Inflationary pressures stall optimism for small businesses [WSJ/Vistage July 2021]

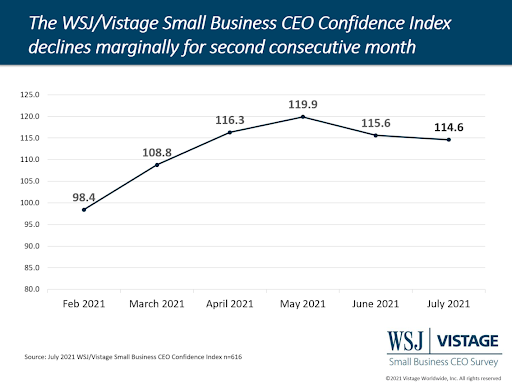

Optimism among small businesses has plateaued, according to the most recent WSJ/Vistage Small Business CEO survey. This finding matches the latest GDP growth rates, which were healthy but lower than forecast. The July WSJ/Vistage Small Business CEO Confidence Index dipped marginally to 114.6 in July, however this is the second consecutive month of decline after reaching a peak in May.

Cresting the wave of growth

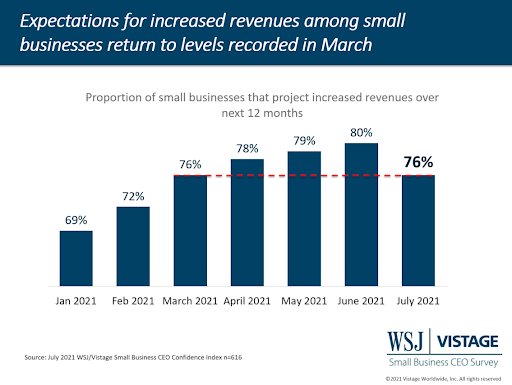

While all components of the Index remain strong, the largest month-over-month change was in revenue expectations over the next 12 months, which decreased 2.8% returning to levels recorded in March. The data indicate that small businesses have crested the current wave of growth and are waiting for the next wave to surge.

Fighting the currents of inflation and supply chain

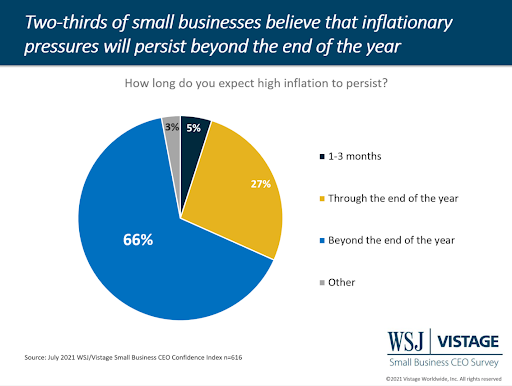

The reason for the softening in revenue projections can be attributed to a variety of factors that impede progress. Last month we learned that hiring challenges were impacting small businesses’ ability to operate at full capacity. This month’s survey reveals that continued inflationary pressures are contributing as well; two-thirds of small businesses report expectations that inflation will persist beyond 2021.

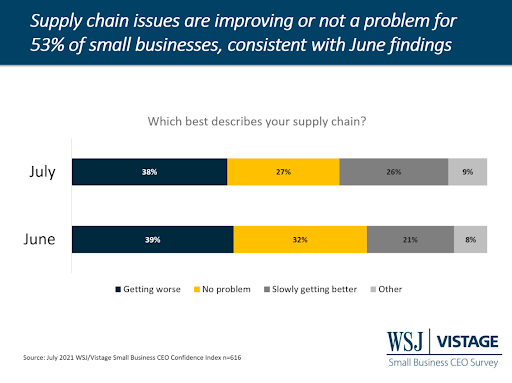

Supply chain issues are slow to improve as projected, with 38% of small businesses reporting worsening problems – on par with last month – and 27% reporting no change. Supply chain challenges have downstream effects, impacting some businesses directly and others indirectly. While this is likely to resolve itself with time, one challenge that continues to plague all small businesses is the rising cost of wages.

Wage pressures swell with hiring plans

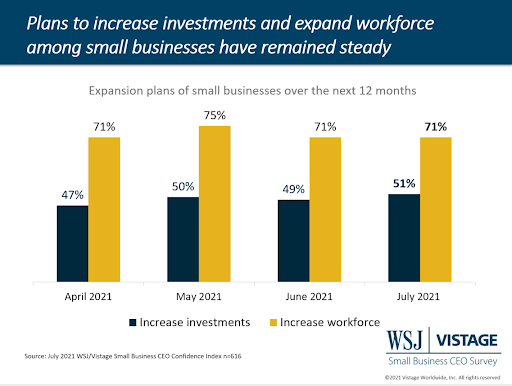

Despite the persistent inflationary pressures projected to last through the end of the year, the proportion of small businesses that plan to increase their workforce and fixed investment spending has held steady over the past 4 months, indicating they continue to look ahead past the current challenges and prioritize investments in the future to capitalize on projected growth.

More than 7-in-10 small businesses are investing in expanding their workforce, and the impact to their bottom line is compounded by the need to increase wages to attract new talent. But rising wages impacts even the 26% of small businesses who plan to maintain the size of the current workforce as boosting wages might be required to retain existing employees as well as replace those that leave. According to Dr. Curtin, a researcher from the University of Michigan who analyzed the data, “Post-pandemic hiring will face shifts in the types of jobs workers prefer and wages they will demand.”

Adjusting to changing currents

The impacts of the Delta variant of COVID-19, new CDC recommendations, and reinstatement of mask mandates in certain regions are bringing new uncertainty into planning for the future. Short term, this will require small business leaders to reconsider their return to work plans, how their hybrid model will function and review practices required to keep employees and customers safe. Long term, we can look to the data from India and the UK to see how this latest surge is projected to resolve, and monitor whether additional variants might add to the uncertainty.

Download the July report for complete data and analysis

For the complete dataset and analysis of the June WSJ/Vistage CEO Confidence Index survey from Dr. Richard Curtin, download the report and infographic to learn more, including:

- Optimism about recent improvements to the economy

- Strong investment and hiring plans remain stable

- Revenue and profit expectations rise slightly

DOWNLOAD JULY 2021 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD JULY 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The July WSJ/Vistage Small Business CEO survey was conducted June 6-13, 2021 and gathered 616 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our July survey, in the field August 2-9, 2021, will capture sentiment of small businesses as restrictions and mask mandates re-emerge.

Category: Economic / Future Trends

Tags: Economy, inflation, revenue, supply chain, WSJ Vistage Small Business CEO Survey