The first steps of the hard climb to recovery begin

Anyone who has completed the Empire State Building Run-Up competition will you tell the first 20 flights of stairs are the easiest and quickest. From there the rest of the 86 floors get progressively more difficult to climb, physically, mentally and emotionally.

The climb to recovery for small and midsize businesses (SMBs) is underway according to 1,392 CEOs who responded to the Q2 Vistage CEO Confidence Index survey. Analysis of Vistage survey data from the last 3 months illustrates that CEOs believe that the economy has taken the first steps toward recovery. SMBs are focused on getting their business up the first 20 flights of stairs; the most grueling part of the climb remains ahead.

At a glance: Q2 CEO Confidence Index survey results

The Vistage CEO Confidence Index plummeted to 65.5 in Q2 2020; there have only been two other times in the history of the survey – in the depths of the recession – that the Index was recorded so low. But data from this survey shows that business activity – driven by reduced quarantine levels – has picked up dramatically.

Our survey revealed that 18% of small and midsize businesses (SMBs) have recalled employees who were working remotely, and another 31% have begun a phased approach to bring employees back to the office.

The Paycheck Protection Program (PPP) – leveraged by 80% of our respondents – have helped SMBs maintain payrolls. Of those that received loans, 54% reported plans to maintain their workforces after the funding period, and another 9% plan to increase headcount. Most significantly, 54% of CEOs agreed or strongly agreed that they have seen an increase in customer activity, compared with just 22% who disagreed or strongly disagreed.

Revenue rebirth, rising expectations

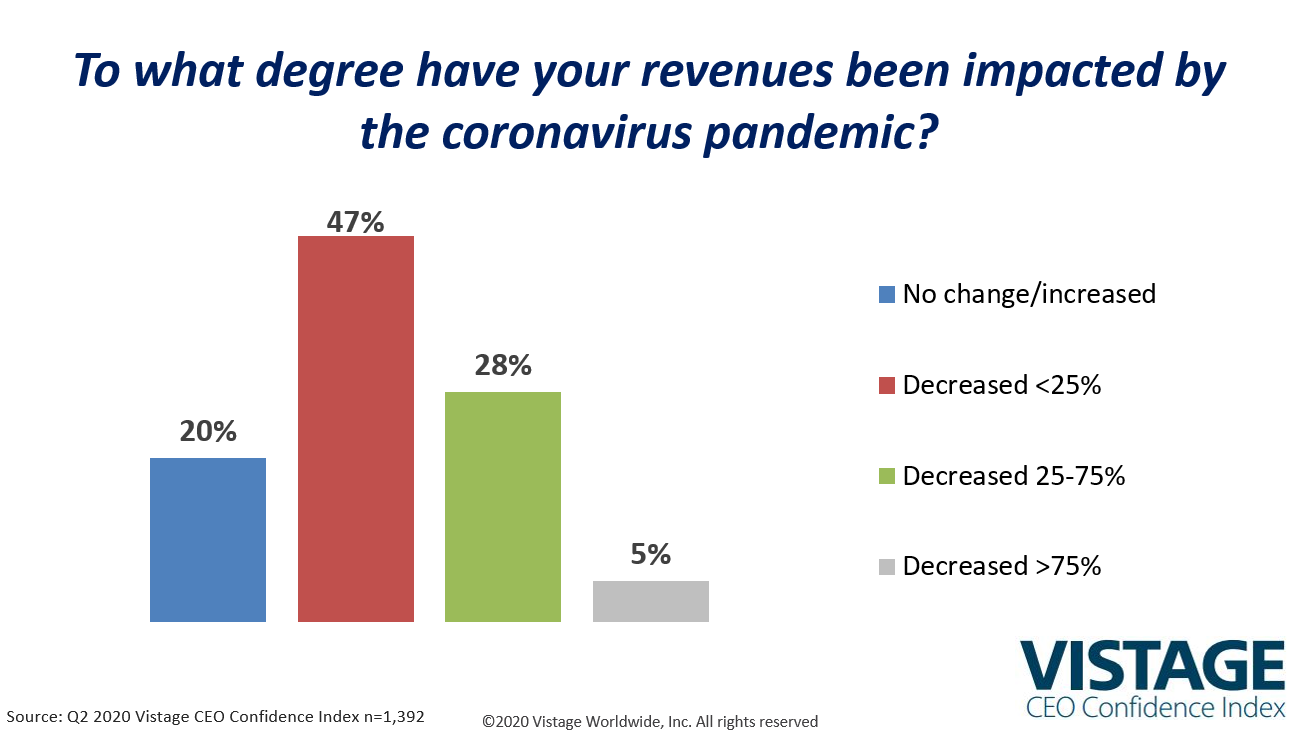

With the increase in business activity comes the first signs of revenue returning. Twenty percent of CEOs reported that, as a result of the pandemic, their revenues are equal to or greater than revenue levels at the beginning of the year. Additionally, 45% of CEO respondents expect revenues to increase in the next 12 months. As more people return to the workplace, business activity will fuel consumer spending, the necessary driver for economic recovery.

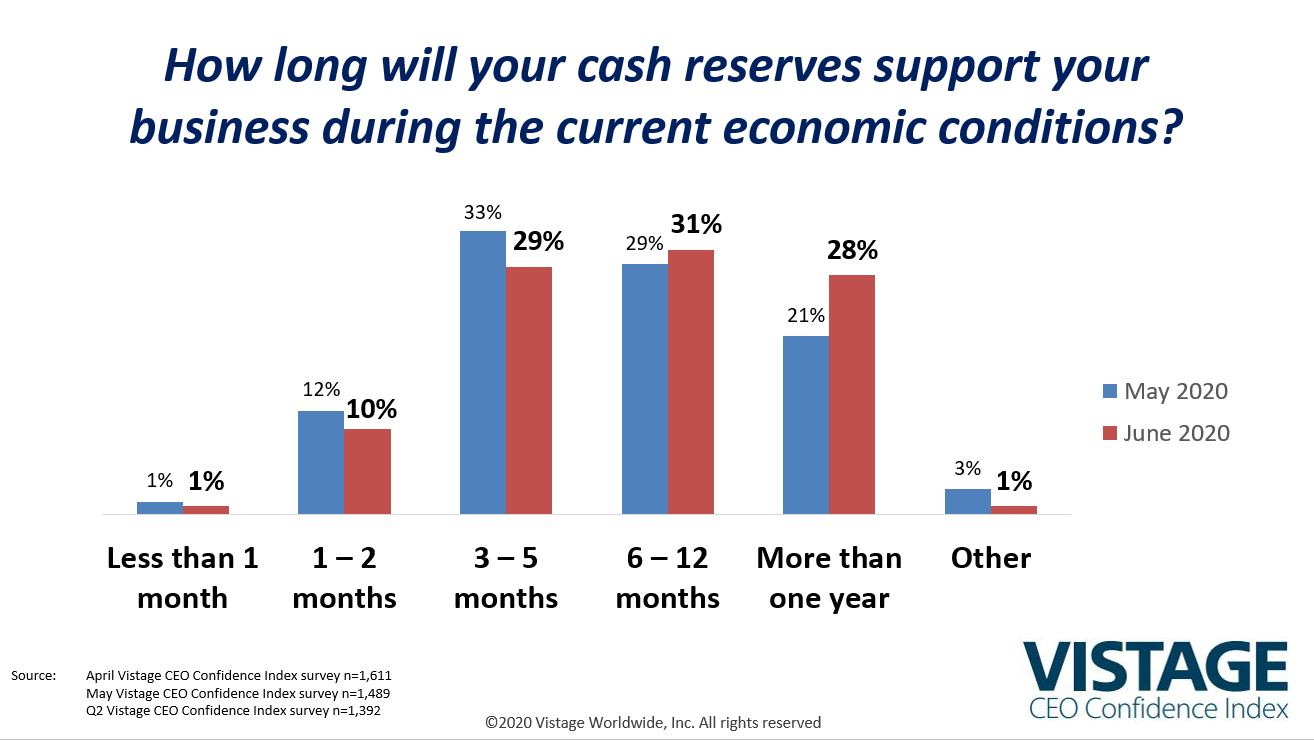

PPP funds provided critical cash flow for SMBs which, along with cost-cutting measures and improving revenues, helped them to minimize workforce impact as well as create a longer runway of cash reserves. Fifty-nine percent of SMBs reported having cash reserves of more than six months, a 9-point improvement from May’s survey in which 50% of CEOs reported having cash reserves of more than six months. This subtle but positive shift indicates that more SMBs will be able to ride out the pandemic and rebuild their business to thrive in the new, post-COVID reality.

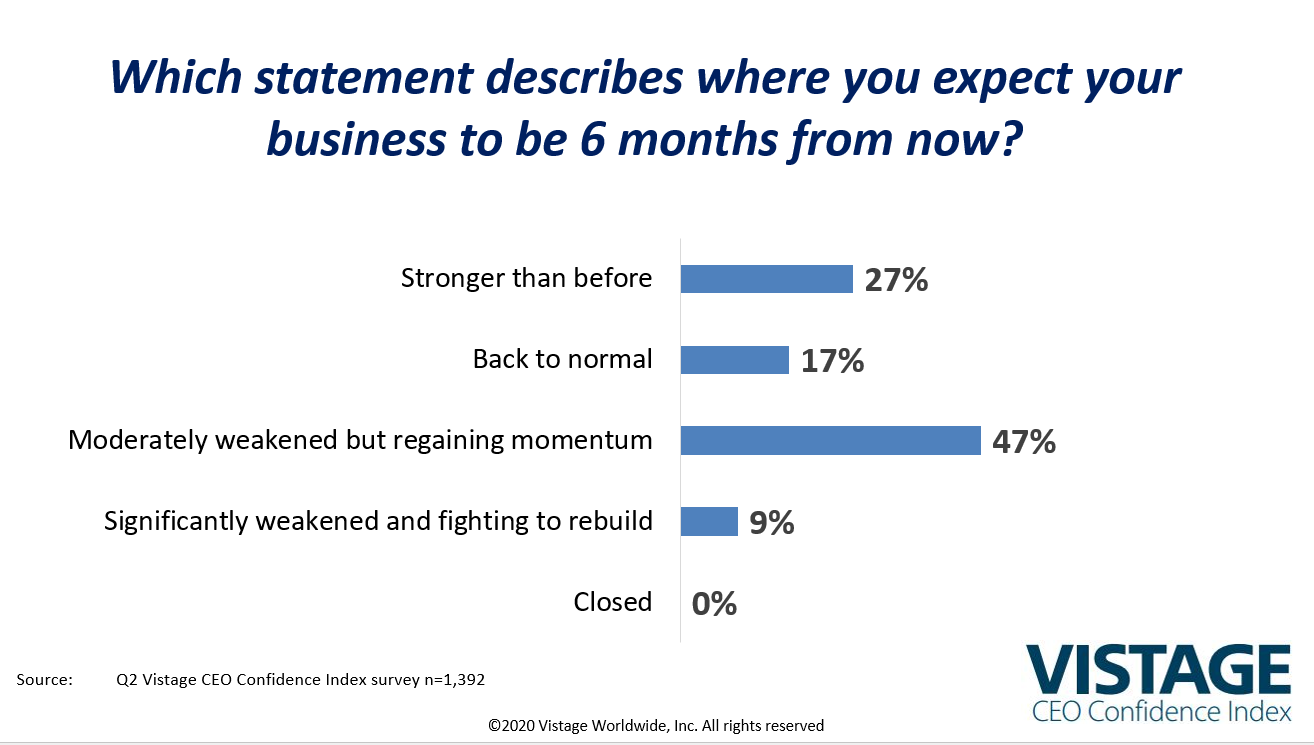

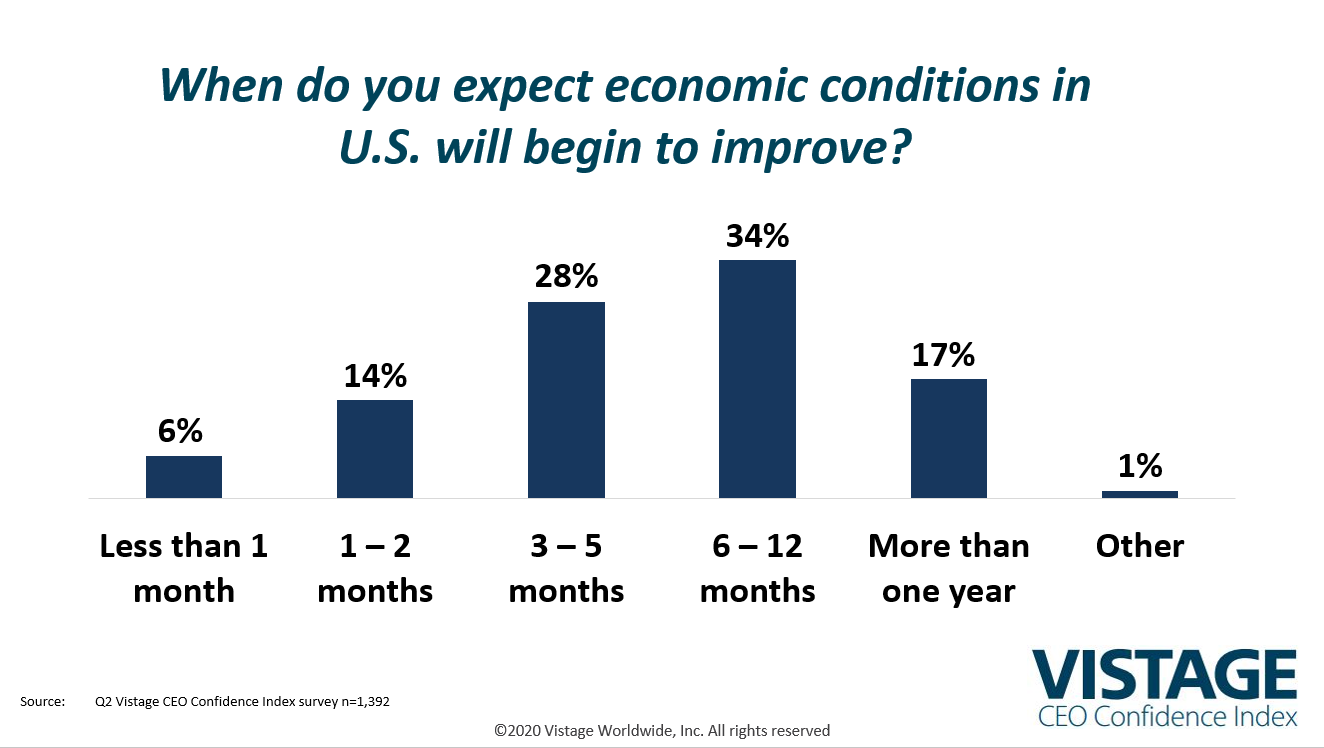

The most powerful indication that the climb to recovery has begun is in the analysis of CEO expectations for the economy and their businesses. Fifty-four percent of CEOs reported that they believe the U.S economy will improve in the next 12 months, and nearly two-thirds (62%) believe the improvement will take place between three and 12 months. This momentum of positive expectations for the economy should continue to build over the next quarter as business activity increases and as the country enters different phases of reopening. It’s important to note that despite the positive bias, 56% of CEOs believe that in six months their businesses will be weakened to some extent, meaning the hard part of the climb to recovery has yet to begin.

The leadership challenge

Leading can be a challenge even in the best of times. The COVID-19 pandemic ended the good old days of 10 years of economic expansion by triggering an abrupt free-fall of economic activity. In terms of leadership, the pandemic created unprecedented circumstances for leaders, adding new challenges for them to tackle.

Our survey asked respondents about the most significant leadership challenge they face today. In our analysis of nearly 900 open-ended responses, the challenges mostly fell into four categories:

- Morale: The most common theme shared by CEOs was maintaining and building morale with their leadership team and employees. It has been a highly stressful three months for everyone personally and professionally. The next three months won’t be any easier, which will challenge leaders to motivate a workforce with diverse needs. Priorities for leaders include keeping employees focused and positive, avoiding executive burnout and inspiring the organization for the hard climb.

- Back to Work/ Work from Home: The pandemic has changed the workplace forever. CEOs are challenged to redesign the workplace with physical health and safety as a priority for the workplace, one that also creates the feeling of safety for those employees returning to that workplace. Compound that with the broad acceptance of remote working as a proven option, which forces leaders to adapt their culture and communications to incorporate remote workers, engage in hybrid meetings and accept that work-from-home is a permanent fixture in the new reality.

- Growth: Leaders are challenged to crank the growth engine back on from a cold start. For 80% of businesses, revenue is down at some level since customers shut down or postponed non-essential purchases over the last three months. Creating new demand, re-engaging with customers and rebuilding opportunity pipelines are all prerequisites to rebuilding business volume. Quickly adjusting to changed customer behaviors and shaping messages that connect to their new reality will accelerate the return to the growth curve.

- Uncertainty: Undercutting everything is the uncertainty leaders feel and face in every direction. There has never been a business scenario like this except in classrooms. Uncertainty about the length of the pandemic, the direction of the economy and the unknown impact to their markets are just some of the uncertainties that leaders are facing. Forecasting has become a black art once again as pre-COVID financial models have lost relevance. The absence of data or clear direction will force leaders to rely on their instincts and judgement to make the best decision and be prepared to quickly adapt.

Ready, set, climb

Our data shows that that the worst may be behind us. The virus is waning and the right health and safety protocols are have been identified for how we engage at the workplace and in society. Our knowledge about the attributes and characteristics of the virus grows every day while science accelerates its work on producing a vaccine. However, even the most optimistic economist foresees a long and hard climb out of the “covid-ditch.” Despite the positive jobs report, more than 20 million people – all of them consumers – remain out of work and therefore not spending.

Revenue is beginning to return and expectations for the future are improving. Increased business activity will continue to improve revenue expectations through Q3 with more to follow in Q4. 2021 is shaping up to be a strong year of growth. Getting to 2021 may feel like climbing another 86 flights of stairs. Expect a series of plateaus throughout the climb as we test the limits of the virus and our willingness to adhere to health safety guidelines in order to keep our communities and our economy open for business.

Category: Economic / Future Trends

Tags: CEO Confidence Index, coronavirus, Paycheck Protection Program