Tempered investments put small business confidence on hold [WSJ/Vistage Jan 2023]

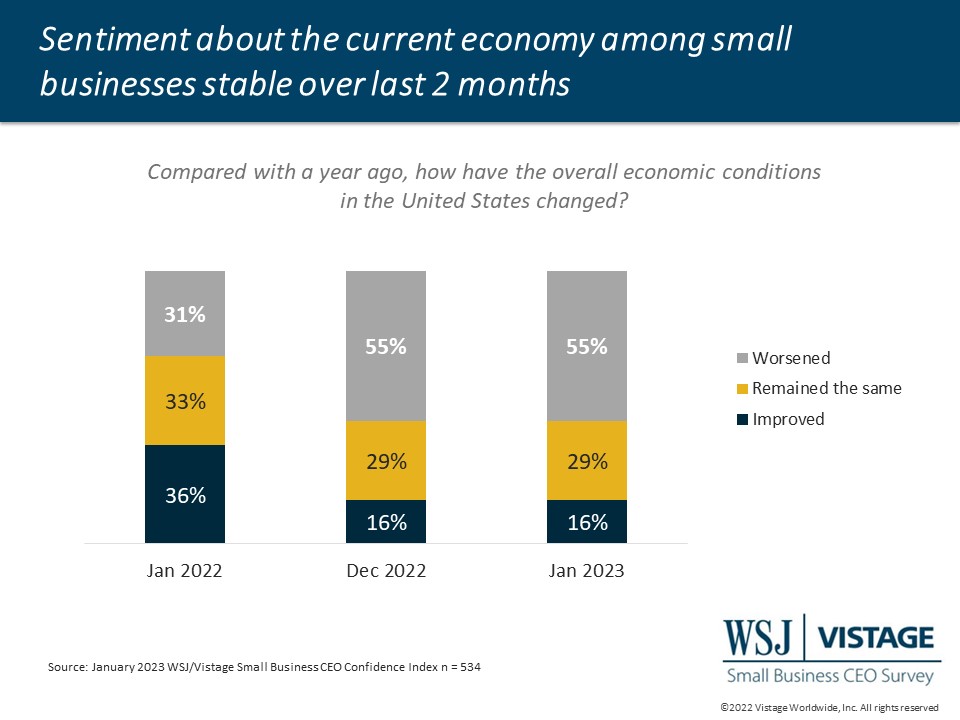

A looming recession hasn’t impacted spending as of yet with GDP rising 2.9% in the last quarter according to the latest report from the U.S. Bureau of Economic Analysis. Adding to consumer optimism, the January jobs report showed healthy growth, bucking projections of a decline.

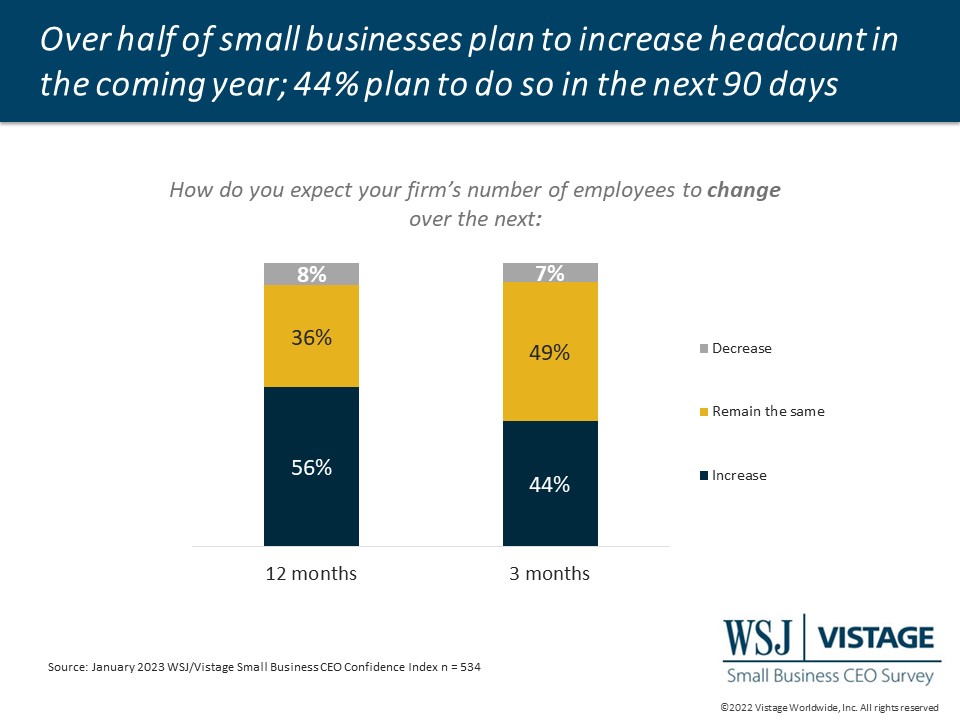

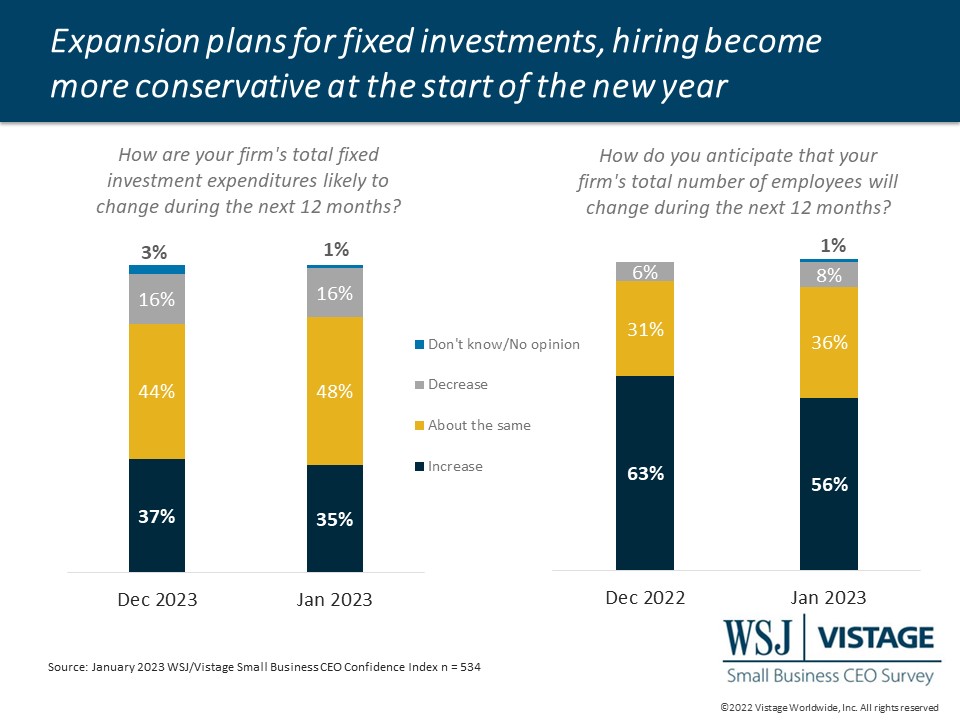

And for good reason. The start of the new year is often the start of new annual budgets and headcount requisitions as well. This healthy labor market was no doubt supported by small businesses; in the January WSJ/Vistage Small Business CEO Confidence Index survey, 56% reported plans to expand their workforce in the next 12 months.

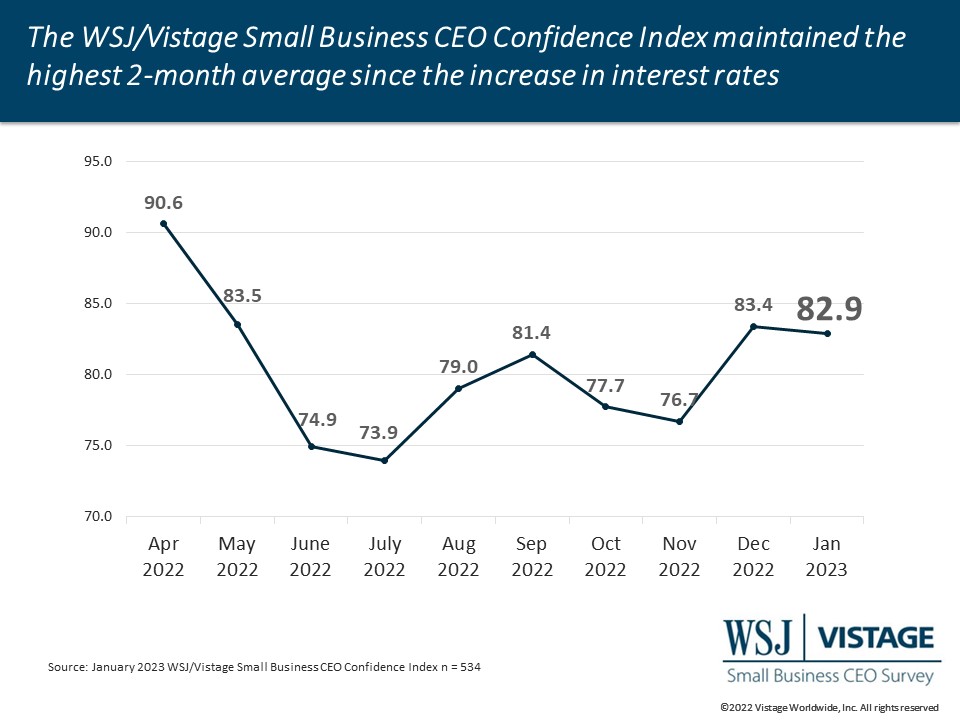

However, this is a 7-point drop from last month’s 63%. Plans for fixed investments have also fallen and more conservative hiring and investment plans are the driver of the negligible decline of the WSJ/Vistage Small Business CEO Confidence Index to 82.9 from last month’s 83.4.

Ease of hiring, strong engagement stabilizes workforce

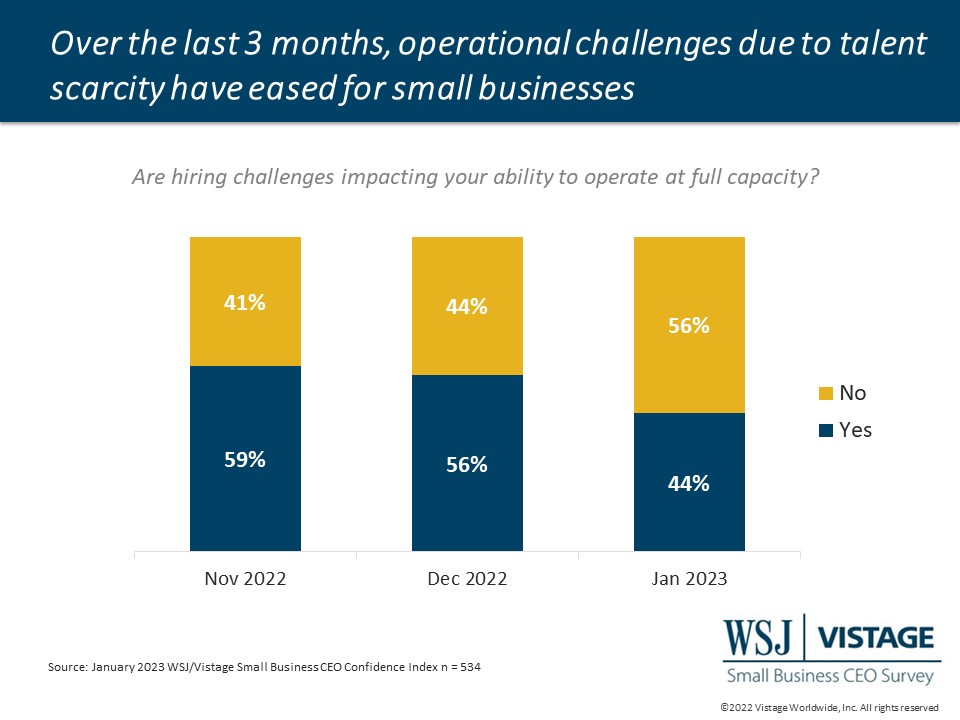

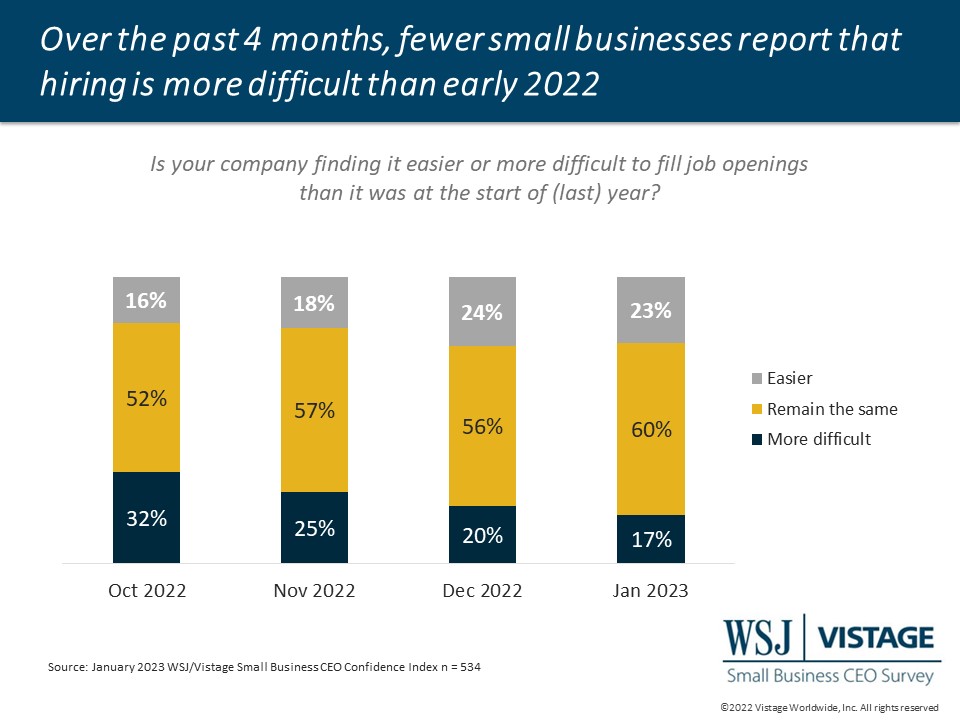

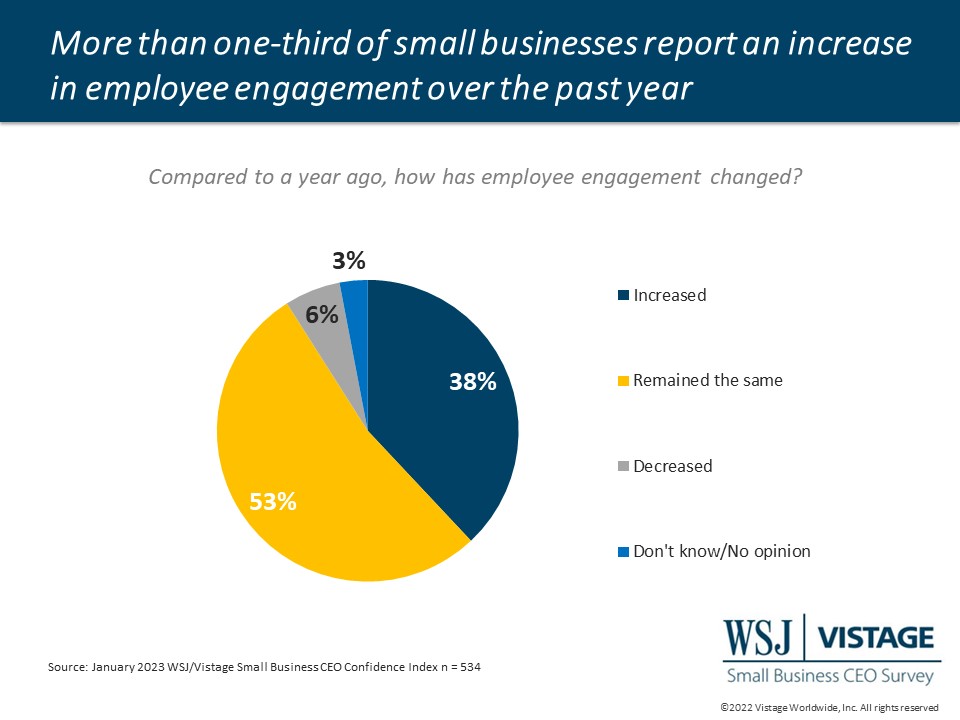

A key part of workforce expansion is keeping the current base of employees, and accordingly, engagement and retention have been a focus for small businesses. 38% report increased engagement, while just 6% report that engagement has worsened. Small businesses are finding it increasingly easier to find talent; 23% report that it is easier to fill job openings now than at the start of last year. Accordingly, over the last 3 months, there has been a 15 percentage point drop in small businesses that are struggling to operate at full capacity.

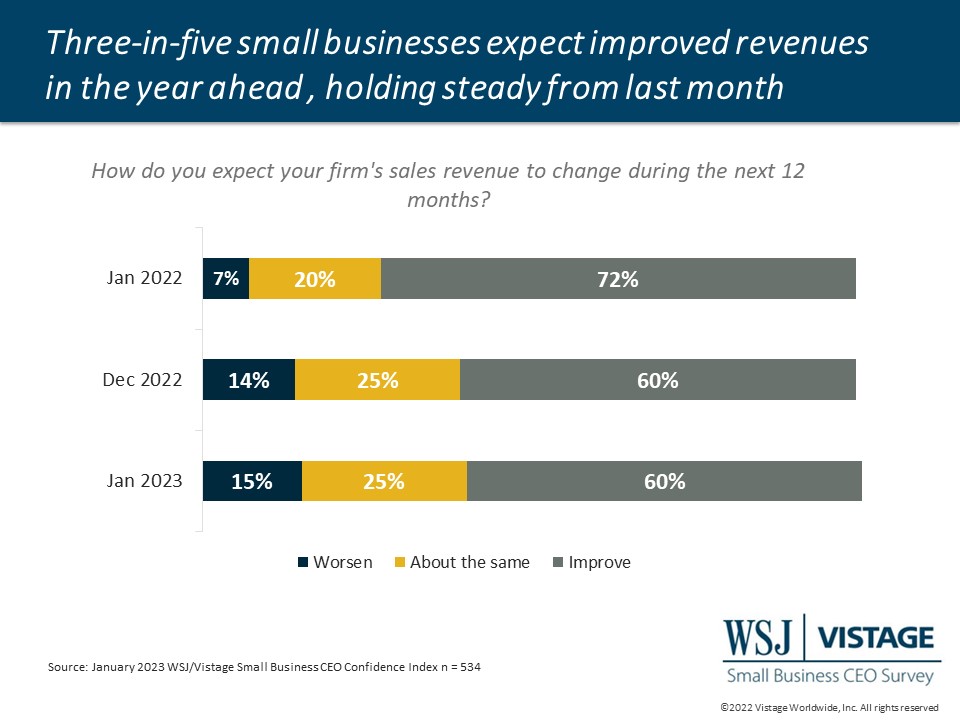

Not only does the new stable workforce help with operational challenges tied to current demand, but it also creates capacity for scalable growth. Looking ahead over the next 12 months, 60% of small businesses expect increased revenues.

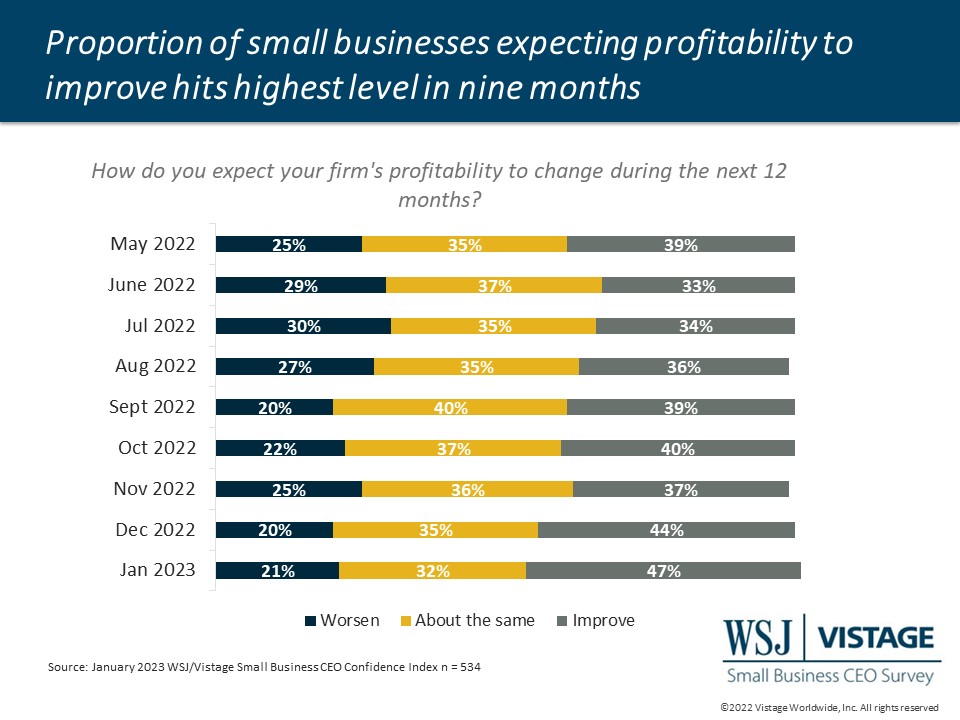

Moderating prices support profitability expectations

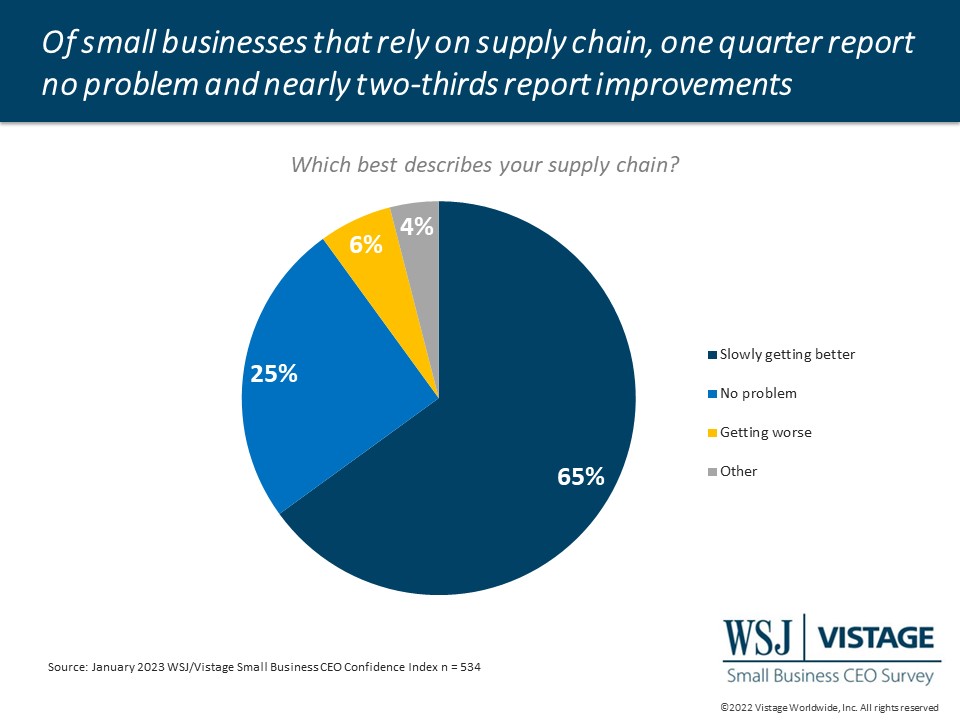

The rate of inflation has eased, with the most recent reading of 6.5% representing the sixth consecutive month of decline. Last month’s survey revealed that prices were increasing at a slower rate, which is evidenced by a greater proportion of small businesses expecting improved profitability; 47% of small businesses expect improved profitability — the highest level in nine months. Supply chain woes have dissipated greatly with over 90% of small businesses reporting either improvements or no problems.

Sadly, the healthy labor market recording a low of 3.4% unemployment means that the Federal Reserve is not likely to back down on raising interest rates. While the Fed sees some signs of inflation cooling, one of the uncertainties small businesses have is how to best manage their investments and remain competitive in the job market.

January Highlights:

- The WSJ/Vistage Small Business CEO Confidence Index declined a point to reach 82.9 in January, based on more modest investment plans

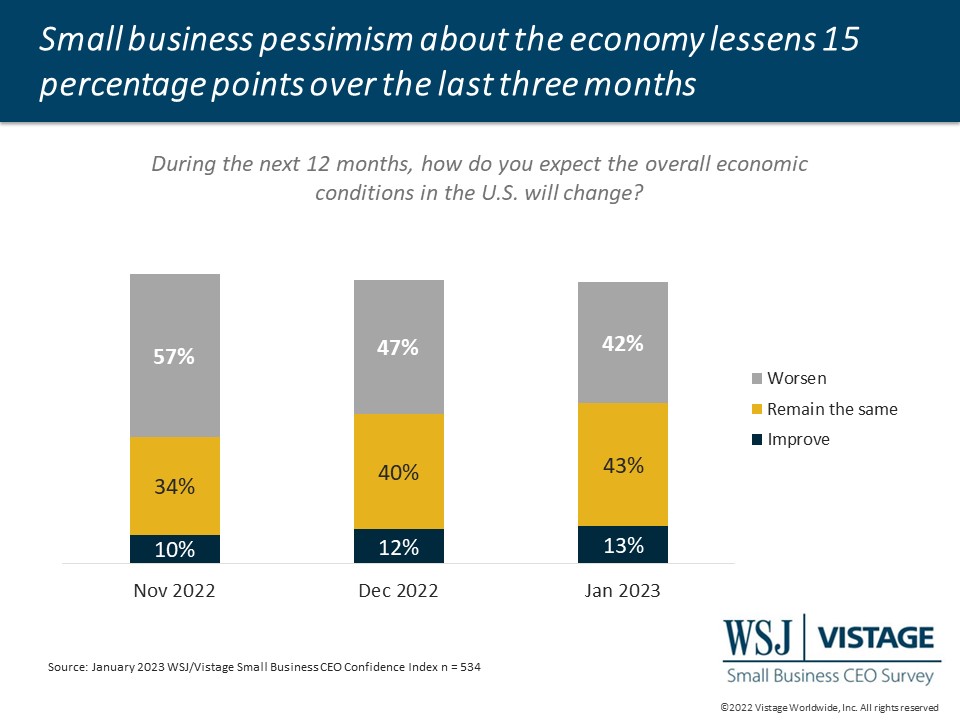

- Pessimism about the future of the U.S. economy declines 14 points since October

- Of those small businesses dependent on supply chain, 25% report it is no problem, and 65% report slow improvements

Download the January report for complete data and analysis

For a complete dataset and analysis of the January WSJ/Vistage CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic:

DOWNLOAD JANUARY 2023 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD JANUARY 2023 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The January WSJ/Vistage Small Business CEO survey was conducted January 9-16 and gathered 584 responses from CEOs and leaders of small businesses. Our next survey will be in the field February 6-13, 2023.

Category: Economic / Future Trends

Tags: profitability, supply chain, workforce expansion, WSJ Vistage Small Business CEO Survey