Economic trends for 2024 and beyond

Editor’s note: This is the third installment of an annual 4-part series on trends impacting small and midsize businesses. Here, we study economic trends for 2024.

Some have compared U.S. Federal Reserve Chair Jerome Powell to that friend who always arrives late to parties. The Fed raising rates 500 basis points in 12 months was meant to be a blunt force trauma to our economy.

But with trauma comes pain. Some experts felt the Fed did too much too late, and are even questioning whether the Fed’s dual mandate of 2% inflation at maximum employment is achievable.

Hear Marc Emmer explore the key business trends that SMBs will face in 2024, including society, technology, the economy and the environment. Watch now

Some wonder: Have we already entered a long-term debt cycle revolving around a wage-price spiral, persistent inflation and higher bond yields?

Is the recession really canceled? This soft landing is feeling very soft, and the prospects for lower interest rates feel so far away. Yet a rising federal deficit will pressure the Fed to try to lower rates in the future.

The economic signals are contradictory. While supply chains have normalized, the suddenness of interest rate hikes has created imbalances.

There is a clear lag before fiscal policy (stimulus) and monetary policy (Fed action) have an impact on the economy. Q3 produced a shocking 5% real GDP growth (“real” denotes adjusted for inflation), followed by a better-than-expected jobs report and inflation rising again to 3.7% in September.

More in this series

Part 1: Ecological trends for 2024 and beyond

Part 2: Technology trends for 2024 and beyond

Part 4: Social trends for 2024 and beyond

This all comes at a time when governments are being weighed down by aging populations along with escalating health-care and pension costs. Layer in new requests for military spending to preserve U.S. interests around the world, and you have a ticking time bomb.

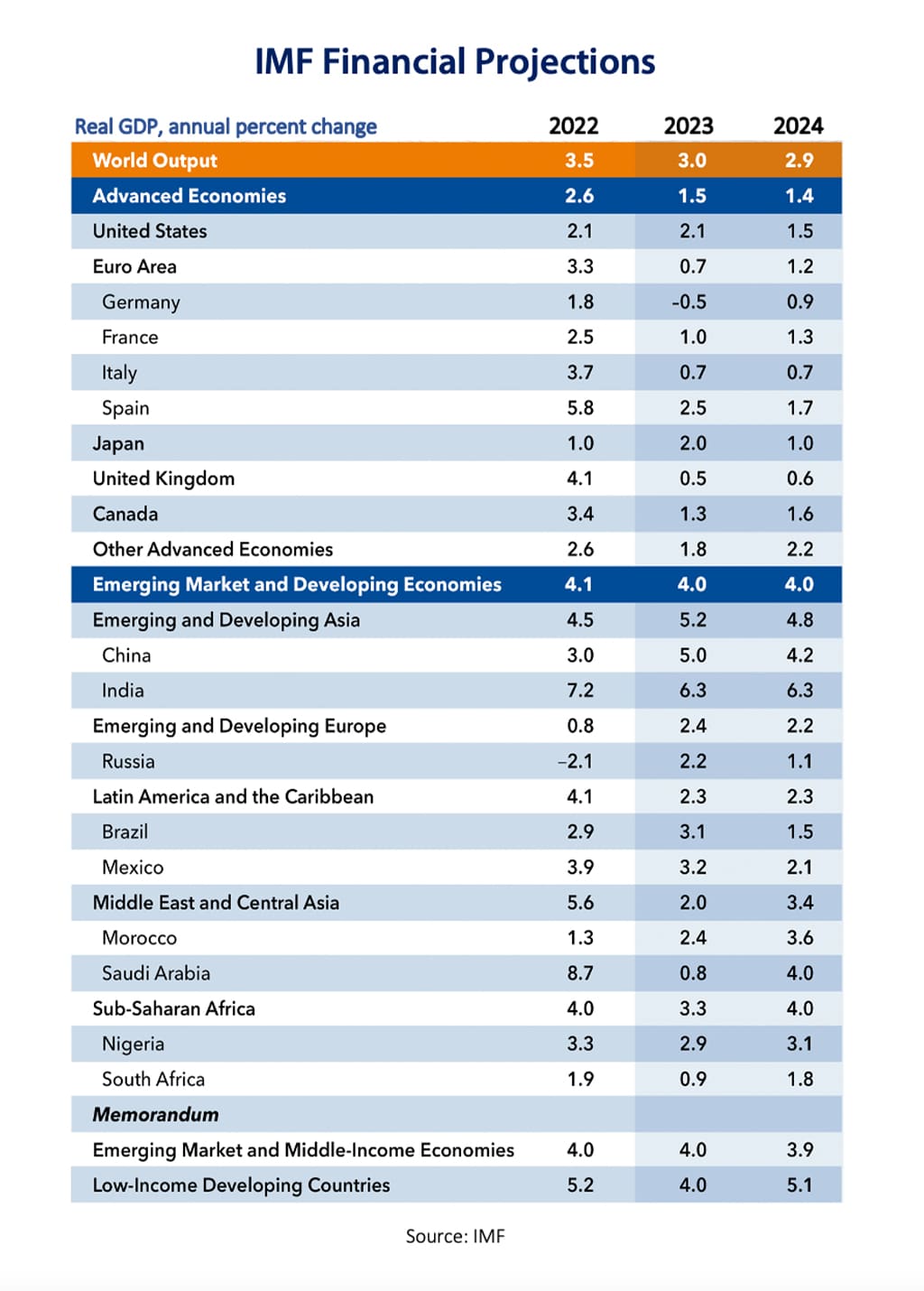

Higher yields and interest rates are bad economics for countries such as the U.S., France, Germany, Italy and Japan, who are suffering from swelling deficits and use short-term bonds to finance spending. The cost of debt was low at near-zero interest rates, but over time high-interest rates will require more debt service.

2024 outlook

While the U.S. economy is performing extraordinarily well under the circumstances, there are several notable headwinds businesses will face entering 2024:

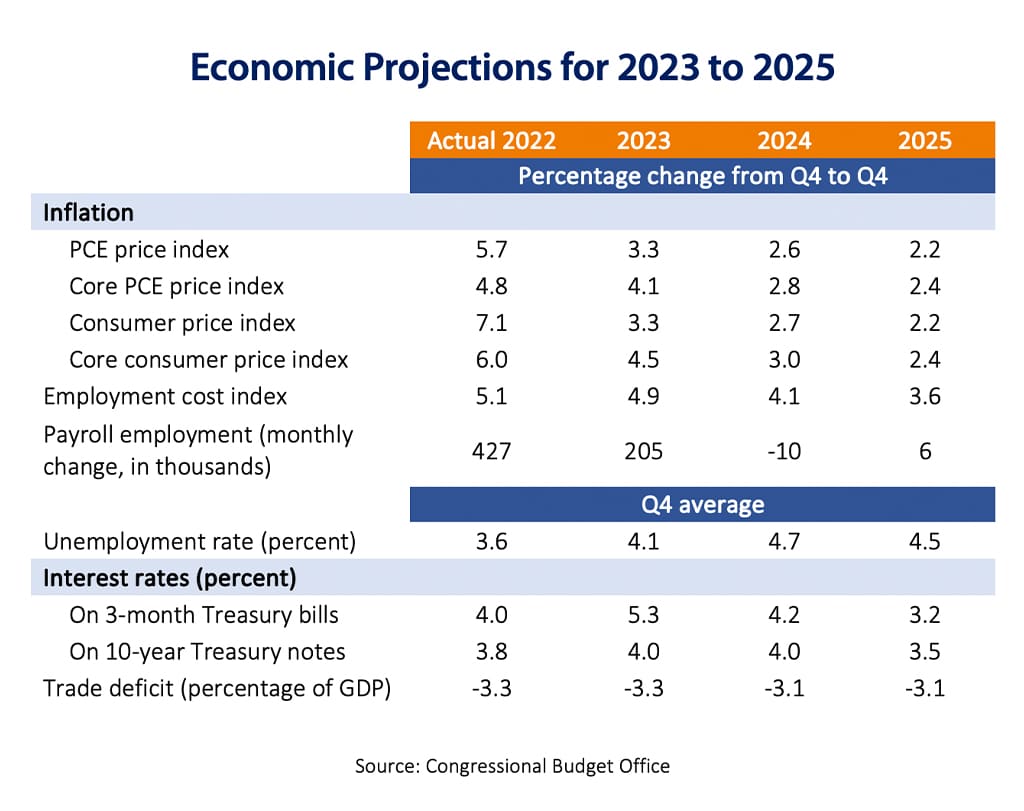

- Wage growth is decelerating.

- COVID-era stimulus is waning, and the savings rate is lower (3.5%).

- Student loan repayments began again in October.

- Credit card delinquencies have risen steeply over the last 8 quarters (2.8%).

- In addition to credit card debt, household debt, mortgage debt and auto loan debt are rising.

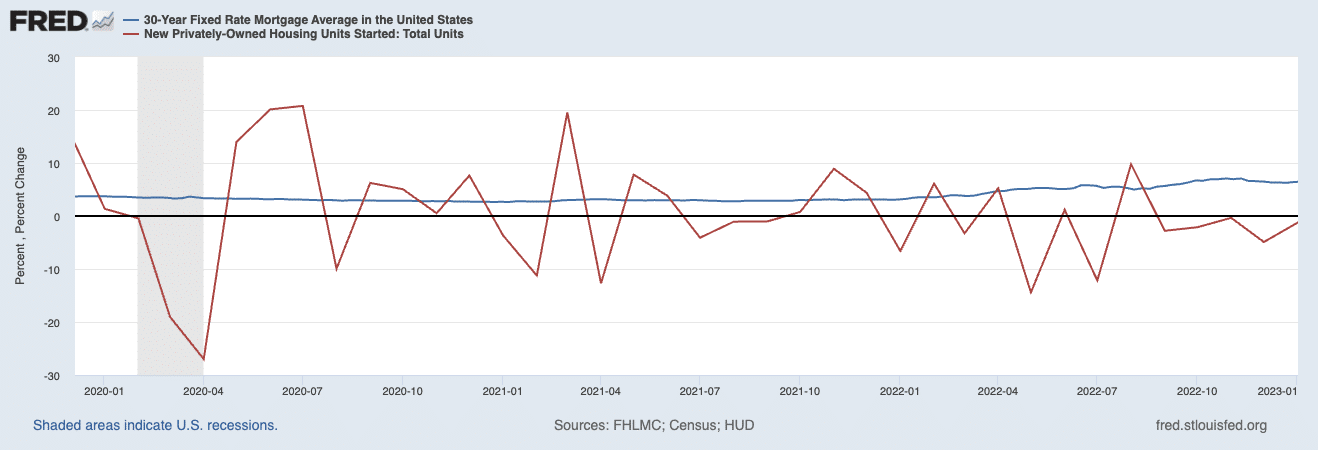

- Higher interest rates including mortgage rates are approaching 8%.

- The auto worker strike will inflate the cost of automobiles, a key driver of the CPI.

- A weakened dollar will make imports more costly.

- After an 8.7% cost-of-living adjustment to Social Security, payments will increase only 3.2% in 2024.

As a result of these conditions, the consumer spending portion of GDP is expected to erode quickly. The global economy is also cooling, given the sluggish growth in Europe and China. High-interest rates supporting higher bond yields create a drag on equities.

Click here to see an interesting view of long-range forecasting for the capital markets.

Inflation and labor costs

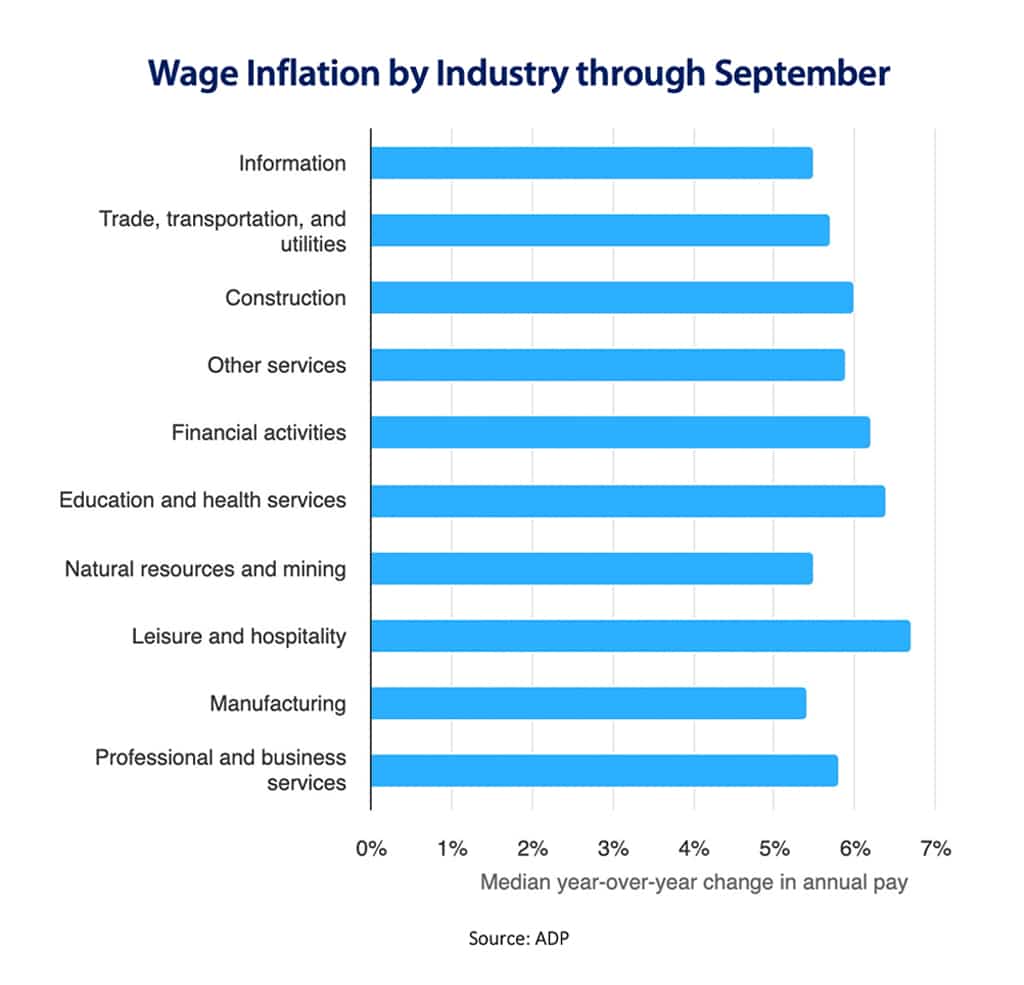

The lag of interest rates has resulted in positive job growth into Q4 — much higher than expected. As raw material and transportation costs have normalized, wages are a key variable driving inflation.

As we noted last year, federal reports on wages are misleading as they report on “total wages.” For a more accurate picture of wage increases by industry, see ADP Insights. As of September, wage inflation was 6% for “job stayers” and 9% for “job switchers.”

Predictive indicators

Below are U.S. Congressional Budget Office forecasts for 2024-2025. Of note is job growth being flat in 2024 after most economists incorrectly predicted declining job growth in 2023:

Transportation costs

The transportation sector is in flux. The recent bankruptcy of Yellow Freight is a blinking red light in a sector with too much capacity. More failures are expected in a consolidating industry.

Dry van rates are down 11% at $2 per mile. Yet UPS and FedEx have announced 7% increases in rates amid rising labor and energy costs (especially for diesel).i

Middle East tensions are likely to promote higher fuel costs for some time. These variables are stoking ambitions for EVs and driverless trucks — with a live test beginning in Texas.

Meanwhile, container shipping costs from China have returned to their pre-pandemic levels.

China decoupling

While decoupling from China may be harder than advertised, a new world economic order is emerging. In 2015, China’s imports into the U.S. peaked at 22%. Chinese imports now equate to 16.5% of U.S. imports.

U.S. President Joe Biden has continued Trump-era tariffs to protect U.S. technology such as supercomputing, drones, aerospace and surveillance.

In industries like electronics, Chinese imports fell by over $25 billion, as the supply chain moved to Mexico and other countries and U.S. production increased by $51 billion.ii

2023 Imports from China

Source: Kiplinger

U.S. Manufacturing

While manufacturers aspire to build more “smart factories,” many lack the capability to do so.

Despite the fact that 62% of manufacturers plan to increase automation in the next year, they face challenges in finding engineers and equipment. Within the manufacturing sector, holding onto critical tribal knowledge is at a premium, and 75% of employers report retaining their existing employees as their top workforce productivity priority.

While supply chains have normalized, they are fragile. During the pandemic, one of our clients scrambled to find a raw ingredient in which 80% of the world’s supply came from Ukraine.

Nearshoring and onshoring have taken longer than expected, as new logistics hubs and infrastructure must be built to support demand.

See Deloitte’s manufacturing report

Industry profiles

Construction

While the entire construction sector is constrained by high-interest rates, there are pockets of opportunity. While there is still an undersupply of housing, new housing starts are dropping quickly, providing an escalating level of risk to construction and other housing-related sectors.

Construction is unique in that subcontractors and tradesmen simply move from one sector to another — in this case, into sectors supported by infrastructure spending. A bright spot is manufacturing construction, up 74% during the first half of the year.iii

For more on infrastructure projects, see our ecological trends post in this series.

Consumer goods

The consumer packaged goods (CPG) industry is undergoing a significant transformation, fueled by a series of supply chain innovations.

Concerns about holding inventory and changing customer expectations have created an arms race — whoever can deliver faster and cheaper. AI and other technologies are providing consumers with more choices and providers with better analytics.

The home improvement sector is sluggish amid declining new home sales. CPGs become price-sensitive in economic downturns, and retailers are already amping up discounts and sales as evidenced by Amazon Prime adding events this year.

Energy

Three bills — the Infrastructure Investment and Jobs Act, CHIPS and Science Act, and Inflation Reduction Act — appropriate more than $500 billion to clean energy initiatives over the next decade.

These investments are the impetus to radical shifts in U.S. energy policy. The war in the Middle East will only fuel the fire on higher oil prices that shot up to $80 per barrel. In 2023, of the $2.8 trillion in global investment, $1.7 trillion will be in solar, hydropower, geothermal and nuclear.

Finance and insurance

An extended inverted yield curve and higher bond yields are a drain on equities. Financial institutions are facing a liquidity crunch, requiring that they provide products with more yield.iv

The insurance sector is reeling from unusually high claims as a result of weather events and fires. Many providers have stopped writing policies. Auto insurance renewals in 2024 are expected to exceed 20%. In the long term, the sector will benefit from lower costs related to autonomous vehicles and smarter vehicles.

Health care

Health care now represents 7% of GDP. The industry is staggering from the pandemic, changes to Medicare rules, high prescription prices and surging demand for elective surgeries conducted post-pandemic.

AI can disrupt health care more than any other industry, potentially leading to a set of new cures and therapies. Some even believe AI could cure cancer.

However, the sector is plagued by an undersupply of nurses, technicians and even physicians who are commanding starting salaries of $500,000 or more.

Implementation of new solutions is constrained by data privacy and other concerns about patient outcomes. The last few years have led to consolidation and a greater presence by private equity.

Hospitality

Given pent-up demand (revenge travel), hotel and motel occupancy is at 64% — well above 2020 levels — and the industry grew 19% year-to-date. Employment continues to plague the industry, with hospitality having sky-high wage inflation and turnover.

Information technology

The technology sector is dominated by discussions of AI and cybersecurity and is expected to grow about 6% this year. Over 70% of mid-market companies expect to spend more in 2024 as providers release new tools that improve the client experience and productivity.

For more analysis on this sector, see our Technology Trends post.

Professional services

Concerns about a slowing economy have spurred layoffs by consulting firms. Law firms, accountants and consulting practices have adapted to a tight labor pool and demands by their workers to support a work-from-anywhere culture. Given high inflation, they are seeking tools that improve productivity.

Retail trade

The death of the mall has been highly exaggerated. Many retailers are performing well given a deceleration of e-commerce growth. Brands are using AI to offer more choices based on customer history and patterns.

Automobiles comprise a large portion of the sector, and auto sales will be depressed as a result of strikes on U.S. automakers. High-interest rates are also likely to dampen demand. New cars are coming out with a plethora of features, including voice commands.

Wholesale trade

Strong demand for durable goods fueled the sector earlier in the year, but demand fell during the summer in part because of higher borrowing costs. Yet the sector has grown 5.8% this year. Distributors are having to pull back on inventories. The sector is ripe for automation.

Also see:

Conclusion

Without another significant black swan, such as an escalation of the war in the Middle East, we think fears of recession are overstated. It will likely be some time before the Fed reduces rates, and we are in for a sustained period of slow growth.

Companies will need to be selective in what sectors they participate in, protect their margins, leverage technology and be employers of choice.

References

i The Kiplinger Letter

ii The Kiplinger Letter

iii RSM

iv RSM

Category: Economic / Future Trends

Tags: economic factors affecting business, economic forecast, Economic trends, Upcoming Webinar