Mergers and Acquisitions: Understanding the Essentials of Strategy and Execution in the M&A Ecosystem: Part 1 of 4

It’s hard to name many business transactions that are as risky and complex as mergers and acquisitions (M&A). Over 85% of M&A deals fail, according to a recent study on M&A outcomes by KPMG. Another study, by A.T. Kearney, found that the total return to shareholders on 115 global M&A transactions was negative 58%. These astounding numbers are enough to make any organization think twice.

Still, when interviewed by the NY Times recently, Robert Kindler, global head of M&A at Morgan Stanley, responded that he is optimistic about the takeover market for the first time in years. He stated, “When you have historically low interest rates, less volatile equity markets and stock trading at low forward multiples, that is when mergers and acquisitions are going to be active.” Despite the grim statistics, there are many compelling reasons to attempt an M&A transaction, but they must be done with and understanding of the risks and challenges involved. In this first installment of a four part series, we will begin by building some M&A foundations and define the ecosystem of an M&A transaction.

M&A activity tends to be driven by favorable market conditions, but that drive really begins with broader strategic objectives that are complementary among the parties in the M&A transaction. The objectives of the buyer and the seller come together in a way that propels the transaction to forward. For example, one or both organizations may need the M&A in order to survive; or perhaps the move will enable a leaner, more profitable company; or it will better position the resulting company for necessary growth.

Why Consider an M&A Transaction?

There are many strategic reasons why mergers or acquisitions are considered in the first place, and include:

• To gain economies of scale

• To increase financial growth

• To achieve vertical integration

• To eliminate competition

• To acquire new assets

• To hedge a counter-cyclical business

• To gain Intellectual Property (IP)

• To expand into new markets

• To expand into complimentary products and services

• To eliminate emerging IP and product threats

• To acquire new customers

The need or desire to acquire or merge is always present in the business world but the challenges are many.

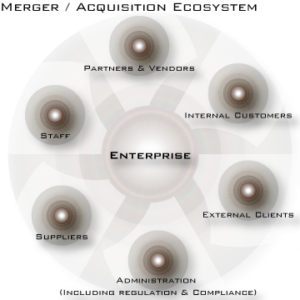

What Does the Ecosystem of Mergers and Acquisitions Look Like?

For the purposes of this discussion, an ecosystem is a system formed by the interaction of a community of entities with their business environment. The key players in the M&A ecosystem are:

• Being acquired / selling companies

• Shareholders

• Banks

• Federal / State agencies

• Business enterprises of the buyer and seller, specifically the affected areas of each:

• Staff

• Administration

• Partners & vendors

• External customers / clients

• Internal customers

• Suppliers

To simplify the topic and delve into the nuances of the decisions to be made, change management to occur and execution required, we will focus on the buyer and seller along with the ecosystem members directly related to the enterprise operations for this analysis.

Is it a merger or an acquisition?

This is a small question where the answer has big implications. Let us examine some foundations to the M&A ecosystem.

The Merger:

BusinessDictionary.com definition:

Merger: Voluntary amalgamation of two firms on roughly equal terms into one new legal entity. Mergers are effected by exchange of the pre-merger stock (shares) for the stock of the new firm. Owners of each pre-merger firm continue as owners, and the resources of the merging entities are pooled for the benefit of the new entity. If the merged entities were competitors, the merger is called horizontal integration, if they were supplier or customer of one another, it is called vertical integration. Read more: here ( hyperlink to:

https://www.businessdictionary.com/definition/merger.html#ixzz15Az6IxEl )

If the M&A deal is structured as a merger, that suggests fully integrating the purchased company into the buying company. Cultures must be meshed, operations made to work together cohesively and core competencies of the resulting organization enhanced. Sound simple? Consider as an example the merger (integration) of two firms on the basis of manufacturing consolidation. While the benefits may be great, the additional costs incurred for merging engineering, establishing new sales channels, blending marketing organizations and philosophies, and all other elements of the business could significantly offset the benefits being used to drive the merger / integration effort in the first place.

Mergers are most common when an industry begins to consolidate in order to survive. Such is the case with the consolidation occurring right now within the airline industry. After struggling over the past few years, it has been clear for some time that changes needed to be made so that the industry can continue to grow and thrive. Hence, major mergers began to be announced on the heels of one another. The merger pattern started when Delta and Northwest joined together. The transaction was positioned as a merger, but was really a take-over by Delta – resulting in the world’s largest airline. The most recent high profile merger occurred when United and Continental agreed to merge. The resulting airline will operate under United’s name. When the merger is complete (it’s expected to take a couple of years), United will take over the title of world’s largest carrier. Judging by the remaining independent legacy carriers (especially US Airways and American Airlines), United should hold the title for quite a while. Southwest Airlines was the most recent airline to announce a merger. Southwest is merging with another low-cost-carrier – AirTran, one of its main budget competitors. A series of smaller mergers and alliances have truly altered the landscape of the airline industry.

The Acquisition:

BusinessDictionary.com definition:

Acquisition: Taking control of a firm by purchasing 51 percent (or more) of its voting shares. Read more: here (hyperlink to:

https://www.businessdictionary.com/definition/acquisition.html#ixzz15AzneMvR )

So if mergers are complex, are acquisitions simpler to complete successfully? It would be nice if that were the case, but unfortunately for all concerned, acquisitions pose their own set of challenges. One of those challenges is in making the right decision on whether to integrate or leave the acquired company alone and allow them to remain autonomous.

Allowing the acquired company to remain separate can certainly be advantageous in some situations due to the lesser degree of complexity required, but the reasons behind the acquisition may dictate integration.

Consideration must be give to factors like:

• If separate, can we cross sell to each firms customer base?

• If cross selling is the intent, how will sales and marketing be cross-trained and educated on the benefits? What might compensation and commission plans look like if integrated?

• If combined, is there elimination of duplication of effort?

• Will the products and/ or services integrate & what might that process look like?

• Is there commonality in approach across regions?

• Would integration squash the entrepreneurial spirit of the acquired company?

• If the goal is to create an entrepreneurial atmosphere in the company, would the entrepreneurs of the acquired company stay in the boat long enough to wait that happen?

• Can the acquisition target’s culture actually become the dominant culture?

• Can two distinctive cultures be integrated?

——–

To View Part 2 of this Article, Click Here

To View Part 3 of this Article, Click Here

To View Part 4 of this Article, Click here

—Article by Joe Evans of Method Frameworks—-

Joe is a published author, frequent speaker and recognized expert in corporate strategic planning . Contact Method Frameworks about scheduling Mr. Evans about an upcoming speaking engagement or email requests to media_relations@methodframeworks.com

Category: Mergers & Acquisitions

Tags: Acquisitions, Management, Mergers, Small business, Strategy

[…] part one of this four article series, we explored the landscape of the Merger & Acquisition (M&A) […]

[…] […]

[…] part one of this four article series, we explored the landscape of the Merger & Acquisition (M&A) ecosystem and how M&A activity is generally driven by strategic objectives that must form a match between […]

Great article with regards to the Merger & Acquisition Activity providing insight into the strategic objectives that should form a match between both parties the buyer and the seller.Just read an excellent article Successfully navigating due diligence in a competitive deal process @ http://bit.ly/pkIXne

Bonjour!!

I will be out of the office from Friday 9/30 until Monday 10/17 traveling France and Italy.

For email, List, and communications related items please contact Automated Marketing Specialist Louis Patrick. (Louis.Patrick@vistage.com)

For website, regional site or other web related items please contact SEO/SEM Specialist Dominick Frasso. (Dominick.Frasso@vistage.com)

For all other issues please contact Director of Communications Gina Onativia (Gina.Onativia@vistage.com)

A la votre,

Andy Ramirez