CEO Confidence Index stable in Q2 2018

New data from Vistage indicates that the economic confidence of CEOs from small and midsize businesses (SMBs) has stabilized at favorable levels.

The Vistage CEO Confidence Index measured 104.1 in the Q2 2018 survey, which is slightly lower than the index from last quarter (105.8) and slightly higher than the index from last year (103.1). The index is calculated using results from a quarterly Vistage survey, which captures SMB CEO opinions on current economic conditions, expected economic conditions, expected change in employment, planned fixed investments, expected revenue growth and expected profit growth.

According to Dr. Richard Curtin, a researcher from the University of Michigan, the index slipped between Q1 and Q2 this year due to slight reductions in SMB CEOs’ investment plans, hiring plans, expected revenue growth and expected profit growth.

Other key insights from the Q2 2018 survey, which had 1,467 respondents, include the following:

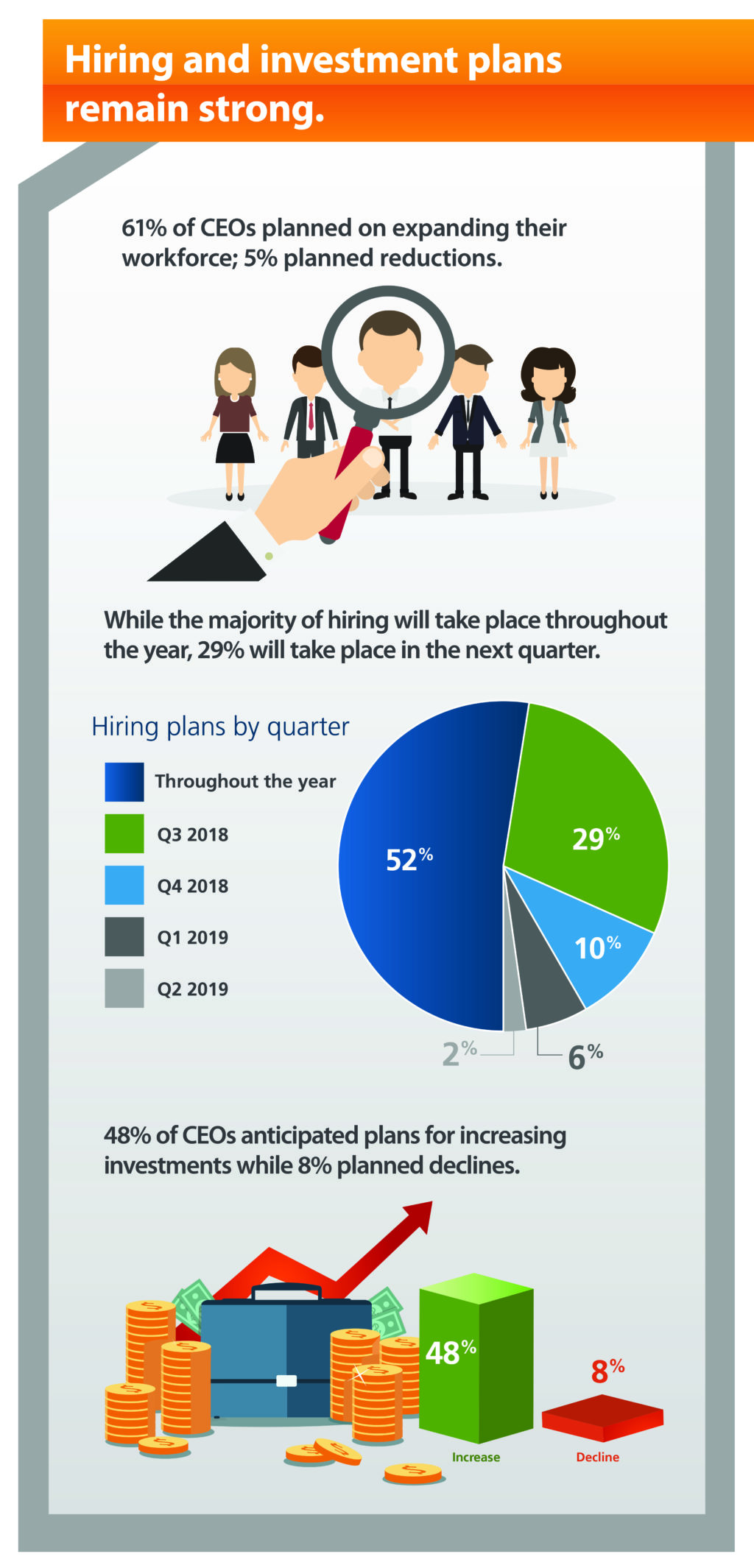

Slightly fewer CEOs plan to hire and invest

In the Q2 2018 survey, more than half (61%) of CEOs said that they planned to increase their workforce, while only 5% planned to decrease it. Less than half (48%) said they planned to increase their investments, while only 8% planned to decrease them.

These figures represent a decline from the previous two quarters but are similar to those recorded one year ago (Q2 2017). Curtin believes that the “prior quarters were dominated by the anticipation and passage of tax reform, largely without knowledge of exact details,” he said.

Half of CEOs expect no change to economic conditions

About two-thirds (64%) of CEOs say that economic conditions in the United States have improved in the last 12 months, while 30% say they have stayed the same and 5% say they have worsened. Looking ahead, only 32% of CEOs expect economic conditions to improve, while half (50%) think they will stay the same and 17% expect they will worsen.

Curtin speculates that this outlook may change “if the second-quarter GDP comes in close to the 4% as now expected,” he said. “Wages, commodities, and interest costs will continue to edge upward during the year ahead, putting the emphasis on lowering costs as well as increasing prices.”

Changes to the index and GDP differ

Historically, the CEO Confidence Index has closely corresponded with GDP changes published by the U. S. Bureau of Economic Analysis. However, Curtin has identified “an increasing divergence [between these], beginning in 2017,” he said. “The gap will mostly likely be closed by an increase in GDP and moderation in confidence. The data indicate continued economic expansion with an uptick in the average rate of GDP growth during 2018 and into 2019.”

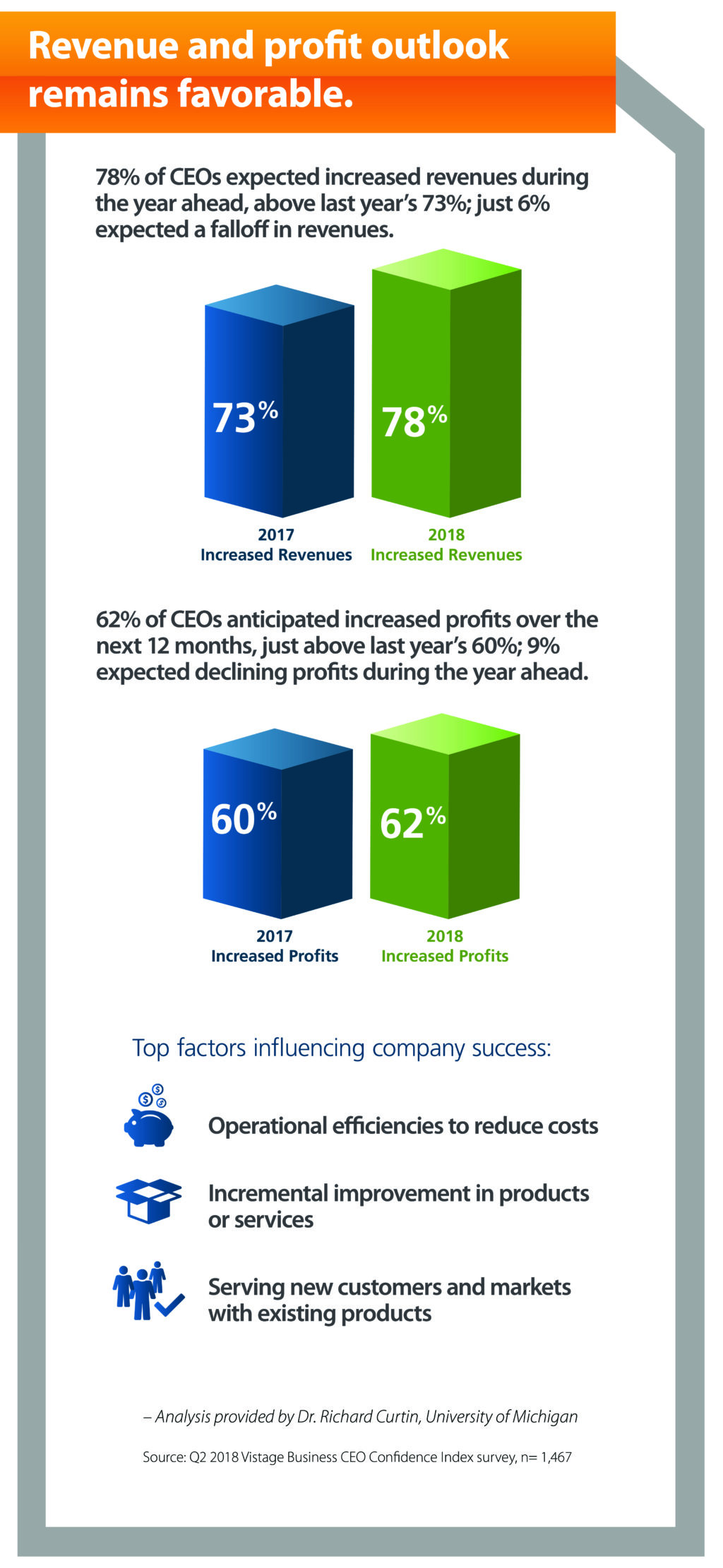

Most CEOs anticipate revenue and profit growth

Most CEOs anticipate revenue and profit growth

Consistent with last quarter, the majority of CEOs in the Q2 2018 survey said they anticipated an increase in revenues and profits in the year ahead. However, the number of CEOs expressing this outlook decreased slightly.

About three-quarters (78%) of CEOs said they expect their revenues to increase in the year ahead, compared to 79% last quarter and 73% one year ago. Only 6% expect revenues to decrease. Similarly, 62% of CEOs anticipate increased profits during the year ahead, compared to 66% last quarter and 60% one year ago. Only 9% expect profits to decrease.

CEOs see efficiency as key to success

When asked about the factors impacting their business, 67% of CEOs said they “agree” or “strongly agree” that operational efficiencies play an important role in their company’s future success. In addition, 60% of CEOs identified “incremental improvement in products and services” and “serving new customers and markets with existing products” as important factors. The least-important factors included developing radical innovations and new patentable technologies; only 16% and 15% of CEOs, respectively, said that they “agree” or “strongly agree” that these two factors will impact their success.

“While all of these strategies involve some risk, CEOs favored strategies based on known customer and market needs, banking on the higher probability of payoff for the firm,” said Curtin.

Category: Economic / Future Trends

Tags: CEO Confidence Index, Economy, Small business, Vistage