Record-setting expectations for the economy propel small business growth projections [WSJ/Vistage March 2021]

Spring signifies new life, which has an entirely new context as we emerge from a year of shelter-in-place orders and restrictions. While COVID-19 spikes, variants and vaccine distribution challenges still cast shadows, those grey clouds are not long in the forecast as new phases of vaccine eligibility come into play and relief payments hit bank accounts. The positive effects of vaccine distribution and stimulus funds have gone from buds to blooms quickly, providing tangible evidence that we are accelerating through this time of transition.

DOWNLOAD MARCH 2021 WSJ/VISTAGE SMALL BUSINESS REPORT

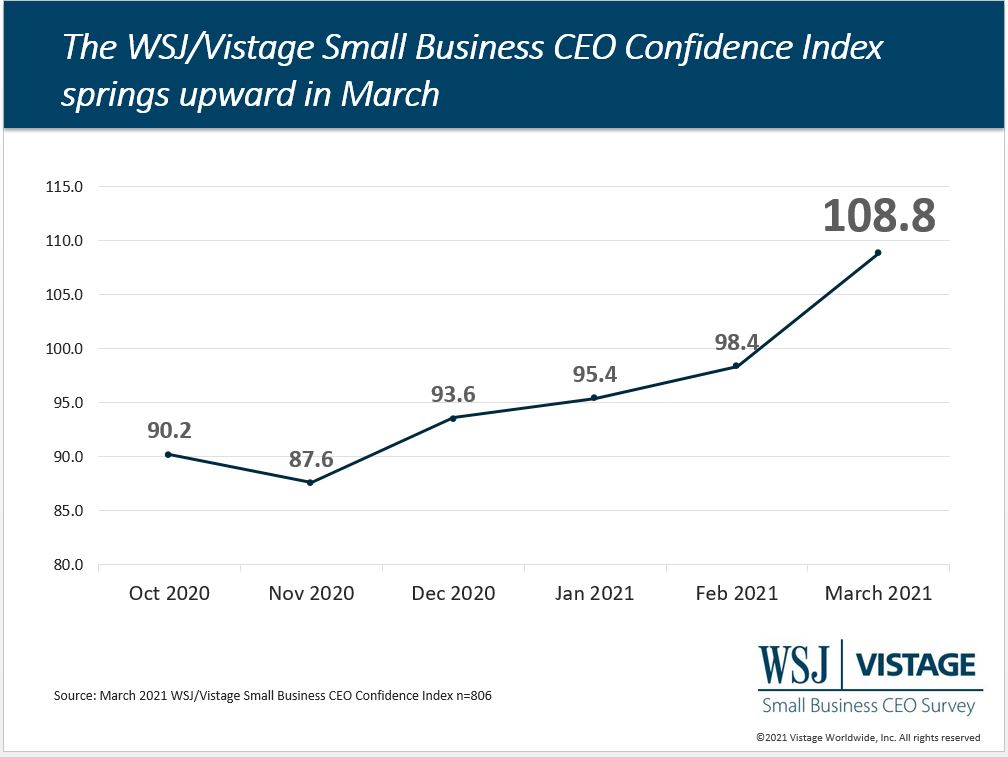

These “signs of spring” are propelling small businesses forward, as evidenced in our latest survey. The March WSJ/Vistage Small Business CEO Confidence Index leapt upward, growing over 10 points from last month to reach 108.8. This is also a gain of 18% year-over-year, which is the most significant increase since February of 2017.

DOWNLOAD MARCH 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

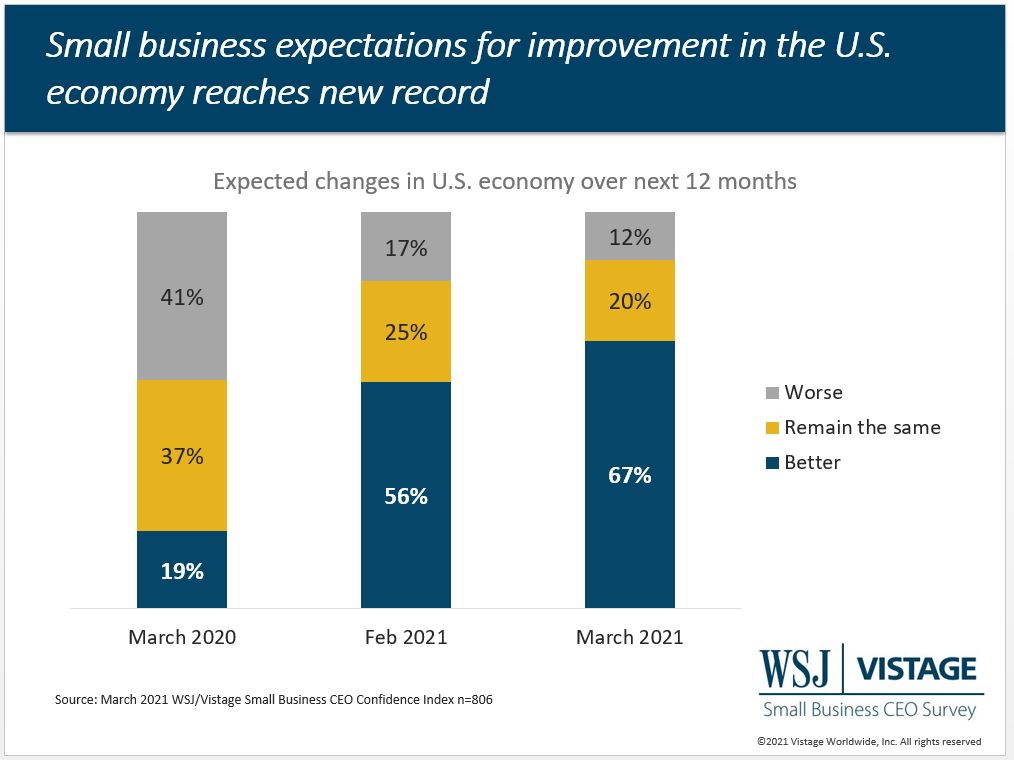

While all six factors that comprise the Index improved from both last month and last year, the most significant driver of the monthly gain is the increase in positive expectations for the economy over the next 12 months. Over two thirds (67%) of small businesses expect the economy to improve in the next 12 months, a 9-point increase from last month and the highest level recorded since the survey began in 2012.

Projected economic growth creates demand

The record-setting sentiment among small businesses about their expectations for the economy is also reflected in their projections for their business. Over three quarters (76%) of small businesses expect increased revenues in the year ahead, returning expectations to pre-pandemic levels recorded in February 2020 before the pandemic. Profit expectations follow suit, with 61% of small businesses expecting increased profits in the year ahead, a 4 point gain from last month.

The momentum created by stimulus funds and lessening restrictions is clearly having a positive effect on small businesses. As they anticipate the full reopening of the economy, CEOs will have to invest to keep up with demand. Over two-thirds of small businesses report plans to expand their workforce in the next 12 months. To be able to find the talent needed to meet their growth expectations, it is critical that small businesses evaluate and refine their hiring and retention practices now to be competitive, moving from a hiring mindset to a recruitment mindset. This shift looks beyond filling open positions and looks for the people essential to long term growth.

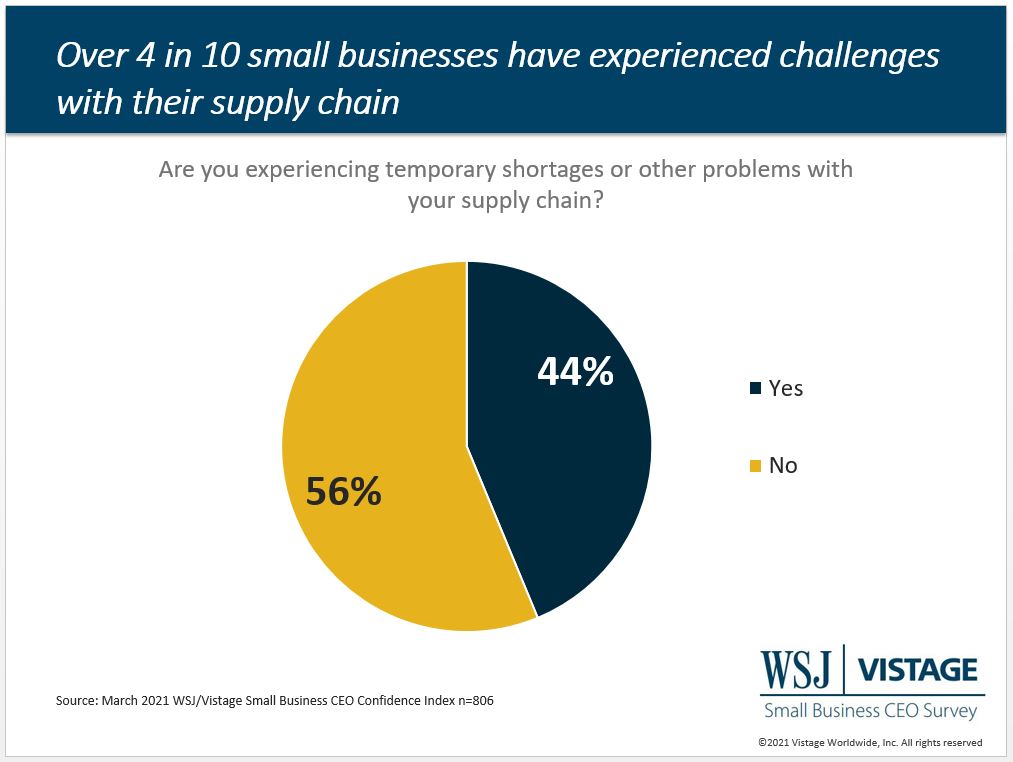

While finding and keeping talent is a challenge facing all small businesses, those segments that rely on a supply chain – including manufacturing and construction – are experiencing specific disruptions that will impact their ability to fully capitalize on the projected economic surge.

Supply chain disruptions challenge growth for specific segments

Last March, our survey found that 30% of small businesses were negatively impacted by tariffs, many of those impacted in the same verticals of manufacturing and construction. Now in 2021, supply chain problems have become a leading challenge; 44% of small businesses reported that they are experiencing temporary shortages or other problems – including rising costs of raw materials – with their supply chain.

Beyond the need to adjust pricing in the short term, CEOs of small businesses need to review customer demand and their product portfolio to ensure a viable long term approach in the face of inflation. Just 9% of small businesses indicated that they are adjusting the supply chain to reshore vendors and suppliers, a figure that will likely grow if supply chain problems persist. While these issues are specific to certain industries, as increased costs are passed on to consumers, all segments will feel the pinch of inflation.

With the rising cost of raw materials, CEOs in impacted industries face the choice of absorbing costs and the negative impacts on profitability, or passing the costs on to the consumer through price increases. In the December 2020 WSJ Vistage Small Business survey, 40% of small businesses reported plans to raise prices in 2021, a figure that is likely rising as costs become a bigger challenge.

Despite these challenges, Dr. Richard Curtin, a researcher from the University of Michigan who analyzed the data states there is “convincing evidence that a strong economic rebound is well underway.” Acknowledging rising costs, Curtin anticipates that “small businesses will pass these input price increases to their customers, with the knowledge that as competition returns, part of those increases may prove to be temporary.”

Download the March 2021 WSJ/Vistage small business report for complete data and analysis

For the complete dataset and analysis of the March WSJ/Vistage CEO Confidence Index survey from Dr. Richard Curtin, download the report and infographic to learn more, including:

- Optimism about the current economy doubles from last month

- Investment and hiring plans continue to rise

- Revenue and profit expectations rise slightly

DOWNLOAD MARCH 2021 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD MARCH 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

Related links

- About the WSJ/Vistage Small Business CEO Survey

- Interactive data from WSJ/Vistage Small Business survey

|

Survey Methods The March WSJ/Vistage Small Business CEO survey was conducted March 1 – 8, 2021 and gathered 806 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our February survey, in the field April 5 – 12, 2021 will capture sentiment of small businesses as vaccines accelerate and stimulus funds hit the economy. |

Category: Economic / Future Trends

Tags: Challenging Times Business Strategies, coronavirus, Small business, US Economy, WSJ Vistage Small Business CEO Survey