Despite uncertainty, workforce plans remain stable for small businesses [WSJ/Vistage Nov 2022]

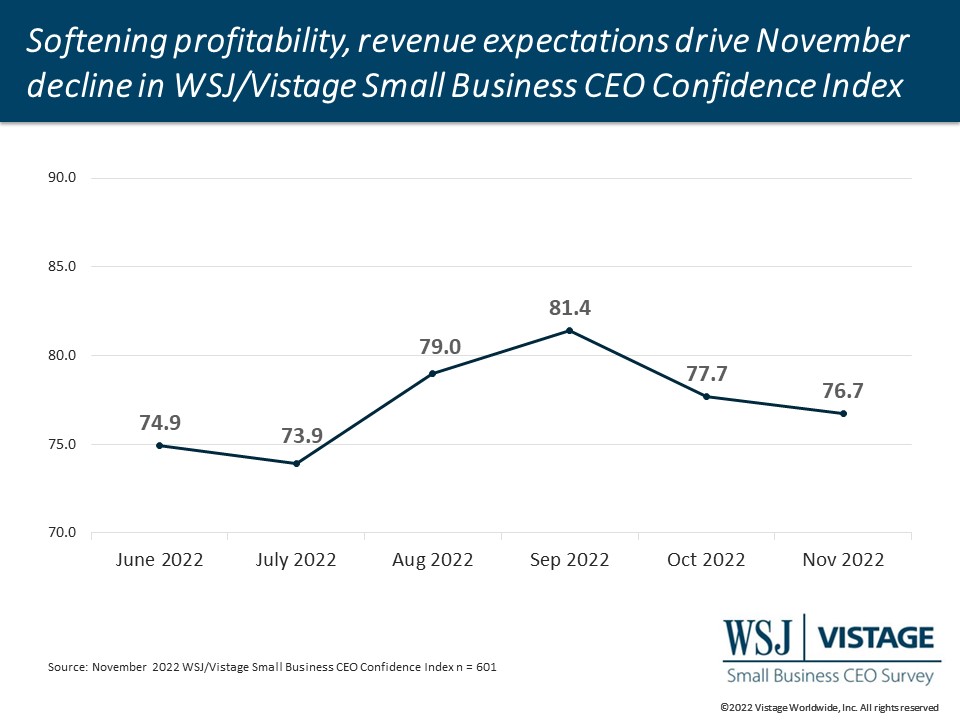

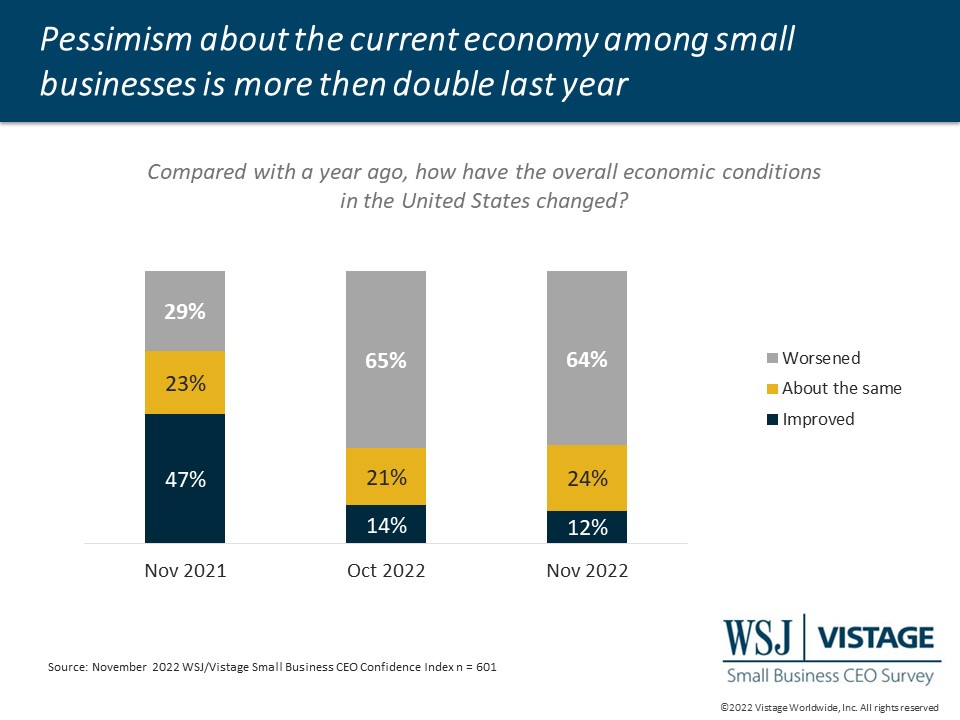

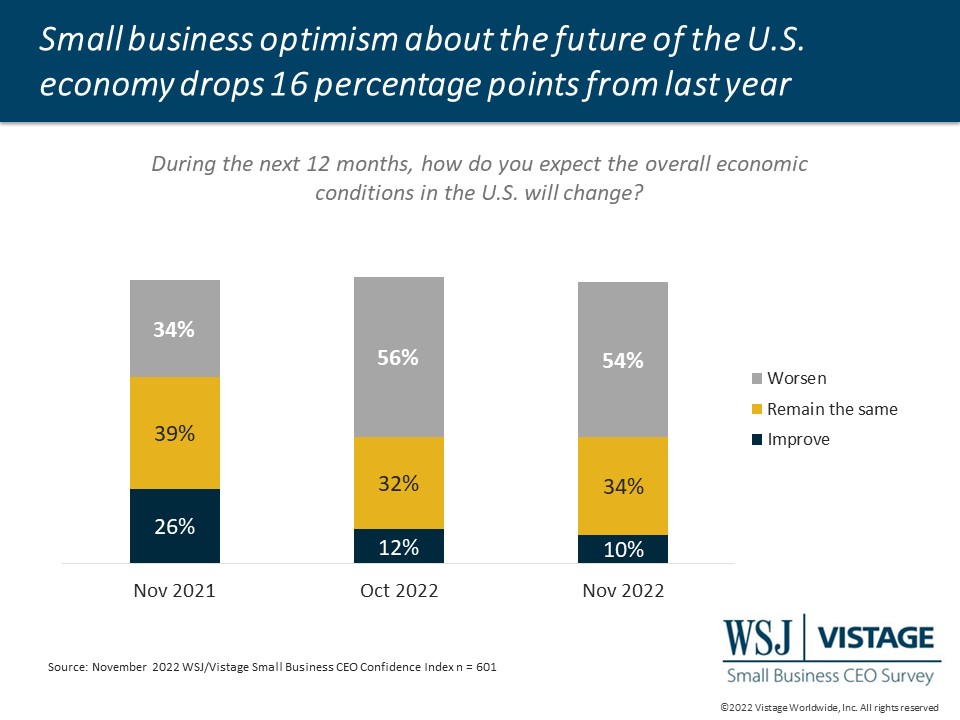

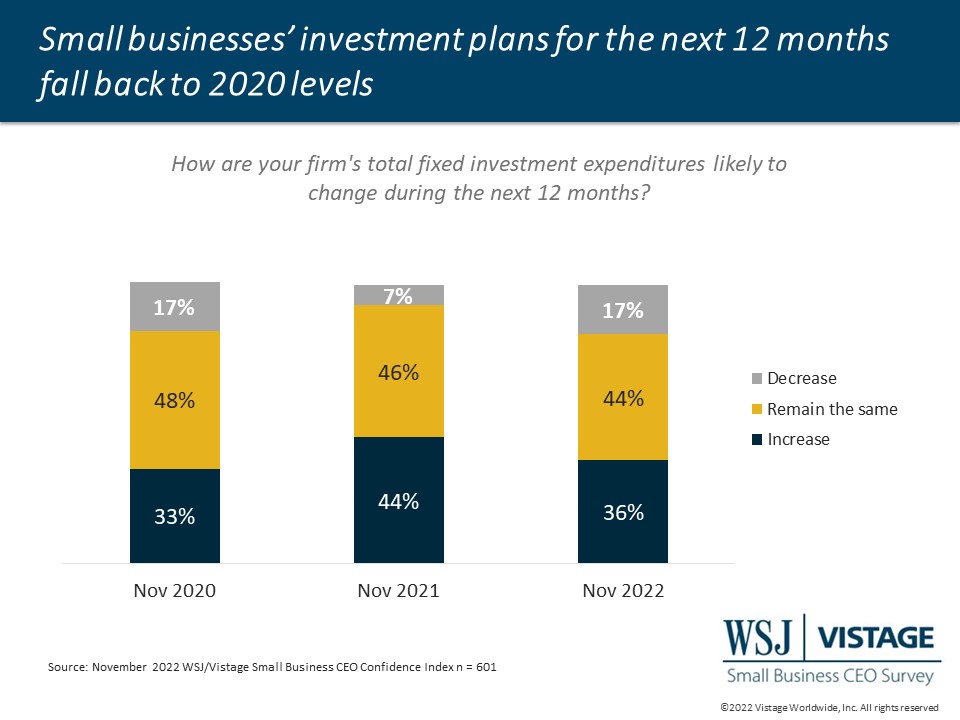

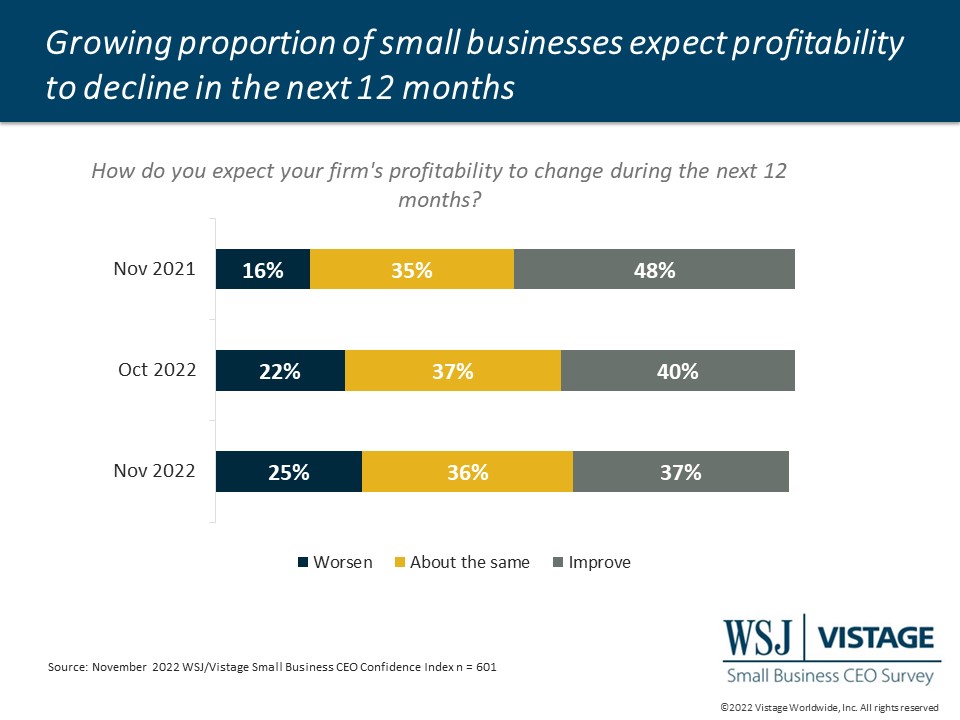

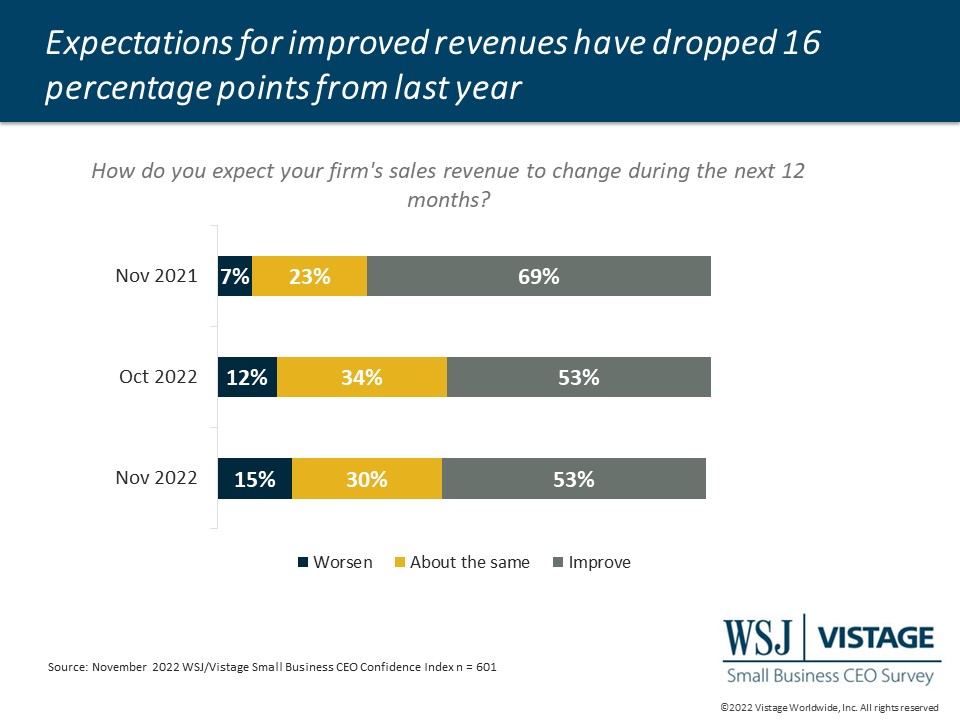

For the second month, there has been a marginal decline in the WSJ/Vistage Small Business CEO Confidence Index. While this decline was driven by a slight drop in profitability expectations and a mild increase in pessimism about revenues, the one factor that did not contribute to the decline was workforce plans.

Hiring remains stable

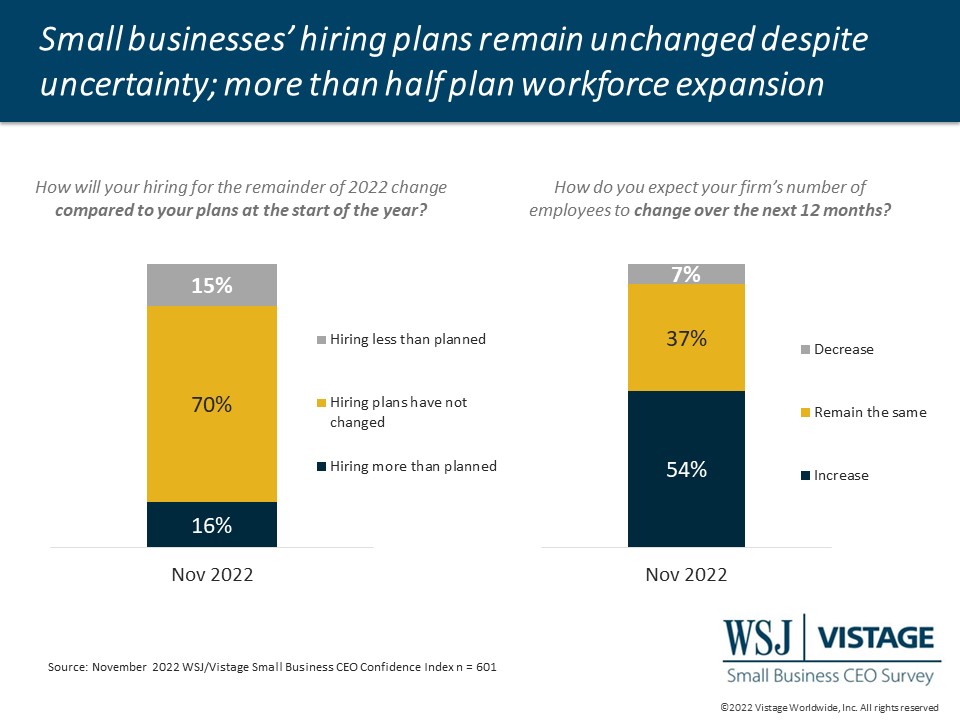

Operational challenges are still fueling the labor market with 59% of small businesses reporting that hiring challenges are making it difficult to operate at full capacity. Accordingly, 54% are planning to expand their workforce over the next 12 months and 37% report their workforce will remain the same. Small businesses are a solid contributor to the U.S. Bureau of Labor Statistics November report, which indicated that total nonfarm payroll employment increased by 263,000.

Not even the inflationary pressures of increased wages have thwarted hiring plans. Just 15% of small businesses are hiring less than planned, nearly matching the 16% that are hiring more than planned. The majority — 70% of small businesses — report their hiring plans did not change over the course of the year.

And the talent small businesses are seeking is not necessarily easier to find. Just 18% of small businesses report that it is easier to fill job openings than it was at the start of the year, while one quarter said it was more difficult. The 57% that report no changes are likely to be split in their sentiment; “no change” could mean that it is equally as difficult or equally as easy as it was at the beginning of the year. Finding qualified talent remains a top priority for small businesses as unemployment continues to hover below 4%.

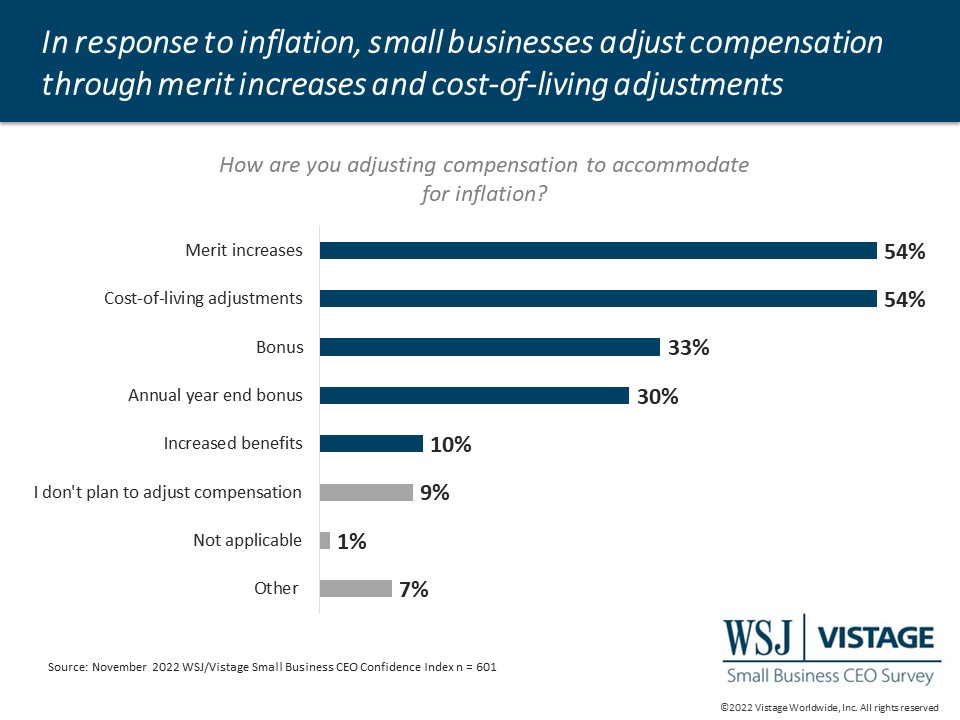

Rising costs of compensation

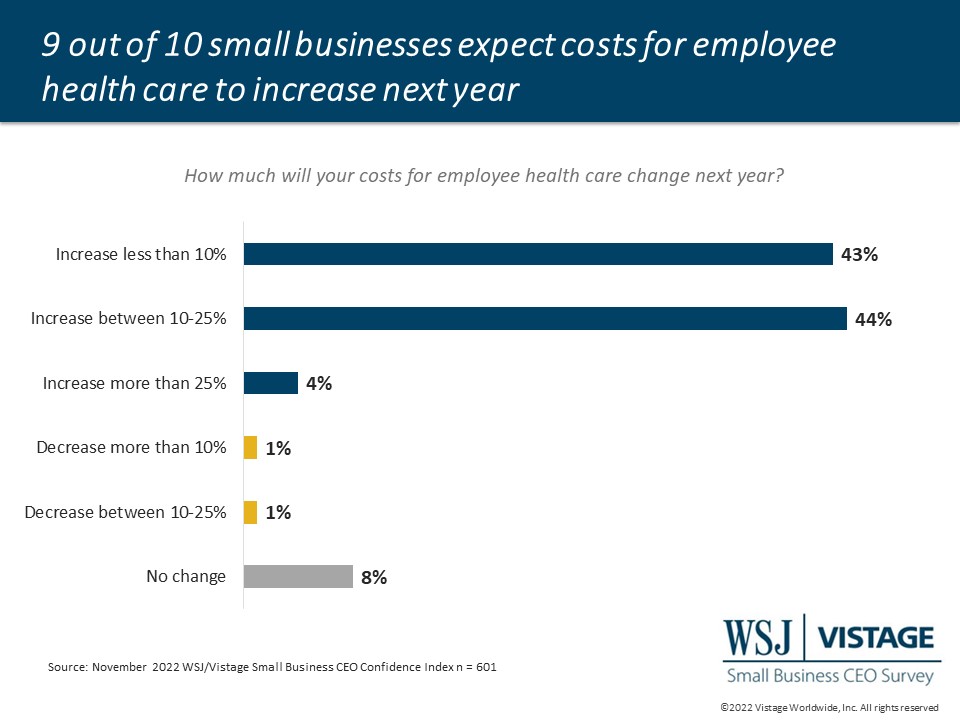

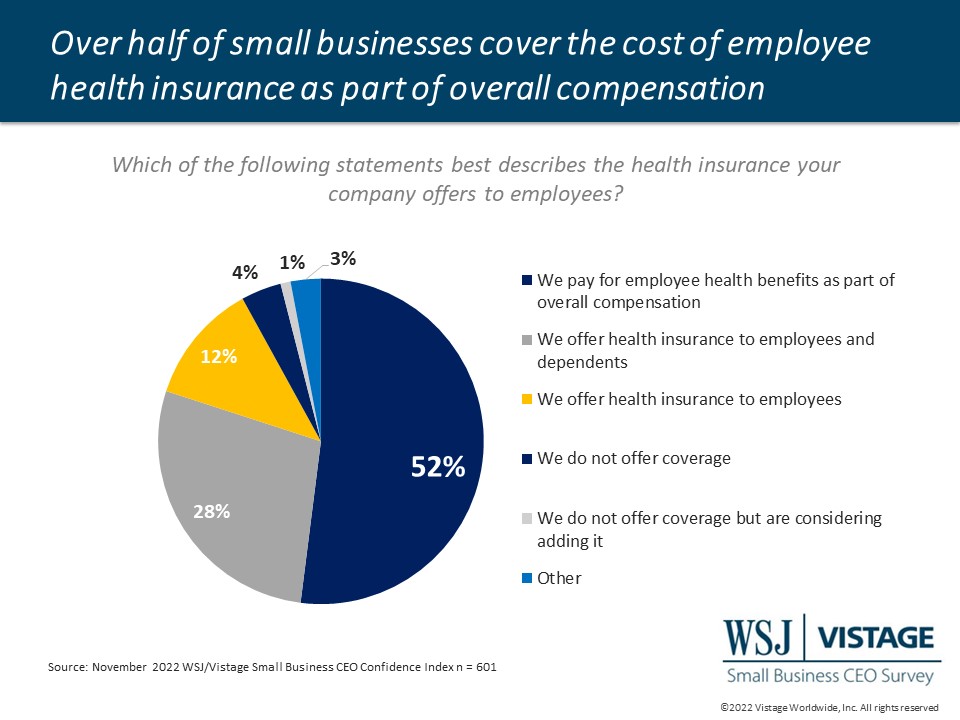

Wages and compensation have been the top inflationary pressure reported by small businesses this year. Part of that compensation equation includes the employee benefits that companies offer. In September, 46% of small businesses reported adding benefits, 13% were planning to add and 36% had already added benefits to better compete in a competitive labor market. In the November survey, we sought to understand small businesses’ approach to health insurance specifically.

Over half of small businesses report that they pay for employee health benefits, while an additional 28% offer health insurance to employees and dependents. 12% offer health insurance to employees only and just 5% offer no coverage. These benefits come at a cost that rises next year. 48% expect increases over 10%, and 43% expect increases of less than 10%. Just 10% expected costs to remain the same (8%) or decrease (2%).

Concern about recession holds amid interest rate hikes

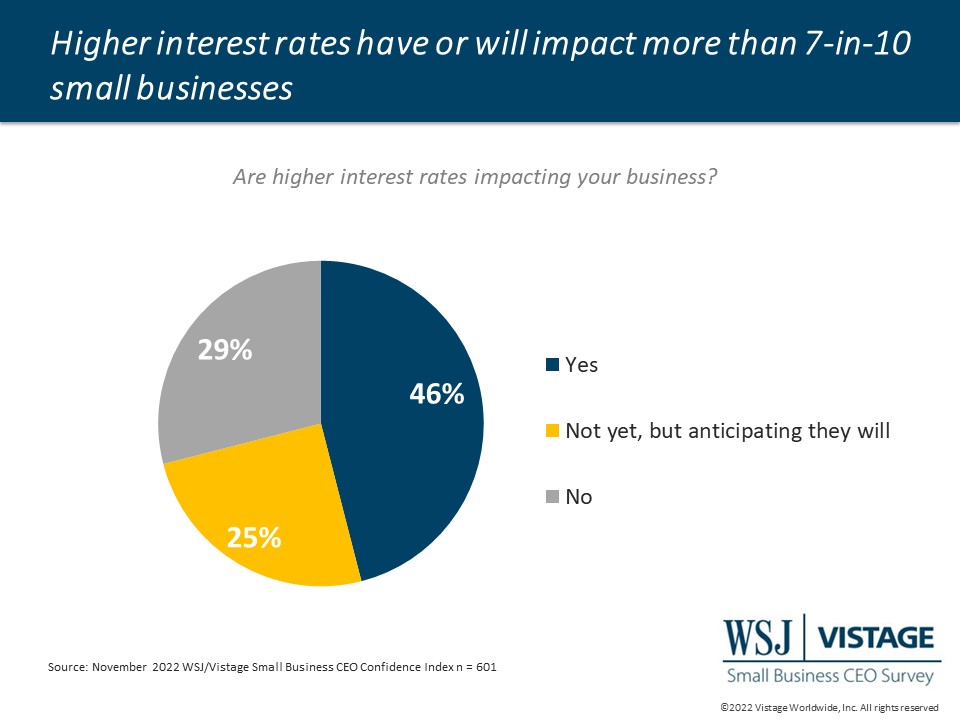

Other costs that are impacting revenues and profitability are rising interest rates. If the same loan costs more in interest today, that eats into profitability. Small businesses have experienced changes in customer demand, which are also likely driven by the conservative spending that has been brought on by interest rates. In November, 46% of small businesses reported impacts from interest rates — up marginally from 43% in October — and an additional 25% expect impacts in the future, up one point last month.

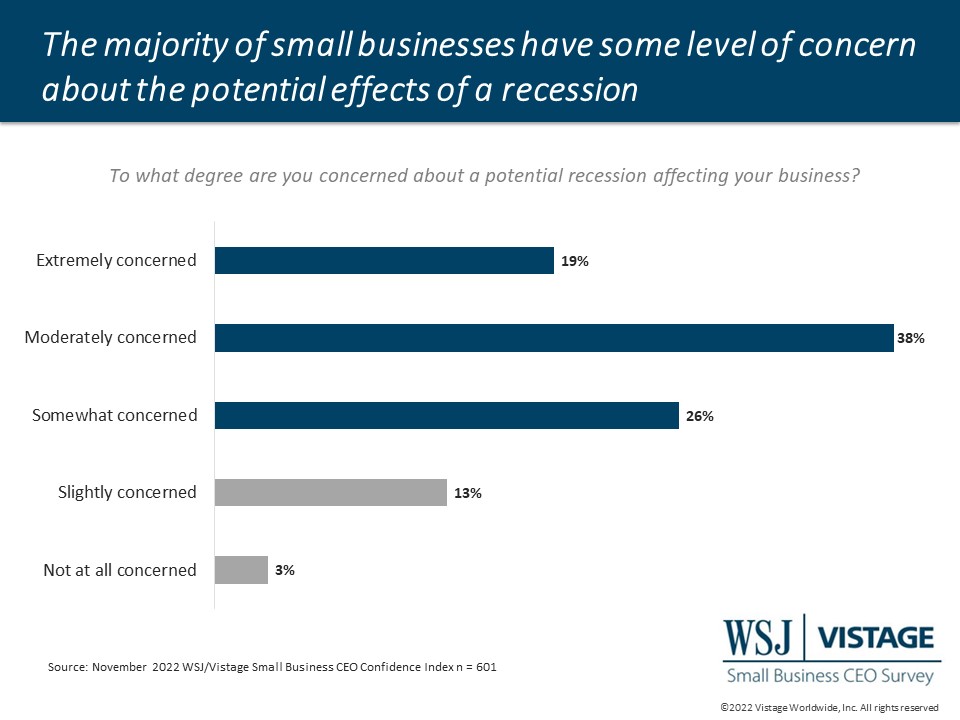

Even with rising interest rates and increased costs of benefits, small businesses are not significantly more concerned about a recession than last month. In November the proportion of small businesses extremely or moderately concerned about a recession ticked up one point to 57%, while those slightly to not at all concerned fell two points to 16%.

A strong labor market has been holding the official declaration of a recession at bay. While hiring has held steady over the past 6 months with an average of 53% of small businesses planning to expand their workforce while only 7% expect to reduce the size of their workforce, December’s survey will show if that bright spot continues to hold.

November Highlights:

- For the second consecutive month, the WSJ/Vistage Small Business CEO Confidence Index declined marginally, reaching 76.7 in November.

- Hiring holds steady at 54% of small businesses planning to expand their workforce in the next 12 months.

- More than 7-in-10 small businesses report the current or future effects of rising interest rates will impact their business.

- Nearly 6-in-10 small businesses (59%) report that the talent shortage has impacted operations.

Download the November report for complete data and analysis

For a complete dataset and analysis of the November WSJ/Vistage CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic:

DOWNLOAD NOVEMBER 2022 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD NOVEMBER 2022 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The November WSJ/Vistage Small Business CEO survey was conducted November 7-14, 2022, and gathered 601 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our next survey will be in the field December 5-12, 2022.

Category: Economic / Future Trends

Tags: Compensation, Hiring, WSJ Vistage Small Business CEO Survey