Past the peak of the economic surge [Q3 2021 CEO Confidence Index]

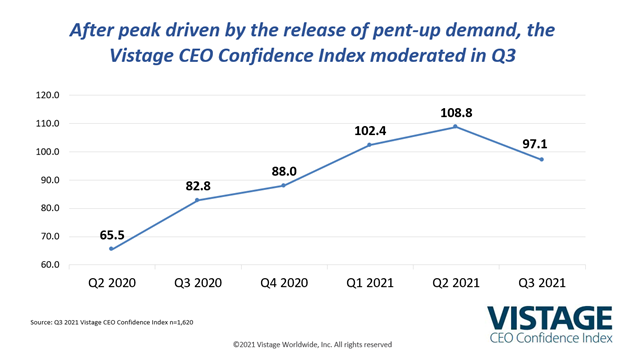

Strike a match and it flames brilliantly, then settles into a steadier flame. That metaphor best describes the state of the economy and the sentiment of 1,620 CEO respondents to our latest survey as they look ahead to the balance of 2021. After peaking at 108.8 in Q2, the Vistage CEO Confidence Index backed off to 97.1 in Q3. This moderation in confidence is driven mostly by the passing of the economic surge in the first half of the year — the proverbial striking of the match — that has settled into the steady flame of realistic expectations for future economic growth.

Decelerating growth best captures CEO sentiment captured in the Q3 Vistage CEO Confidence Index. While still growing above 2018-19 levels, the economy can’t sustain the surge experienced in the first half of the year that was driven by pent-up consumer demand, government stimulus and the rapid adoption of the COVID-19 vaccine by growing segments of the population. Headwinds soon appeared in the form of inflation, talent scarcity, supply chain hardships, and now the COVID-19 Delta variant has further slowed growth by eroding confidence and further complicating decision-making.

Trees don’t grow to the sky. The lofty optimism of Q2 has given way to healthy, but more realistic levels. In Q3, 68% of CEOs reported expectations for increased revenue in the year ahead, and 50% expect increased profits. While this is down from Q2 by 10 and 7 points respectively, the revenue expectations remain healthy while profitability is taxed by rising costs that can’t be offset by price increases. When business is good and projections for the future indicate further growth, increases in investments and head count follow. Nearly half (47%) of CEOs are planning to increase fixed investments in the year ahead. Hiring also stayed strong with 66% of CEOs reporting plans to increase headcount.

Hiring challenges plague small and midsize businesses

Human capital is the fossil fuel of the growth engine, and fuel that is harder to come by and more expensive than ever. Over two-thirds (67%) of CEOs said that hiring challenges are impacting their ability to operate at full capacity, up 5 points from Q2. The pressure to retain existing workers is intense as more than a quarter (27%) of CEOs report decreased retention rates since the beginning of the year. Replacing a lost worker will take longer and cost more than ever, resulting in a productivity drain until someone can be hired and trained. Our analysis showed there is a direct correlation between retention rates and revenue; those with higher retention rates reported stronger revenues through the pandemic. The competition for new employees is no less intense as small and midsize businesses hiring at all levels from the front line to the executive team. Today, 65% of CEOs are investing in automation to reduce the labor burden on their product or service. This doesn’t necessarily mean robots replacing people, but intelligently applying technology to repeatable tasks and improving individual productivity.

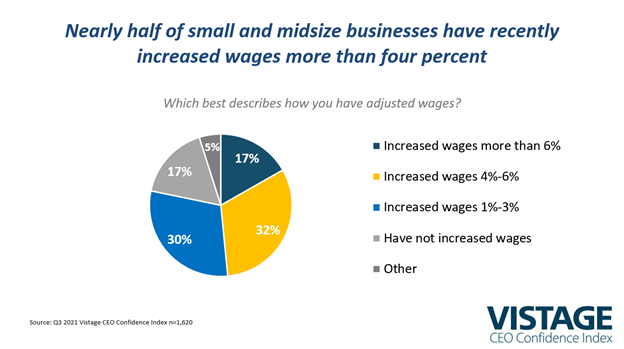

Cash is king, especially when it comes to hiring. In response to challenges hiring 63% of CEOs are boosting wages and 21% are tossing in hiring bonuses. A contributor to inflation, rising wages are the result of low supply and high demand for workers. Workers at all levels are not willing to accept a return to 2019 incomes when there are opportunities and options available to them. When looking at wage increases, 26% of CEOs have increased wages 4-6 percent with another 13 percent increasing them even more. While money always matters, there are other tactics CEOs can utilize to retain and attract workers.

Employee development not only improves the productivity — and loyalty — of existing employees but is a competitive differentiator for prospective new hires. Employee and leadership development programs demonstrate a commitment and investment in team members. More than onboarding and job-specific skills, professional and leadership development programs allow employees to continue their professional growth and challenge their capabilities. Beyond the productivity gains of training, wellness programs can enhance the lives of workers. Consider creating a personal development plan for each worker and have managers review it regularly. This will establish a comparative baseline when they think about leaving. Use the same framework for prospective employees and ask them to compare what’s available at their current job. For greater insight, review our research report, Employee Development, The CEOs Competitive Advantage.

New complications for return-to-workplace plans

The explosion of the COVID-19 Delta variant has forced many CEOs to reconsider their back-to-office plans. Many companies targeted the start of September as a time to begin to bring workers back before the Delta variant surged in mid-July. The intensity of the outbreak has made many reconsider delaying until later in the fall or 2022 for a full return. In the interim, many remain at the office and others attend on occasion. CEOs report various changes in response to growing cases; 41% have updated their mask policy because of the Delta variant. 28% have changed return-to-work dates and 23% have rethought their vaccine policy.

Mask policies have evolved over the last 6 months as we went from the promise of vaccinations in April to the confidence of mid-summer to today’s worries about the intensity and duration of the current spike in cases.

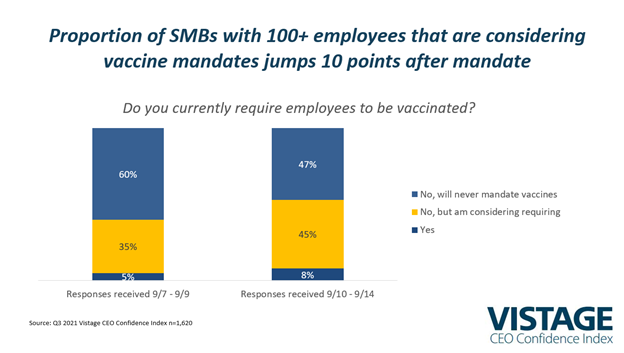

Even more challenging are decisions regarding vaccine mandates. Just 9% of CEOs report they are currently mandating vaccines, 36% are considering their vaccine requirements and 56% said they would never mandate vaccines. On September 9, in the middle of the survey period, the Biden administration stated they would require all employers with more than 100 employees to mandate employees be vaccinated or be tested weekly. Analysis of responses over time from CEOs with more than 100 employees saw a shift in their vaccine policies. While the proportion of respondents who answered “yes” increased 3 percentage points, the proportion of those who responded “No, never” response dropped 13 points, and those considering a vaccine requirement grew by 10 points.

CEO considerations for vaccine policies

To gain greater insight into the thoughts of our community on vaccines, we asked respondents to share more details on their approach to vaccines for their workplace in an open-ended question. The results spanned a spectrum of opinions ranging from “No vaccine, no job” to “I will never mandate a vaccine.” For 7% of respondents, it’s not an issue as they are either fully remote or are already 100% vaccinated, but the others shared a range of responses that captures the unprecedented nature of the decision CEOs face.

One-quarter of CEOs stated it was a personal choice and they did not want to mandate what employees should put in their bodies; it is a personal decision for each individual and their healthcare professional. There were some very obvious political responses to the personal choice decision, and several CEOs expressed concern about the legal liability of mandating vaccination in absence of a government/OSHA requirement.

Another 25% said they would not mandate but strongly encourage/encourage employees to get vaccinated. Education, awareness and even on-site vaccinations were supported by this group. There were several comments regarding incentives. Bonus paid based on the total company vaccination rate, individual bonuses, time off for testing, etc. There were also some punitive comments about increasing healthcare costs to the unvaccinated or forcing them to take PTO if infected. A couple even suggested they were “easing” the unvaccinated out of the business.

At around 10%, two responses were common. “If not vaxxed, then masked or be tested” and “will comply with OSHA/CDC.” A vaccinated or mask/test represents a middle ground that both vaccinated and non-vaccinated can live with while defaulting to CDC guidelines takes pressure and responsibility off CEOs.

The next grouping at 6-8% said “I will mandate”, “it’s a customer requirement” and “turnover concerns.” There were caveats for religious, personal health issues (pregnancy or immunocompromised) or if people were working exclusively from home, thereby mitigating the requirement. There were also different sets of rules for new hires and mandates for those who work with or routinely visit customers, depending on customer requirements. Genuine concerns regarding turnover and the difficulty in replacing lost workers were already a strong influence for this group. In an environment where 67% of CEOs say the talent scarcity is impacting their ability to operate at full capacity, this becomes a perilous decision. The questions of vaccines — both pro and con — adds more energy to that equation as people both pro and anti-vaccination will align with a business that aligns with their beliefs.

Summary: There is no right answer to vaccine mandates. No one has ever had to face this type of decision before. No guidelines or best practices exist. There is no clear path. Each CEO must make the best decision they can for their organization balancing personal beliefs, leadership demands and business realities. The question of mandates will continue to be politicized , further complicating and obfuscating the issue for all.

CEOs need to carefully consider their decision and its impact on their workforce both as a cultural component and workplace dynamic. Only time will tell if they made the right call and how that will ultimately impact the fate and fortune of their business.

Related Resources

Category: Economic / Future Trends

Tags: CEO Confidence Index, coronavirus, Hiring, revenue