer firms plan for expansion

Fewer firms plan for expansion

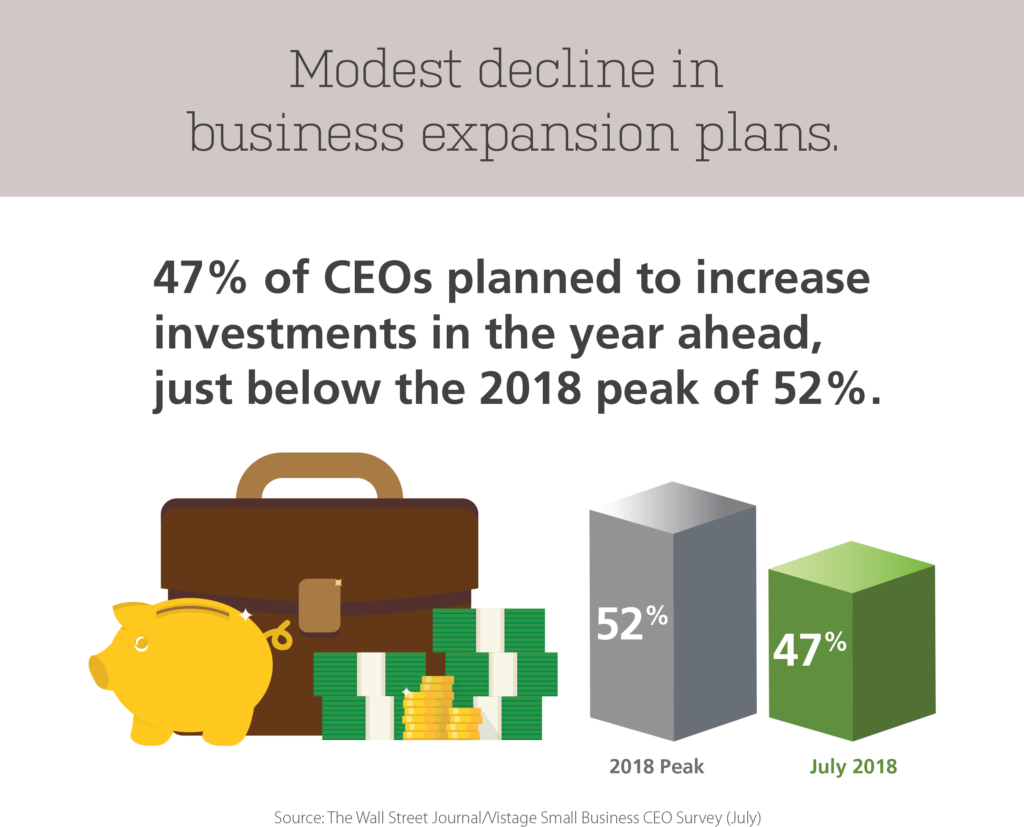

In July, less than half of small firms (47%) said they planned to increase their investments in new plant and equipment. This is below the peak of 52% recorded in January but equal to the ratio recorded one year ago.

Majority of firms to increase hiring

Majority of firms to increase hiring

The majority of small firms (62%) expect to increase their hiring in the year ahead. This is below the peak of 72% recorded in late 2017, but higher than the percentage recorded one year ago (59%).

In addition, 81% of all small firms reported hiring in the past quarter. About 10% of CEOs reported that their firms’ expansion was due to seasonal factors, while 13% of CEOs reported that their firm was impacted by changes in immigration policy.

“Despite the small reduction in anticipated expansion of their workforces, the hiring plans of small firms strongly suggest that the labor market will remain quite tight during the year ahead,” says Curtin.

Category: Economic / Future Trends

Tags: Economy, Hiring, tariffs, WSJ Vistage Small Business CEO Survey