Future investments fuel small business projections for increased revenues [WSJ/Vistage June 2021]

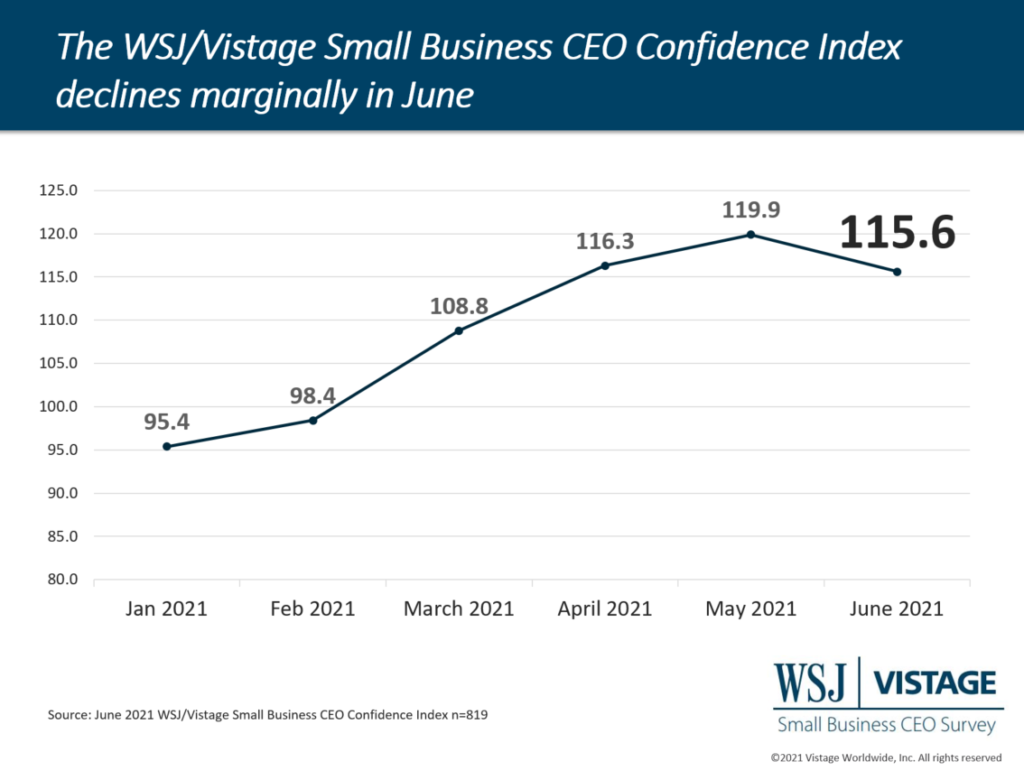

While analysis of the latest quarterly Vistage CEO Confidence Index survey revealed an increase in confidence among CEOs of small and midsize businesses between Q1 and Q2, trends from our monthly survey conducted in partnership with the Wall Street Journal reveals that confidence among small business leaders has tempered from last month. The WSJ/Vistage Small Business CEO Confidence Index declined marginally from 119.9 in May to 115.6 in June.

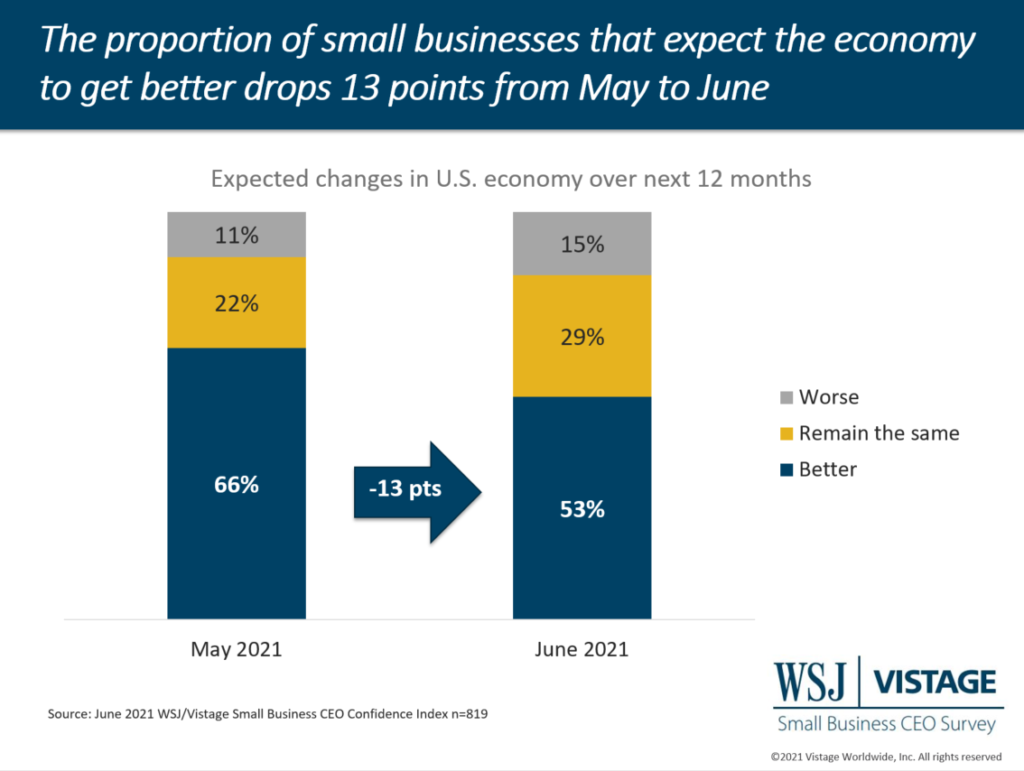

Small businesses continue to have favorable views of the economy compared to last year with 74% reporting the economy recently improved, down marginally from 77% last month. However, looking ahead, fewer small businesses are optimistic. The percentage of small businesses that felt the economy would improve in the year ahead fell 13 points in one month, reaching 53 percent in June.

Despite their trepidation about the economy, small business CEOs are optimistic about their own businesses, with 4-in-5 projecting revenue increases over the next 12 months.

To realize these revenue expectations, small business leaders are maintaining strong expansion plans with 49% planning to increase their fixed Investments and 71% planning to expand their workforce in the year ahead. However, with an eye on the future of the economy, the proportions of small business CEOs investing in expansion has softened from May as well, perhaps in reaction to the economy. The next few months will determine if this softening turns into a downward trend.

Rising costs impact profitability

While revenue expectations are at the highest they have been since May of 2018, rising costs are contributing to the gap between revenues and profitability. In June, 59% of small businesses reported expectations for increased profitability in the year ahead, a 3-point decline from May.

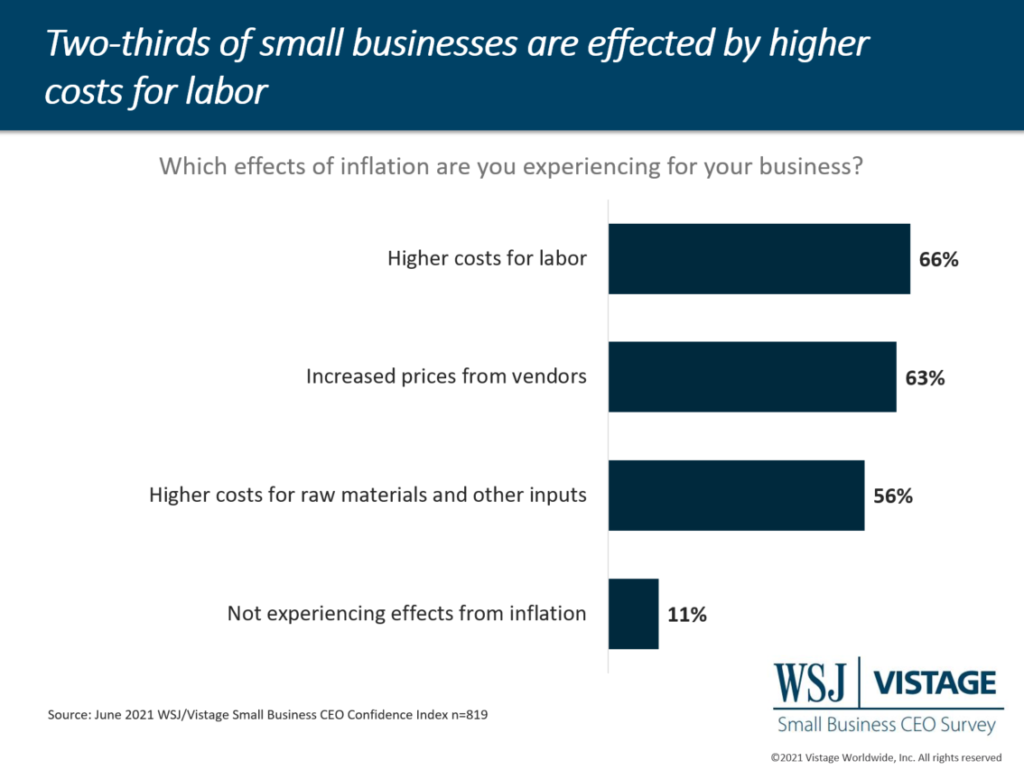

Increased prices for raw materials are reported by 56% of small businesses. Compounding that are supply chain challenges; nearly twice as many 39% of small businesses feel they are getting worse (39%) than improving. These impacts tend to be a greater in some industries more than others. However one growing cost center that impacts all companies is wages; two-thirds (66%) of small businesses report higher costs for labor.

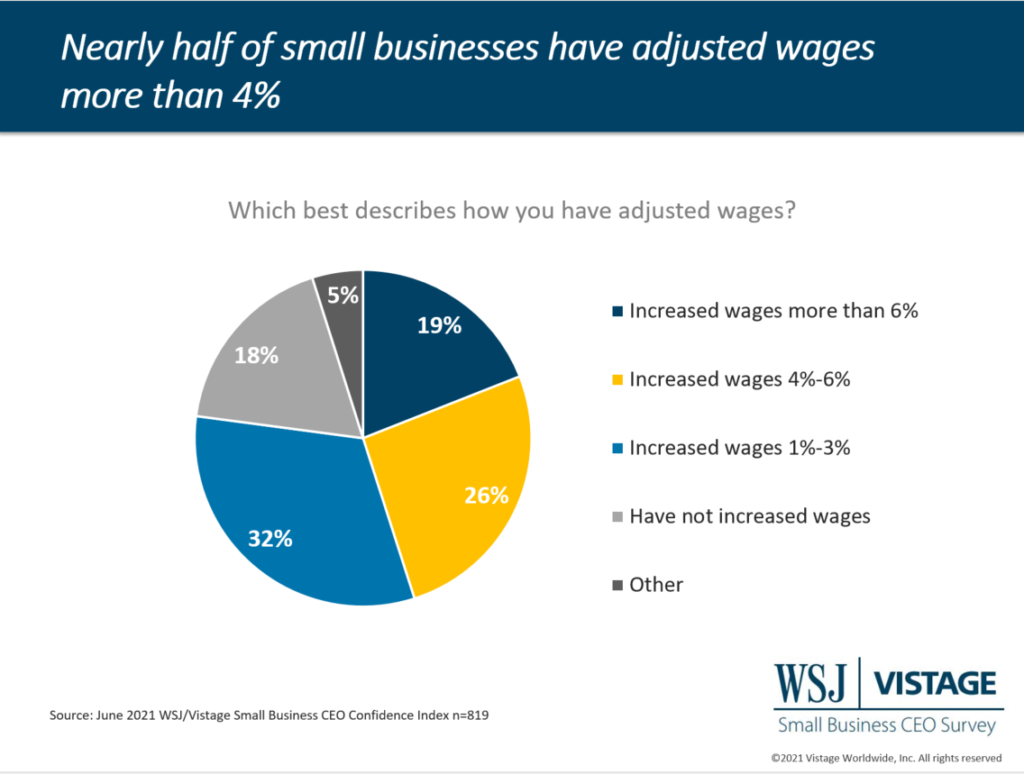

Digging into increased costs for labor, our survey revealed that nearly three-quarters (73%) of small businesses have increased wages to some degree, and 50% report wage increases of more than 4%. Increasing wages is a key area that small businesses are focused on to compete in the talent wars. Last month, 62% of small businesses reported boosting wages as a way to address hiring challenges.

Expanding the workforce starts retaining employees

With 71% planning to expand their workforce in the year ahead, hiring is a challenge for many small businesses. In order to expand the net workforce, leaders have to also focus efforts on retaining the people they have today. Retention rates should be something leaders monitor closely, currently 19% of small businesses report their retention has decreased since the beginning of the year.

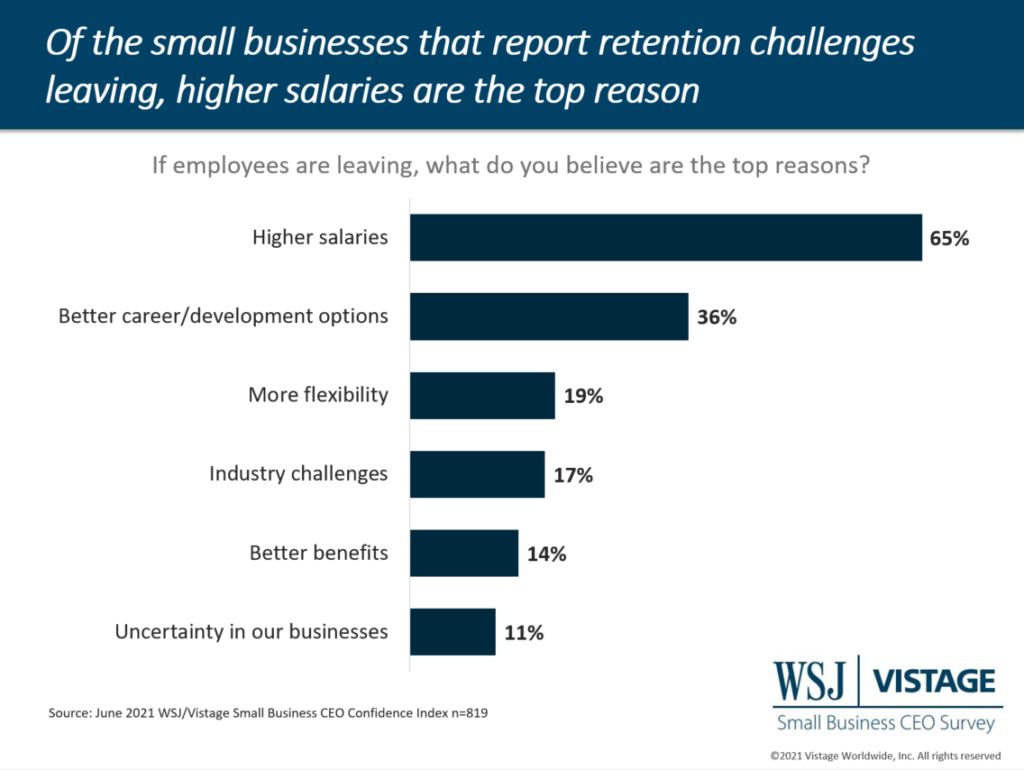

When asked about why they believe employees are leaving, CEOs who are impacted by turnover believe that higher wages (65%), better career and development opportunities (36%) and more flexibility (19%) are key drivers for turnover. Certainly flexibility in terms of remote or hybrid work is not an option for all businesses or only select employees, but one that can’t be overlooked as knowledge workers are increasingly seeking out these opportunities.

In the Q2 CEO Confidence Index survey we learned that just 40% of CEOs surveyed their employees about their preference for a workforce model. With 60% of small businesses not knowing what their employees really want, they also don’t have a clear picture of the retention risks that might stem from their decisions about remote work policies for those that are able to work from home.

Overall, small businesses optimism has been tempered as there are significant variables to weigh that impact their business. Labor and rising costs are a challenge. Vaccine distribution has slowed in the U.S., and it remains to be seen when international restrictions will be lifted. The impact of the Delta variant both domestically and internationally may present a challenge, especially in areas with lower vaccination rates. Back to school is looming, which may present a whole new challenge in the area of vaccines and childcare. While at times it feels like we are living in the new reality, the pandemic is not yet over and lingering effects still present challenges that leaders need to anticipate.

Download the June report for complete data and analysis

For the complete dataset and analysis of the June WSJ/Vistage CEO Confidence Index survey from Dr. Richard Curtin, download the report and infographic to learn more, including.

– Improving optimism about recent improvements to the economy

– Investment and hiring plans continue stable

– Revenue and profit expectations rise slightly

>>DOWNLOAD JUNE 2021 WSJ/VISTAGE SMALL BUSINESS REPORT

>> DOWNLOAD JUNE 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

Related links

- About the WSJ/Vistage Small Business CEO Survey

- Interactive data from WSJ/Vistage Small Business survey

|

Survey Methods |

Category: Economic / Future Trends

Tags: Challenging Times Business Strategies, Hiring, recruiting, Small business, US Economy, WSJ Vistage Small Business CEO Survey