WSJ/Vistage Dec. 2019 survey: Investment and hiring plans diverge

Following the decline in pessimism about the economy recorded last month, optimism among CEOs of small businesses did not increase according to a survey conducted by Vistage in December. While the percentage of CEOs that expect the economy to improve increased to 17% from 15% last month, the percentage that felt it would worsen also increased from 27% to 32%. Dr. Curtin, a researcher from University of Michigan who analyzed the results, explains this in more detail.

“Increased optimism requires the expectation of positive economic developments, not simply the absence of negative economic news,” says Curtin. “While there has been some easing of fears about an economy-wide downturn and more positive news about tariffs, these gains may have been replaced by rising apprehensions about potential changes in federal spending and taxing policies advocated by Democratic candidates in the upcoming presidential election.”

While the trade deal with China, finalized after the survey closed, may drive the Index in coming months, Curtin predicts that “Overall, small businesses have accepted and adjusted to a slower pace of economic growth given that the expansion is the longest in U.S. history and is expected to continue for another year.”

Over the last few months, there has been a growing gap between the factors that measure expansion plans. December’s survey revealed that plans for increased investments versus increased hiring continue to move in opposite directions: Just 40% of small business CEOs surveyed plan to increase spending in fixed investments in the coming year, which has fallen from a 2019 peak of 44%. More notable is that 14% of respondents expect to decrease investments in the year ahead, which is the highest proportion since 2016 and double the 7% recorded last December. Conservative spending may be a reflection of longer-term uncertainty this election year, or may be the result of more aggressive capital investments being complete in the past few years.

However, in contrast, nearly two-thirds (64%) of small businesses plan to grow their workforces in 2020. Workforce expansion will support growth expectations, which remain strong with 69% of small businesses expecting increased revenues in the year ahead. With unemployment hovering near record lows, hiring will remain a challenge for small businesses in 2020.

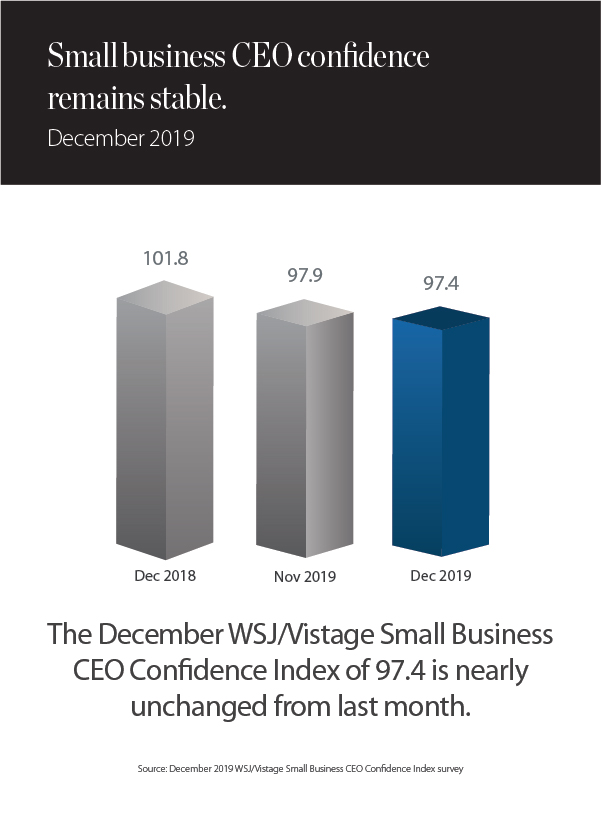

On small business CEO confidence

The WSJ/Vistage Small Business CEO Confidence Index was 97.4 in December, nearly unchanged from the 97.8 recorded last month. The Index was calculated from 681 respondents to a survey conducted December 2-9 that captured input from CEOs and other leaders of small businesses – defined as $1-20 Million in annual revenues – across the United States.

This survey had a total of 1,604 responses from CEOs of small AND midsize businesses that also informed the Q4 2019 Vistage CEO Confidence Index. Read the latest quarterly report released last week.

Download the December report for more perspectives from the analysis including:

- Optimism vs pessimism in U.S. economy

- Investment plans on the decline; hiring plans strong

- Revenue and profit expectations stabilize in 2019

Related links

About the WSJ/Vistage Small Business CEO Survey

Download infographic

Interactive data

Category: Economic / Future Trends

Tags: Small business, US Economy, WSJ Vistage Small Business CEO Survey